Carbon taxes get the market to tell the environmental truth. Stewart Elgie

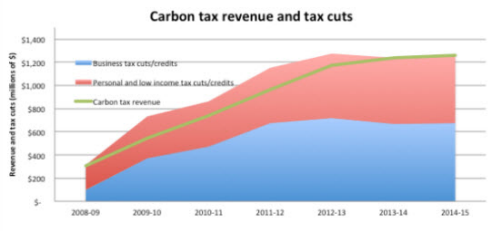

British Columbia is the only jurisdiction in North America with a revenue-neutral carbon tax that taxes greenhouse gas emissions (GHGs) from individuals and businesses alike. The tax was announced in February 2008 and was implemented in July 2008 at a rate of $10 per tonne of CO2, rising in $5 annual increments to the current price of $30/tonne. It is designed as a revenue-neutral tax, meaning that all carbon-tax proceeds collected by the government are returned in the form of income tax cuts and rebates. The tax is now raising over C$1.2 Billion per year, about C$270 per person, and the proceeds are distributed roughly equally between personal and business tax reductions.

People on low incomes get a per-person payment of C$115 annually, and homeowners who live outside the SW of the province can get additional rebates of up to $200 annually. The personal income tax reductions are focussed on earnings below C$75,000. The allocation of carbon tax revenue has to be reported in the annual budget.

Note that the carbon tax was actually revenue-negative over its first few years. In part, this was due to the tax having a bigger effect on demand than anticipated by the government. (Rivers and Schaufele, 2012) Source of graph.

BC has the lowest personal income tax rates in Canada for incomes of less than $120,000 per year (even lower than in oil-rich Alberta) and among the lowest corporate tax rates in North America and the G7 nations (BC Gov). The most visible form of the carbon tax is on gasoline prices, adding C$0.07 to a litre (US$0.25 per US gallon) at the pump. For comparison, BC retail gasoline prices are, roughly, 40% more expensive than in neighbouring Washington State, similar to Australia and 40% cheaper than in the UK.

The Economist reported in 2011 that the BC carbon tax was "a winner". Since then, the results have continued to improve.

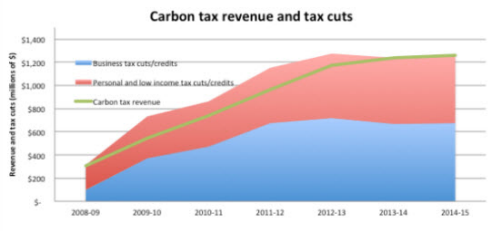

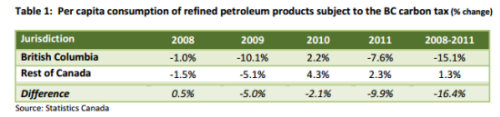

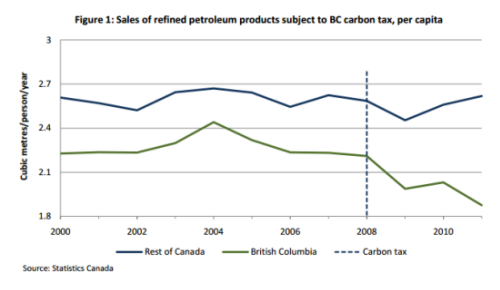

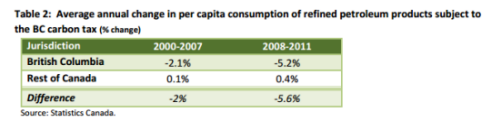

Sustainable Prosperity, a Canadian think tank chaired by Stewart Elgie, a professor of law and economics at the University of Ottawa, produced a report in 2012: British Columbia’s carbon tax shift: the first four years. The report looked at the data from BC and the rest of Canada and concluded that, from the introduction of the tax to the end of 2011, BC’s consumption of petroleum fuels has fallen by 16.4% relative to the rest of Canada and 15.1% in absolute terms. Over the same period, economic growth in BC has been slightly better than the rest of Canada, so the pessimistic forecasts that the carbon tax would cripple the economy have not materialized. Let’s look at some data from the report in more detail.

Source of these and the following tables: Sustainable Prosperity Note that BC was already reducing consumption relative to the Rest of Canada prior to the carbon tax introduction, but that the rate accelerated after 2008. Note also the qualification “subject to BC carbon tax”.

Aviation fuel used in flights that begin or end outside BC is not subject to the provincial carbon tax. Note that this is the only fuel category in which fuel consumption has increased in BC relative to the rest of Canada. (Graphic from personal communication, with Stewart Elgie).

Not all of the decrease in consumption can be attributed to the carbon tax. There has been considerable investment in public transit in BC, particularly in its largest city, Vancouver, paid for by additional local taxes on gasoline. Also, various efficiencies have been promoted by the LiveSmart program.

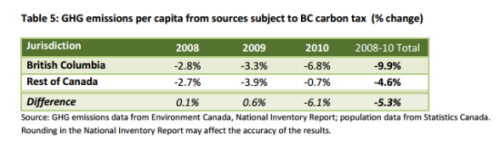

When it comes to reductions in all greenhouse gas emissions, the relative reductions are significant but less spectacular. Note that the figures in the following table only go up to 2010:

Ontario, has over this period, reduced its emissions by reducing coal consumption in electricity generation. Note that the GHG emissions data only go up to the end of 2010. The latest National Inventory Submissions figures show BC’s GHG emissions continuing to decrease from 2010 to 2011, while the rest of country’s emissions increase slightly over that period.

As for the economic effects, BC has slightly outperformed the rest of Canada:

Of course, this short period encompasses the Great Recession and there are many effects on the economy of Canada, such as resource prices, slumps in manufactured products and demand for lumber, that will make such comparisons noisy, and it is not possible to conclude that the carbon tax is helping the BC economy. Nevertheless, pessimistic forecasts that the carbon tax would be devastating for the BC economy have been shown to be groundless.

One thing that is surprising is that the reductions in fuel use have been nearly five times bigger than economic theory would predict from increase in prices caused by the carbon tax. Part of this may be due to the effect of other programs and taxes, such as a 17 cents per litre gasoline tax charged in the Vancouver area that is allocated to mass-transit funding. But still, the reduction in demand due to the tax seems larger than equivalent changes in market price would cause and it is not easy to explain this with conventional theory, even when appealing to behavioural economic models that take account of irrational consumer reactions.

Other suggestions are that consumers react to market fluctuations as temporary phenomena that can be ignored, whereas a planned steady increase in taxes provides a rational basis upon which to take long-term decisions, for example, by buying a more efficient car. There also may be some influence from a “reverse free-rider effect”, in which instead of people being reluctant to make decisions that may benefit society more than themselves directly; instead, by believing that “everyone is doing it”, they are more motivated to act.

Another factor may be that the BC carbon tax has been publicized and promoted by politicians. Price increases, whether caused by market forces, increases in retailer margins or by non-revenue-neutral taxes are more likely to be introduced stealthily by oil companies or governments and may, therefore, not loom as large in the consumer’s mind.

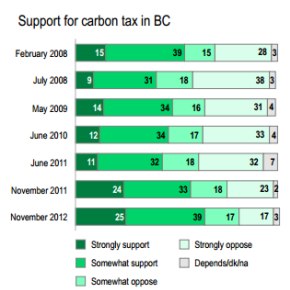

The Carbon Tax was introduced in 2008 by the BC Liberal Party, which is a centre-right political party. Since that time, the party has been re-elected twice, in 2009 and, just recently, in May 2013. Although the government does not have plans to increase the carbon tax, nor to extend it to cover emissions not currently taxed, there are no plans to rescind the tax, nor does any credible opposition party oppose it. As far as anybody can predict anything in politics, it appears that the carbon tax is here to stay and that political opposition to it is negligible. Part of this is due, no doubt, to the ethos on the Pacific Coast of North America that tends to be more eco-conscious than in the heartland of the continent. But part of it is probably also rooted in the realization that getting rid of a revenue-neutral carbon tax would necessarily increase income taxes.

The Carbon Tax was introduced in 2008 by the BC Liberal Party, which is a centre-right political party. Since that time, the party has been re-elected twice, in 2009 and, just recently, in May 2013. Although the government does not have plans to increase the carbon tax, nor to extend it to cover emissions not currently taxed, there are no plans to rescind the tax, nor does any credible opposition party oppose it. As far as anybody can predict anything in politics, it appears that the carbon tax is here to stay and that political opposition to it is negligible. Part of this is due, no doubt, to the ethos on the Pacific Coast of North America that tends to be more eco-conscious than in the heartland of the continent. But part of it is probably also rooted in the realization that getting rid of a revenue-neutral carbon tax would necessarily increase income taxes.

Source of poll: Environics, December 2012

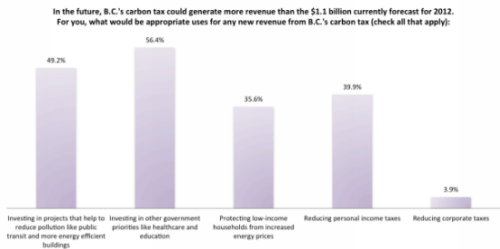

As the polling results show, 64% of the BC public is in favour of the carbon tax and support is growing with time. Indeed, the political debate in the province has turned more to how to spend the carbon revenue rather than whether to reduce or remove it. In the recent provincial election, the main opposition party had plans to allocate some of the revenue to fund transit and other environmental initiatives. Polling shows that the public is divided on how any additional revenue should be allocated.

There is little reason for optimism about the future of BC’s emissions, despite this excellent start. For one thing, there are no plans to increase the level of the carbon tax, at least until the province’s trading partners in the rest of Canada, the USA and Asia start to introduce carbon pricing of their own. There is no point, for example, in putting BC cement manufacturers out of business and, instead, importing cement from Washington State or Alberta. That outcome would be bad for the local economy while not budging the Keeling Curve one bit. Nor would it do any good to tax aviation fuel on out-of-province flights until everyone does it, because the airlines would be incentivized to fill their fuel tanks elsewhere.

There are also gaps in BC’s carbon tax coverage that are not likely to be filled in any time soon. These untaxed emissions may well grow as a direct result of government policy in promoting Liquefied Natural Gas (LNG) exports to Asia.

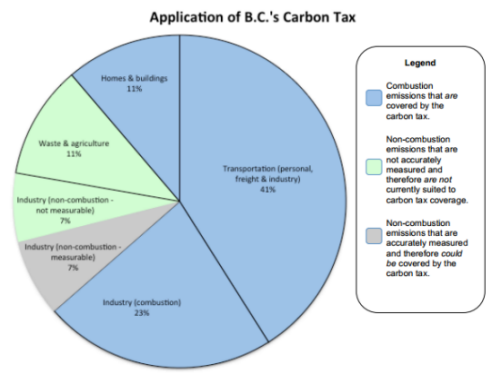

The non-blue areas on the pie chart represent sectors that are currently exempt from the carbon tax, about one-quarter of the province’s total emissions. The green areas are supposedly impossible to tax because they are not accurately measurable. The industry “non-combustion” emissions (the green pie-slice of 7%) are mostly fugitive methane emissions from the natural gas industry. These are estimated by government agencies as about 0.3% of the volume of natural gas produced in the north east of BC. As I have argued elsewhere, this is very likely a gross underestimate; using the latest EPA estimates for the USA gas industry (~1.5% leakage) would increase this pie-slice by a factor of five. And using recently published field estimates of fugitive emissions in the USA could inflate these estimates by a factor of twenty or more. The BC government has announced no plans to attempt to measure fugitive emissions from its gas industry more accurately. As any engineer would say, what can't be measured, can't be managed.

The grey slice on the pie chart represents, mostly, emissions of CO2 from unconventional natural gas operations in the Horn River Basin in the NE of the province. CO2 makes up 11-12% of the produced gas in that basin and it has to be stripped out at processing plants before the methane can be sold (Jaccard and Griffin, 2010). The CO2 waste product, which can be accurately measured, is simply vented to the atmosphere, without any tax penalty. This constitutes an effective annual subsidy of about $100 million to the natural gas industry.

The BC government has ambitious plans to develop the province’s natural gas export industry by exporting LNG to Asian market through ports on the north BC coast, near Prince Rupert and Kitimat. This could potentially triple, or more, current gas production. This will increase both taxed combustion emissions and untaxed vented and fugitive emissions, undoing any progress made by the province in reducing emissions from other sectors of the economy. Stephen Leahy has written two comprehensive articles on this, here and here. There’s a fundamental contradiction with a jurisdiction trying to grow a fossil-fuel industry and, at the same time, trying to reduce emissions.

Despite the loopholes and the concerns about the future, BC’s bold experiment with carbon pricing has demonstrated that…

There are several myths about carbon taxes that BC’s four-year experiment debunks. Let’s quickly run through these. Note that these are generic myths, compiled from numerous online sources: e.g. Common Ground OR/WA, BC Government, David Suzuki, Victoria Greens (Au), Skeptical Science, etc.

|

Myth |

Reality |

|

Legislating carbon taxes would be a difficult and lengthy process. |

It took BC four months from announcement to implementation. It helps that BC, like nearly every other jurisdiction, already taxed fuels and income. |

|

It’s just a tax grab. |

No, a carbon tax can be—and in BC is—a tax shift. |

|

I don’t trust left-leaning governments to keep their hands off the carbon revenue. |

Fine; then get conservative legislators to write the laws, as they did in British Columbia. |

|

Carbon taxes are unpopular and a political impossibility. |

The BC Liberal Party has been re-elected twice since introducing a carbon tax. No major provincial party now opposes carbon taxation. |

|

Carbon taxes will wreck the economy. |

Even when jurisdictions like BC introduce carbon taxes unilaterally, without their trading partners following suit, there is no sign of economic damage. Low personal and corporate taxes compensate for higher fuel costs. |

|

They will hurt the poor and rural people. |

BC has focussed tax cuts on low-income taxpayers and has provided rural and northern residents with extra grants. |

|

Carbon taxes are discriminatory and based on shaky science. |

Yes, they discriminate, against emissions. The need for emissions mitigation is based on the reliable knowledge—endorsed by a large majority of experts—that human emissions are causing global climate change. |

|

Carbon taxes are ineffective. |

BC’s experience is that the tax actually works better than expected. Gradually rising taxes send a strong signal for individuals and businesses to adapt in the ways and on the time frames that work best for them. |

XKCD, with the meme later propagated by Richard Dawkins.

BC’s carbon tax at $30 per tonne of CO2 is probably only about one-third of some recent estimates of the social cost of carbon of $80-100 that would truly reflect the cost of emissions. Revenue-neutral carbon pricing will certainly spur private-sector innovation and deployment of new technologies, but there may also be a requirement for government-funded basic research and support for emerging industries that goes beyond simply taxing emissions.

In Canada, there is increasing support for carbon taxes, even among executives in the oil sands industry, as the Financial Post reports. The virtue of carbon taxes is that they provide more economic certainty than other measures, such as caps or government mandates. Business leaders hate regulatory uncertainty more than regulations themselves. However, it must be acknowledged that this economic certainty comes at the cost of reduced certainty in meeting emissions targets. As economist Marc Lee said, quoted in the Financial Post:

The intuition behind carbon pricing is straightforward: we should tax things that we do not want, and making it more expensive will reduce pollution. […] A carbon tax provides greater certainty around the price of GHG emissions, but poses a great deal of uncertainty around actual emission reductions.

The Citizens Climate Lobby is a group lobbying for a carbon fee and dividend policy to be implemented in the United States. There are encouraging signs that this issue is gaining traction, even among some conservative lobby groups. Americans don’t often pay much attention to their neighbours to the north, but in the case of BC’s carbon tax, they should take a hard look at the successful experiment being carried out above the 49th parallel. Former Republican Congressman Bob Inglis is certainly aware of BC's carbon pricing, as he shows in a speech he gave in Vancouver in November 2012.

Carbon taxes—or fees, if you prefer—with the money directed back to citizens, are a simple, fair, popular and effective way to start tackling the biggest challenge of our times.

More information:

The Pacific Institute for Climate Solutions (PICS) has posted videos of a panel session held at the University of Victoria on June 4, 2013 on The Benefits of Carbon Taxation. The recording has been divided into two parts. Part One (56 minutes) features:

Part Two (48 minutes) features:

Posted by Andy Skuce on Thursday, 27 June, 2013

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |