Note: this will be our final entry on Climate Consensus - the 97%. The Guardian has decided to discontinue its Science and Environment blogging networks. We would like to thank this great paper for hosting us over the past five years, and to our readers for making it a worthwhile and rewarding endeavor.

Last week, Prime Minister Justin Trudeau announced that under the Greenhouse Gas Pollution Pricing Act, Canada will implement a revenue-neutral carbon tax starting in 2019, fulfilling a campaign pledge he made in 2015.

The federal carbon pollution price will start low at $20 per ton in 2019, rising at $10 per ton per year until reaching $50 per ton in 2022. The carbon tax will stay at that level unless the legislation is revisited and revised.

This is a somewhat modest carbon tax – after all, the social cost of carbon is many times higher – but it’s a higher carbon price than has been implemented in most countries. Moreover, a carbon tax doesn’t necessarily have to reflect the social cost of carbon. The question is whether it will be sufficiently high to meet the country’s climate targets.

The Preamble in the Act is worth reading. It begins by noting “there is broad scientific consensus that anthropogenic greenhouse gas emissions contribute to global climate change” (this is somewhat understated – carbon pollution is the dominant factor). It also notes that Canada is already feeling the impacts of climate change through factors like “coastal erosion, thawing permafrost, increases in heat waves, droughts and flooding, and related risks to critical infrastructures and food security.”

The Preamble also notes that in 1992, Canada signed the UNFCCC whose objectives include “the stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system,” and that Canada ratified the Paris Agreement, whose aims include limiting global warming to less than 2°C above pre-industrial temperatures.

Canada’s Paris commitment requires cutting its carbon pollution by 30% below 2005 levels by 2030. Prior to the implementation of the carbon tax, its policies were rated Highly Insufficient to meet that goal. Instead Canada’s emissions were on track to fall only about 4% below 2005 levels by 2030. So, the carbon tax is an important policy to close that gap.

Several Canadian provinces have already implemented or plan to implement carbon pricing systems. British Columbia, Alberta, and Quebec already have such systems in place; the Canadian government noted that these provinces were “among the top performers in GDP growth across Canada in 2017.”

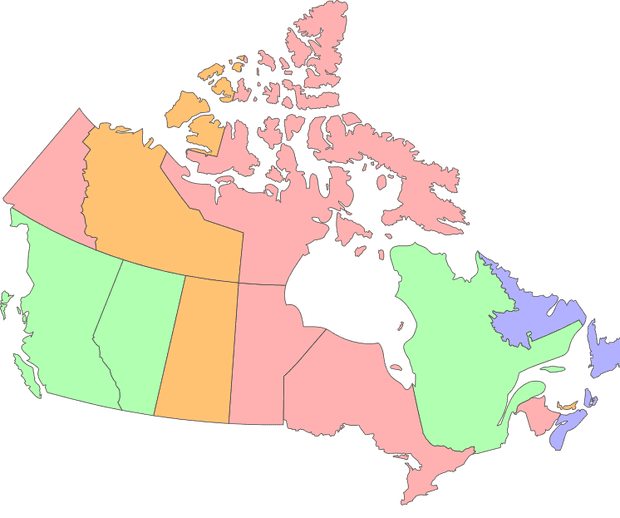

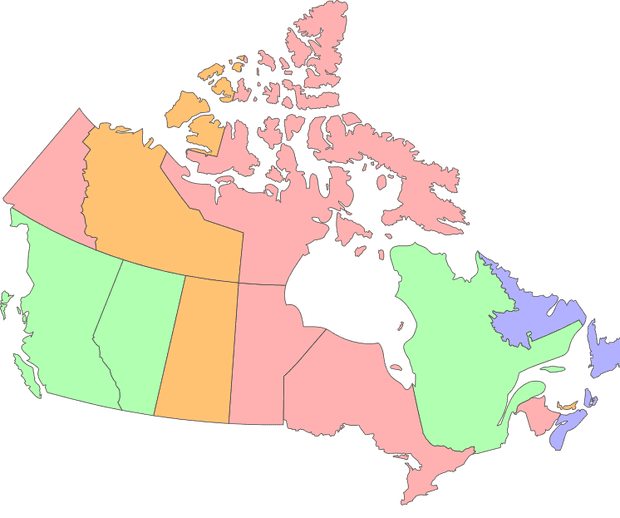

Provinces whose carbon prices meet the federal standards are already in compliance, so the new law won’t apply to them. Several other provinces (Northwest Territories, Nova Scotia, Prince Edward Island, Newfoundland and Labrador) have planned or proposed carbon pricing systems that will meet the federal requirements. The federal carbon tax will be applied to the remaining provinces.

Green indicates that the province’s own carbon pricing system meets the federal standards. Purple and orange indicate a province’s planned or proposed carbon pricing will meet the federal standards, respectively. Red indicates that the federal carbon pricing will apply to the province. Illustration: Dana Nuccitelli

A $20/ton carbon tax translates into a 16.6 cent per gallon surcharge on gasoline. So, in 2022, the $50/ton carbon tax will increase Canadian gasoline prices by about 42 cents per gallon (11 cents per liter). For comparison, the average price of gasoline in Canada is $1.43 per liter, so that would be about an 8% gasoline price increase in 2022.

The price of coal would more than double, with a carbon tax surcharge of about $100 per ton in 2022. Natural gas prices will rise by about 10 cents per cubic meter in 2022 compared to current prices of around 13 cents per cubic meter – about a 75% increase. This will increase demand for cheaper carbon-free electricity. However, Canada already supplies about 60% of its electricity through hydroelectric generation and 16% from nuclear – only about 20–25% comes from fossil fuels.

For that reason, only 11% of Canada’s carbon pollution comes from generating electricity. The industrial sector is responsible for the biggest chunk of Canadian carbon pollution (40%). It will not be subjected to the carbon tax, but rather to an Output-Based Allocations system (similar to cap and trade).

One key component of the federal carbon tax is that it’s revenue-neutral, similar to the policy proposal from Citizens’ Climate Lobby. All the taxed money will be distributed back to the provinces from which they were generated. The provinces will in turn rebate about 90% the revenues back to individual taxpayers. The rebates are anticipated to exceed the increased energy costs for about 70% of Canadian households.

For example, a Manitoba family will receive a $336 rebate in 2019 compared to its increased costs of $232. A similar family in Saskatchewan will receive $598 compared to its higher costs of $403. In Ontario, families will receive $300 to offset its $244 in carbon taxes. And in New Brunswick a $248 rebate more than offsets the average household cost of $202. The rebates will more than double by 2022 as the carbon tax rises, and the net financial benefit to households will grow over time.

Posted by dana1981 on Monday, 29 October, 2018

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |