A new report from the International Monetary Fund (IMF) estimates that overall global fossil fuel subsidies amount to about $1.9 trillion annually. As large as this number sounds, it's actually an underestimate for many reasons. The IMF report lists several of these reasons, including the fact that it's simply impossible to obtain data for all fossil fuel subsidies in all countries. However, the biggest contributor to the conservative dollar figure is related to the social cost of carbon.

The social cost of carbon is an estimate of the direct effects of carbon emissions on the economy, and takes into consideration such factors as net agricultural productivity loss, human health effects, property damages from sea level rise, and changes in ecosystem services. It's the economic damage caused by CO2 via climate change. The IMF report uses an average US government agency value of $25 per tonne of CO2 emissions; however, there is substantial evidence and research suggesting the value should be much higher. Dave Roberts provides some references in his post on the report, and we go into detail on the subject here.

The true cost of carbon emissions could easily be four times higher, at $100 per tonne. Chris Hope, climate policy researcher at Cambridge University, has argued that an estimate around $150 per tonne may be more accurate. Thus the true cost of our fossil fuel subsidies could be over $4 trillion per year, or over 6% of global Gross Domestic Product (GDP). Compare that to the estimated cost of reducing greenhouse gas emissions to safe levels, which are generally on the order of 1% of GDP, and it becomes clear that our current priorities are completely backwards, pumping trillions of dollars into our fossil fuel addiction when we should be trying as hard as we can to break the habit.

The IMF report estimates that approximately one-quarter of all global fossil fuel subsidies ($480 billion) are direct pre-tax subsidies, with about half of that total coming from the Middle East and North Africa. Most of the rest comes from emerging and developing Asia (20%), and central and eastern Europe (15%). The bulk of these direct subsidies go to petroleum products ($212 billion, or 44%), electricity ($150 billion, 31%), and natural gas ($112 billion, 23%). Electricity subsidies are included because they increase the consumption of coal and natural gas.

As Brad Plumer notes, the IMF report argues that these direct fossil fuel subsidies are crowding out other useful public spending in these developing countries and depressing private investment in the energy sector. In many of these countries, direct fossil fuel subsidies amount to over 5% of GDP. Phasing out those subisidies would have to be done gradually and carefully, but the money could be much better spent in other areas to benefit the countries' populaces, and the report estimates that global carbon emissions would fall by up to 2% if these direct subsidies were scrapped.

As we have previously discussed, carbon is a huge but usually overlooked fossil fuel subsidy, due to the aforementioned damage it causes via climate change. In countries which don't put a price on carbon emissions, those costs are not paid by the producers or consumers of the products causing the damage, but somebody pays the price. This is also known as an economic externality, when the cost is paid outside the economic system rather than being reflected in the market price. This short video produced by the Climate Reality Project illustrates the point nicely.

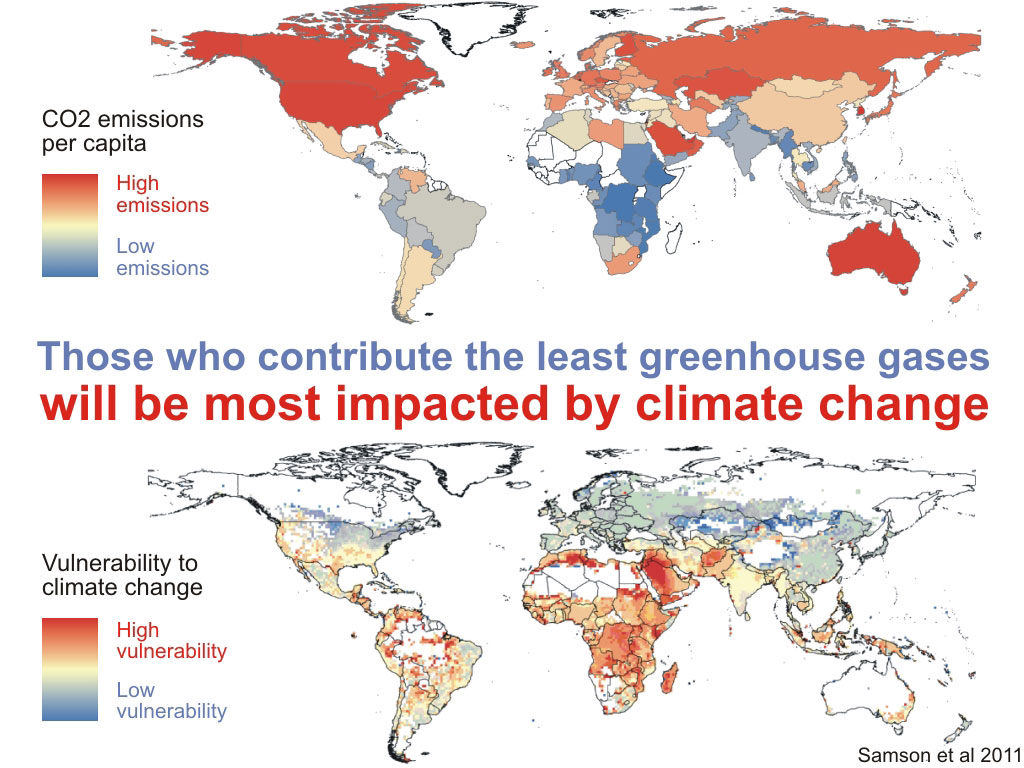

Unfortunately, in the case of carbon, those external costs tend to fall disproportionately on poorer countries which contribute the least to the climate change problem. As Paul Baer put it,

"the world’s poor are subsidizing the world’s rich."

Top Frame - National average per capita CO2 emissions based on OECD/IEA 2006 national CO2 emissions (OECD/IEA, 2008) and UNPD 2006 national population size (UNPD, 2007). Bottom Frame: Global Climate Demography Vulnerability Index. Red corresponds to more vulnerable regions, blue to less vulnerable regions. White areas corresponds to regions with little or no population (Samson et al. 2011).

Due to relatively high carbon emissions and a lack of emissions pricing, the USA accounts for the largest indirect fossil fuel subsidy, at $502 billion per year, according to the IMF report. China comes in second at $279 billion, followed by Russia at $116 billion.

The IMF overall estimate is $1.4 trillion in global indirect fossil fuel subsidies per year. The bulk of direct + indirect subisides goes to petroleum products ($879 billion per year, or 46%), followed by coal ($539 billion, 28%), natural gas ($299 billion, 16%), and electricity ($179 billion, 9%).

As noted above, this estimate is based on a conservative social cost of carbon at $25 per tonne. Some of the cost is associated with local pollution damage from coal combustion – approximately $500 billion (8 billion short tons per year at $65 pollution damage per short ton), and another $200 billion is associated with exemptions from value added taxes. Finally, around $800 billion is associated with the cost of carbon (32 billion tonnes of CO2 emissions per year at $25 per tonne). If we apply an arguably more realistic estimate of $100 per tonne of CO2 emitted, that cost rises to $3.2 trillion, and the overall cost of fossil fuel subsidies becomes over $4 trillion per year – over 6% of global GDP.

And remember, this still does not account for all global fossil fuel subsidies. Note also that global fossil fuel subsidies amount to around $1 trillion per year even without accounting for climate damage costs.

The IMF report also examined the effects of eliminating these subsidies and found they would be substantial.

"The results suggest that this reform would reduce CO2 emissions by 4½ billion tons, representing a 13 percent decrease in global energy-related CO2 emissions. Eliminating subsidies would also generate significant health benefits by reducing local pollution from fossil fuels in the form of SO2 and other pollutants. In particular, this reform would result in a reduction of 10 million tons in SO2 emissions and a 13 percent reduction in other local pollutants."

In developing countries, fossil fuel subsidies also overwhelmingly benefit the rich. The IMF report noted,

"On average, the richest 20 percent of households in low- and middle-income countries capture six times more in total fuel product subsidies (43 percent) than the poorest 20 percent of households (7 percent) (Figure 7)."

Pumping trillions of dollars of subsidies into the fossil fuel industry keeps the market price of their products low, but we can't avoid paying the price elsewhere. These subsidies keep us addicted to fossil fuels at the cost of public health and increasing climate change damage. Alternatively, we could spend this money in much more productive ways, including to transition away from fossil fuels toward low-carbon energy sources, solving the climate crisis in the process.

The transition won't be easy; we've become accustomed to low energy prices, artificially depressed by these massive fossil fuel subsidies. It's akin to going through rehabilitation for an addiction – it may be a somewhat painful process, but it's a necessary one, because the alternative is much worse. The alternative involves continuing to pump trillions of dollars towards our addiction until the inevitable climate crash finally comes.

Note: this post has been incorporated into the rebuttal to the myth 'CO2 limits will harm the economy' and 'renewable energy is too expensive.'

Posted by dana1981 on Tuesday, 2 April, 2013

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |