Senators Sheldon Whitehouse (D-RI) and Brian Schatz (D-HI) introduced a climate bill in the US Senate last week. The American Opportunity Carbon Fee Act proposes to tax carbon pollution at the source or at the border for imports, and return 100% of the revenue to taxpayers. The tax would therefore be revenue-neutral, not increasing the size of government.

A revenue-neutral carbon tax has become an increasingly popular proposal for tackling global warming. Liberals have long been on board with requiring that polluters pay for their carbon emissions, but in the United States and a few other countries where climate science is treated as a partisan issue, conservatives have been resistant to this concept.

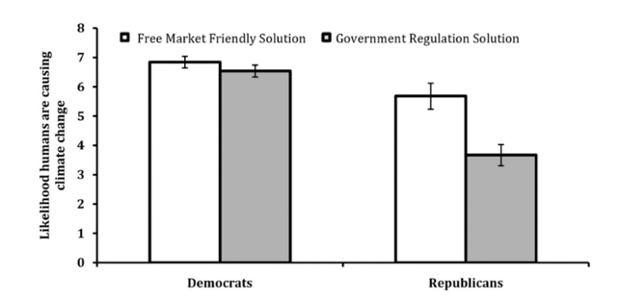

Research has shown that fear of government regulations is one of the primary reasons conservatives tend to reject the overwhelming scientific evidence for human-caused global warming. A majority of Republicans accept the scientific reality when they realize there are free market solutions available.

The American Opportunity Carbon Fee Act is a free market solution that, because it’s revenue-neutral, wouldn’t increase the size of government. All of the revenue generated would be returned to taxpayers through a variety of possible paths:

Senators Whitehouse and Schatz are willing to negotiate these various options with Republicans. However, the bill faces a tough road. Many free market carbon pricing bills have been proposed in both the US House of Representatives and Senate, and none have been voted into law. For example,

The first four bills listed above proposed carbon cap and trade systems. Boxer-Sanders proposed a carbon tax, but one that’s not revenue-neutral. Van Hollen introduced the first revenue-neutral carbon cap and trade system.

ACES was the only effort to come close to becoming law. It passed the House of Representatives in 2009 by a vote of 219–212. The Senate version (Kerry and Lieberman’s Clean Jobs and American Power Act) had a majority of votes, but not the 60-vote super-majority needed to break through a filibuster.

Despite the failed history of climate legislation in the US Congress, Senator Whitehouse is optimistic about his bill’s chances for two main reasons. First, he feels that since Republicans control both houses of Congress for the first time since 2006, they can’t just continue their strategy of obstructionism from the minority. They’re obligated to get something done, especially if they want to maintain control of the Senate in a 2016 election with a map far more favorable for the Democrats than in 2014.

Second, the Environmental Protection Agency is proceeding with its regulation of carbon pollution from power plants. Republicans hate this government regulation, and the Whitehouse-Schatz bill is designed to potentially replace it with a free market, small government alternative. Passing a climate bill in Congress is Republicans’ only realistic shot at eliminating the government regulation of carbon pollution.

It’s also important to remember that John McCain, the 2008 Republican presidential candidate, authored a major climate bill just five years ago. Climate change hasn’t been a purely partisan issue in the GOP for very long, so perhaps the party could change tracks relatively quickly and start treating the issue with the seriousness it needs and deserves once again.

The Whitehouse-Schatz bill is nevertheless a long shot. For example, Senator David Vitter (R-LA) responded to the proposed legislation by saying,

It’s not just energy prices that would skyrocket from a carbon tax, but the cost of nearly everything built in America would go up. And let’s not lose sight of how big of a dud cap and trade was in 2009, or as it came to be known — cap and tax. For some reason Democrats continue to ignore what a disaster these ideas have been for Europe.

Senator Vitter’s objections are not strong ones. While a carbon tax would raise energy prices, that increase would be offset when the revenue is returned to taxpayers. Analysis of a similar revenue-neutral carbon tax proposal found that it could increase personal disposable income in most parts of the America and thus create jobs and modestly benefit the US economy.

Senators Whitehouse and Schatz aren’t proposing a cap and trade system, but the 2009 legislation mentioned by Senator Vitter was no dud; it came within a few votes in the Senate of becoming law. The European Union also implemented a cap and trade system, not a tax. While the system has had its problems, Europe produces much less carbon pollution than the United States, while its economy has done equally well since the cap and trade system was launched in 2005.

Senator Whitehouse is right that his bill probably has the best chance to become law of any climate legislation proposed in the past five years.

Posted by dana1981 on Tuesday, 25 November, 2014

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |