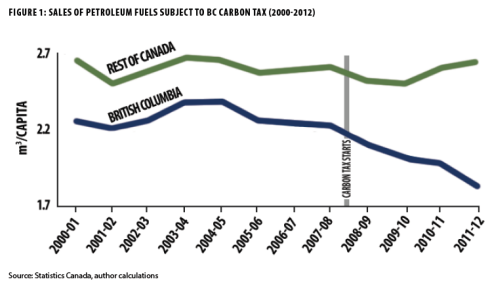

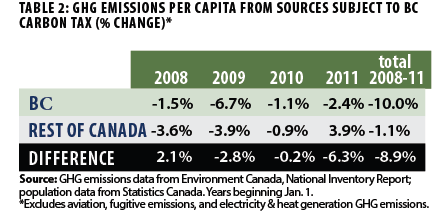

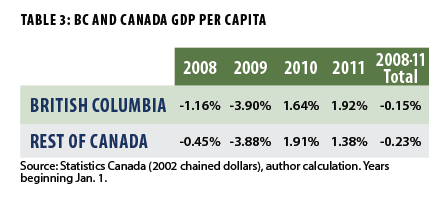

The economic data, which also only go up to 2011, show no big differences in performance between BC and the rest of Canada. The carbon tax was introduced just before the Great Recession hit in 2008 and since then BC has performed only very slightly better than the rest of the country. The significant observation here is that economic disaster has not befallen BC as a result of the carbon tax. The carbon tax is actually slightly better for taxpayers than revenue neutral. The carbon tax revenues have been fully paid back, along with an additional C$500, to individuals and businesses as income tax reductions and direct grants.

The economic data, which also only go up to 2011, show no big differences in performance between BC and the rest of Canada. The carbon tax was introduced just before the Great Recession hit in 2008 and since then BC has performed only very slightly better than the rest of the country. The significant observation here is that economic disaster has not befallen BC as a result of the carbon tax. The carbon tax is actually slightly better for taxpayers than revenue neutral. The carbon tax revenues have been fully paid back, along with an additional C$500, to individuals and businesses as income tax reductions and direct grants.As reported previously, the tax remains popular in BC, with neither of the major provincial political parties having plans to scrap the tax and opinion polls show approximately 64% popular support for it. No doubt, part of the reason for the success is the revenue neutrality, which results in lower income taxes for most BC taxpayers than in any other province, even fossil-fuel-royalty rich Alberta. Repealing the tax would require personal and corporate income tax increases that would almost certainly be very unpopular.

“Revenue-neutral” does not mean—and could not mean—revenue neutral for every individual, it means revenue neutral for the government. People (and businesses) who create more emissions pay more carbon tax than average. The income tax rebates have been focussed on taxpayers earning less than C$117,000 per year, so gas-guzzling plutocrats would be net losers in BC .

Roger Pielke Jr has declared, with some hyperbole, that:

The “iron law” thus presents a boundary condition on policy design that is every bit as limiting as is the second law of thermodynamics, and it holds everywhere around the world, in rich and poor countries alike. It says that even if people are willing to bear some costs to reduce emissions (and experience shows that they are), they are willing to go only so far.

BC has shown that a revenue-neutral carbon tax, set at C$30 per tonne of CO2-equivalent, can be both popular and effective. It is still unclear where Pielke’s boundary condition lies or if there is a boundary condition at all; in any case, it is clearly above $30 per tonne. The popularity of the policy is not because British Columbians, as the stereotype would have it, are all degenerate, pot-smoking lefties.

Well, we are not all lefties, anyway. In the 2011 national election, the percentage who voted for Stephen Harper’s Conservative Party was greater in BC than in Canada as a whole. The provincial government is the right-leaning BC Liberal Party that has won four elections in a row, with two of them since they introduced the carbon tax in 2008.

There are lessons from BC’s experiment that deserve to get the attention of anti-carbon-tax politicians in Ottawa, Washington, Canberra and elsewhere. Carbon taxes can work to reduce emissions without hurting the economy. And if they are designed correctly, they can even help leaders get re-elected.

Posted by Andy Skuce on Thursday, 25 July, 2013

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |