Ian Plimer Pens Aussie Geologist Gish Gallop #2 of the Week

Posted on 1 June 2012 by dana1981

We recently discussed Australian marine geologist Bob Carter's Gish Gallop, published in the Canadian Financial Post on May 23rd. On May 25th, another Australian geologist, Ian Plimer published an exceptionally politically-charged Gish Gallop of his own on the social and political debate website Online Opinion. As is our usual practice at Skeptical Science, we will not comment on Plimer's political rhetoric, but instead will focus on the many climate science myths contained in his piece, which similar to Carter's, exhibited several of what we have described as the 5 characteristics of scientific denialism.

Misrepresentation of the Australian Carbon Pricing System

Toward the end of 2011, the Australian government (primarily their Labor Party) passed Clean Energy Bill 2011, which implemented a national carbon pricing system (starting as a tax, then becoming an emissions trading system). This was a major achievement for Australia, but one which political conservatives tended to oppose, and which the Liberal Party (Australia's main political conservative party) vowed to overturn. Plimer's opposition to the legislation is the basis of his article. However, in attacking the carbon pricing system, Plimer displays one of the the 5 characteristics of scientific denialism by misrepresenting the legislation.

"Once Labor had blown billions on various unsuccessful populist schemes, it needed a "Carbon Tax" to maintain the diet of excessive wasteful spending. Not only does Labor's climate policy lead to unemployment, higher electricity, food and fuel costs..."

An important component of the Australian carbon pricing legislation was the Jobs and Competitiveness Program. This program devotes $9.2 billion of the carbon price revenue over its first three years to assistance for affected jobs in carbon-intense industries. The intent of this program is to shield these business activities from the impact of a carbon price while maintaining incentives to invest in cleaner technologies - essentially buying them time to reduce their emissions while remaining economically competitive with foreign companies in the same industry, without having to lay off employees in the meantime.

This program earmarks a large chunk of the carbon tax funds which cannot be spent on "populist schemes," and will prevent the policy from leading to significant unemployment. Additionally, as we have noted many times, carbon pricing systems do not lead to significantly higher energy costs.

As is characteristic of scientific denialism, Plimer has badly misrepresented the effects of the policy he opposes.

Conspiracy Theories

In his article, Plimer displays one of the two characteristics of scientific denialism which Bob Carter managed to avoid - that of conspiracy theories, which John Cook describes thusly:

"When the overwhelming body of scientific opinion believes something is true, the denialist won't admit scientists have independently studied the evidence to reach the same conclusion. Instead, they claim scientists are engaged in a complex and secretive conspiracy."

In this case, Plimer accuses climate scientists of conducting fraudulent research.

"...scientific fraud by those claiming to be climate scientists was repeatedly exposed..."

Plimer does not provide any examples or evidence to support his accusations of fraud. We can only assume he refers to the stolen Climategate emails, but nine separate investigations found the climate scientists guilty of no scientific wrongdoing, and concluded that the stolen emails did not undermine the scientific evidence supporting the human-caused global warming theory in any way.

Plimer's article contains several other conspiracy theories which do not warrant being dignified with a response; suffice it to say they are very political in nature.

Echoing Bob Carter's Denialism

Plimer then echoes the same misrepresentations of paleoclimate and climate change attribution research made in Bob Carter's article.

Plimer: "Construction of past climates over geological, archaeological and historical time from observation and measurement show that modern climate changes are well within variation..."

Carter: "...numerous high-quality paleoclimate records, and especially those from ice cores and deep-sea mud cores, demonstrate that no unusual or untoward changes in climate occurred in the 20th and early 21st century."

Plimer: "...a human signature can not be identified in major trends and cycles of climate..."

Carter: "...no compelling empirical evidence yet exists for a measurable, let alone worrisome, human impact on global temperature."

As we noted in response to Carter's misrepresentations, current climate changes are quite rapid in comparison to most historical changes, and both fundamental physics and empirically observed 'fingerprints' demonstrate the current human impact on global warming. For further details on these issues, see the Carter rebuttal post.

Plimer vs. Plimer

In Plimer vs Plimer, Skeptical Science has documented many of Plimer's self-contradictions. In this article, Plimer raises one of those contradictions (emphasis added).

"...all past major glaciations were initiated at times when the atmospheric carbon dioxide content was higher than at present and there is no correlation of temperature over time with atmospheric carbon dioxide content. Without correlation, there can be no causation."

Plimer has contrarily previously claimed (emphasis added):

"The low lumunosity of the early Sun was such that the Earth's average surface temperature would have been below 0°C from 4500 to 2000 million years ago. But, there is evidence of running water and oceans as far back as 3800 million years ago. This paradox is solved if the Earth had an enhanced greenhouse with an atmosphere of a lot of carbon dioxide and methane."

and

"...Carbon dioxide-induced overheating of the atmosphere appears to have destroyed land plants and the animals that lived off them. This is the earliest geological clue that extreme global warming can be a killer."

and

"The Sun and atmospheric carbon dioxide were certainly major factors that controlled ancient climate."

and

"The global warmth of the Cretaceous has been attributed to elevated levels of CO2 in the atmosphere."

So apparently Plimer believes there is no correlation between CO2 and temperature...except when CO2 is driving global temperature changes?

Plimer is of course factually incorrect in his Online Opinion comments. CO2 is currently at about 392 ppm, and at the start of recent glaciations, has been around 280 ppm. The correlation between temperature and CO2 is also a rather obvious one (Figure 1).

Figure 1: Temperature (red) and CO2 concentration (blue) reconstructed from the Vostok ice core.

Impossible Expectations of What Research Can Deliver

Another of the five characteristics of scientific denialism displayed by Plimer involves impossible expectations of what research can deliver:

"For scientists to claim that they believe in human-induced global warming uses the language of religion and politics, not the language of science. It matters not whether one or a thousand scientists believe that human activity drives global warming. It is the sum total of the evidence that determines a scientific conclusion, not political populism, noisy scientific grantees or activists. An accomplished scientist believes nothing, is anarchistic, tentatively supports conclusions until more evidence is unearthed, actively and dispassionately participates in debate, criticism and analysis and has no treasured ideology."

In short, Plimer believes scientists should not "believe" anything until it is 100% proven. But of course nothing in science is ever 100% proven. The sum total of evidence overwhelmingly supports the human-caused global warming theory, which is why it has convinced the vast majority of climate scientists. This is not akin to religion or politics, as Plimer ironically accuses in a politically-charged article he has published in a political media source. It's simply a matter of being convinced by the full body of evidence, as opposed to cherrypicking and misrepresenting the data, as Plimer and Carter have done.

Denying the Paloeclimate Record

Plimer wrongly asserts the paleoclimate record supports his position.

"My objections to the unfounded idea of human-induced global warming are that the idea is not scientific and that promoters of this concept chose to ignore past climate changes. It is only geology that leads to the ultimate understanding of climate change."

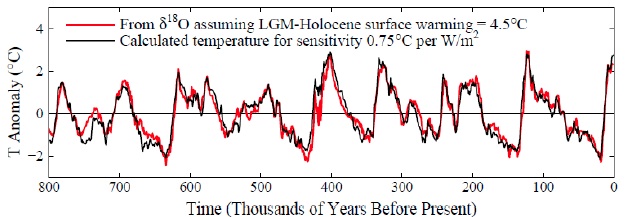

In reality the paleoclimate record is wholly consistent with the human-caused global warming theory, as recently demonstrated by Hansen and Sato, for example (Figure 2).

Figure 2: Black curve: calculated surface air temperature change for climate forcings in Hansen and Sato (2012) and climate sensitivity 0.75°C per W/m2. Red curve: estimated global surface air temperature change based on deep ocean temperatures and assumption that LGM-Holocene surface temperature change is 4.5°C. Zero point is the 800 ky mean.

Figure 2 shows that past climate changes are consistent with a climate sensitivity of approximately 3°C global surface warming in response to an energy imbalance equivalent to that created by a doubling of atmospheric CO2. Humans are currently on track to double atmospheric CO2 from pre-industrial levels within the next ~50 years.

Richard Alley has also discussed that CO2 has been The Biggest Control Knob influencing the Earth's temperature and climate throughout its history. Plimer would do well to watch Alley's presentation.

Ian Plimer Denies Global Warming

Plimer ends his piece with perhaps his worst example of scientific denialism.

"Nature had the last laugh: the planet is cooling"

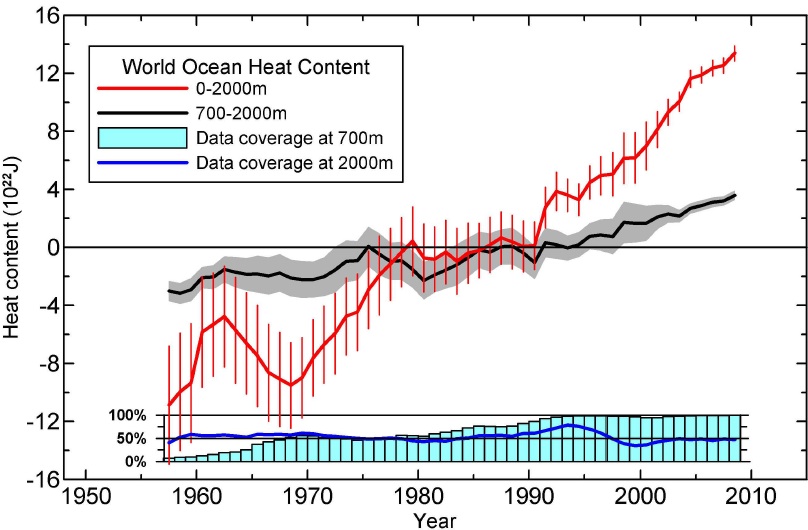

This is of course a complete falsehood. Not only do surface temperatures continue to rise, but the oceans, which accumulate approximately 90% of global warming, continue to heat up (Figure 3).

Figure 3: Time series for the World Ocean of ocean heat content (1022 J) for the 0-2000m (red) and 700-2000m (black) layers based on running pentadal (five-year) analyses. Reference period is 1955-2006. Each pentadal estimate is plotted at the midpoint of the 5-year period. The vertical bars represent +/- 2 times the standard error of the mean (S.E.) about the pentadal estimate for the 0-2000m estimates and the grey-shaded area represent +/- 2*S.E. about the pentadal estimate for the 700-2000m estimates. The blue bar chart at the bottom represents the percentage of one-degree squares (globally) that have at least four pentadal one-degree square anomaly values used in their computation at 700m depth. Blue line is the same as for the bar chart but for 2000m depth. From Levitus et al. (2012)

Once again, Plimer's misrepresentation of the data was similar to Carter's, who falsely claimed there had been "no significant warming trend...since 1958."

Plimer's Unscientific Approach

Like his fellow Australian geologist, Plimer displayed a great many characteristics of scientific denialism in his politically-based article. As we did for Carter, we recommend that if Ian Plimer wants to influence the climate discussion, he should subject his arguments to peer-reviewed scrutiny, rather than cobbling together Gish Gallops of scientific denial and misrepresentations for the poliitcal media.

Arguments

Arguments

0

0  0

0 Dissembly suggests alternative policies for tackling climate change, and he is certainly welcome to pursue them. Optimistically it would take around 10 years for him to achieve the political capital to implement his preferred solution. In that 10 years, without the carbon tax emissions would have grown by another 60 million tonnes of CO2 equivalent per annum. With out the Carbon Tax, therefore, he would face a much more difficult task to reduce emissions because a much larger (and faster) reduction would be required. (This is assuming his plan could in fact be implemented, which I doubt.)

Dissembly suggests alternative policies for tackling climate change, and he is certainly welcome to pursue them. Optimistically it would take around 10 years for him to achieve the political capital to implement his preferred solution. In that 10 years, without the carbon tax emissions would have grown by another 60 million tonnes of CO2 equivalent per annum. With out the Carbon Tax, therefore, he would face a much more difficult task to reduce emissions because a much larger (and faster) reduction would be required. (This is assuming his plan could in fact be implemented, which I doubt.)

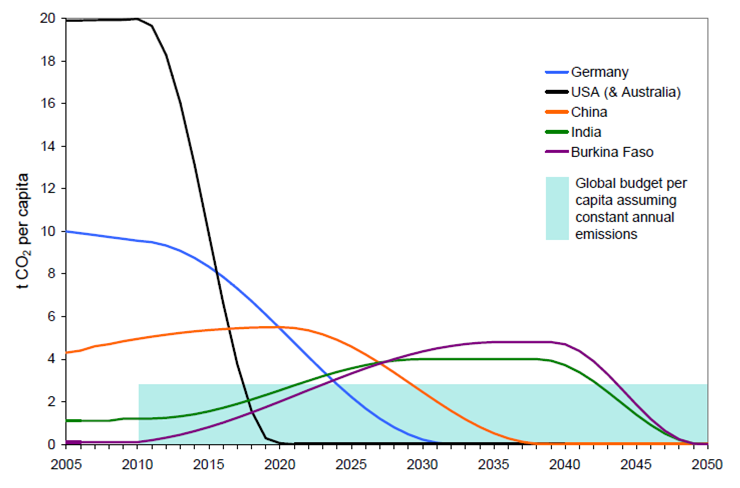

Note that dashed line is the reduction required if we exclude emissions trading. The task is obviously substantial, even with emissions trading (solid lines). Butif we do not flatten emissions growth now and we reject emissions trading, we will be placed in a position within one electoral cycle where Australia must end all emissions within a year, or not contribute its fair share to the task of reducing global emissions.

Actually, it is worse than that. Australia's per capita CO2 equivalent (CO2e) emissions are 28 tonnes per capita per annum. If per capita emissions targets are set on a per nation basis, rather than by national grouping, and without emissions trading, Australia must end all emissions by 2013, or else not be contributing its share to tackling global warming.

So, if your plan to tackle global warming cannot end national emissions by 2013 (and it cannot), then you need to commit to the Carbon Tax now as a means to keep the task manageable. We need to do it on the ethical ground that we should not expect more of other nations (ie, a lower per capita emissions target) than we accept for ourselves. We should also accept it because if we do not, we preclude the negotiation of a reasonable global response because we shall have already violated the terms of any such reasonable response before negotiations begin if we do not curb our emissions now. Finally, we should commit to the Carbon Tax because only with a Carbon Tax can Australia keep emissions down long enough to arrive at an effective solution.

This is not a claim that the Carbon Tax is the best means available to tackle climate change. It is just recognizing the practical fact that a Carbon Tax is currently being implemented, and that no alternative policy can be implemented soon enough to stop the rise of emissions over the next three to five years.

And if you can't recognize that practical fact, and get on board; you are part of the problem. If you cannot recognize that fact, you are guaranteeing that Australia's policy will be in practice, to restrict global warming to 3 degrees, or more. If you think your solution is better, then by all means argue for it - but your argument should only be that, while your plan is better, we should support the Carbon Tax until your plan can be implemented. To do otherwise it to pull your driver of the starting grid because you think your new car design currently in testing would be better for winning the race she is about to start.

Note that dashed line is the reduction required if we exclude emissions trading. The task is obviously substantial, even with emissions trading (solid lines). Butif we do not flatten emissions growth now and we reject emissions trading, we will be placed in a position within one electoral cycle where Australia must end all emissions within a year, or not contribute its fair share to the task of reducing global emissions.

Actually, it is worse than that. Australia's per capita CO2 equivalent (CO2e) emissions are 28 tonnes per capita per annum. If per capita emissions targets are set on a per nation basis, rather than by national grouping, and without emissions trading, Australia must end all emissions by 2013, or else not be contributing its share to tackling global warming.

So, if your plan to tackle global warming cannot end national emissions by 2013 (and it cannot), then you need to commit to the Carbon Tax now as a means to keep the task manageable. We need to do it on the ethical ground that we should not expect more of other nations (ie, a lower per capita emissions target) than we accept for ourselves. We should also accept it because if we do not, we preclude the negotiation of a reasonable global response because we shall have already violated the terms of any such reasonable response before negotiations begin if we do not curb our emissions now. Finally, we should commit to the Carbon Tax because only with a Carbon Tax can Australia keep emissions down long enough to arrive at an effective solution.

This is not a claim that the Carbon Tax is the best means available to tackle climate change. It is just recognizing the practical fact that a Carbon Tax is currently being implemented, and that no alternative policy can be implemented soon enough to stop the rise of emissions over the next three to five years.

And if you can't recognize that practical fact, and get on board; you are part of the problem. If you cannot recognize that fact, you are guaranteeing that Australia's policy will be in practice, to restrict global warming to 3 degrees, or more. If you think your solution is better, then by all means argue for it - but your argument should only be that, while your plan is better, we should support the Carbon Tax until your plan can be implemented. To do otherwise it to pull your driver of the starting grid because you think your new car design currently in testing would be better for winning the race she is about to start.

Note that in the WGBU graph, Australia is not included with the US. Australia's actual per capita CO2 equivalent emissions are 28 tonnes per annum.

Note that in the WGBU graph, Australia is not included with the US. Australia's actual per capita CO2 equivalent emissions are 28 tonnes per annum.

Comments