Putting a price on carbon emissions is often discussed as one of the main solutions to anthropogenic global warming. Carbon dioxide is a pollutant and in economic theory, pollution is considered a negative externality – a negative effect on a party not directly involved in a transaction, which results in a market failure. The Stern Review on the Economics of Climate Change concluded that climate change represents "the greatest example of market failure we have ever seen."

Despite the economic benefits of addressing this market failure, many skeptics argue that putting a price on carbon emissions will cripple the economy. Such arguments generally focus solely on the costs associated with pricing carbon while wholly ignoring the benefits. For example, a Heritage Foundation analysis of the Waxman-Markey climate bill proposed in the US House of Representatives in 2009 concluded that the legislation would cost the average American family $1500 per year – a figure 10 times higher than any non-partisan economic analysis (see below).

The reason the Heritage estimate was so high is that it evaluated the costs of a carbon cap, and then ignored the distribution of those funds. When a price is put on carbon emissions, it creates a revenue stream. The funds which are generated from the carbon price can be distributed in any number of ways – usually through reductions in other taxes, investment in research and development of 'green' technologies, funding of energy efficiency programs, etc.

The Heritage Foundation report effectively assumed that the generated funds would disappear into a black hole. Their analysis was the equivalent of doing your household finances by adding up your expenditures while ignoring your income. It sure looks bad, but tells you nothing about your overall finances.

Here we will look at a few of the climate bills proposed by the US Congress which would have put a price on carbon emissions, and examine a number of economic analyses mainly by non-partisan economic groups which evaluated both the costs and benefits of each proposal.

Senators Lieberman and McCain introduced the Climate Stewardship and Innovation Act of 2007. This bill would have capped greenhouse gas (GHG) emissions at 22% below their 1990 levels in the year 2030, and 60% below 1990 levels in 2050. The Energy Information Administration (EIA) analyzed this bill using the National Energy Modeling System (NEMS), and the US Environmental Protection Agency (EPA) analyzed the bill as well.

Senators Lieberman and Warner introduced the Climate Security Act of 2008. The bill called for a steadily-declining GHG cap, reaching 15% below 2005 levels by the year 2020 and 70% below 2005 levels by 2050. It was analyzed by the EPA using results from two economic forecasting models: the ADAGE model developed at Research Triangle Institute (RTI) in North Carolina; and the IGEM model run by a consulting firm founded by Dale Jorgenson, a professor at Harvard. The Massachusetts Institute of Technology (MIT) analyzed this bill using their Emissions Prediction and Policy Analysis (EPPA) model, and the EIA and Congressional Budget Office (CBO) also analyzed the bill.

Congressmen Waxman and Markey introduced the American Clean Energy and Security Act of 2009. This bill would have reduced greenhouse gas emissions 17% below 2005 levels by 2020 and 83% by 2050. It was analyzed by the CBO, EPA, EIA, and Science Applications International Corporation (SAIC).

Senators Kerry and Lieberman introduced the American Power Act. This bill would have reduced greenhouse gas emissions 17% below 2005 levels by 2020 and 83% by 2050. It was analyzed by the Peterson Institute, EPA, EIA.

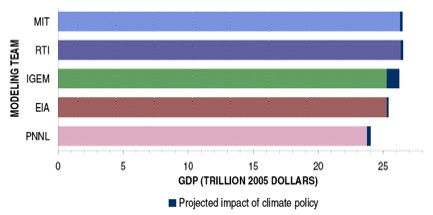

Research groups (MIT, RTI, and the Department of Energy's Pacific Northwest National Laboratories [PNNL]) have also analyzed the economic impacts of a generic comprehensive, economy-wide climate policy to reduce GHG emissions 50-80% by the year 2050.

These studies compare a particular climate policy scenario with a reference scenario corresponding to the model projection of business as usual (BAU) – that is, a world in which the economy continues on its current course with carbon emissions unchecked. All assume that a climate policy would be implemented in the year 2012, and most project economic impacts through the year 2050. The analyses evaluate the costs of reducing greenhouse gas emissions, but do not measure the resulting payoff – the benefits of averting dangerous climate change. Nor do they consider the ancillary benefits, such as the improved local air quality and reduced ocean acidification.

They merely model the economic impact of the climate policy to a BAU scenario where climate change does not impact the economy. Therefore, it is important to bear in mind that these analyses overestimate the policy impact on the economy as compared to a realistic BAU scenario in which climate change impacts the economy. These analyses should be viewed as a comparison between policy impacts and a scenario in which our understanding of the climate is wrong and the climate does not change significantly as GHG emissions continue to rise.

Since it is difficult to predict how much climate change will impact the economy, or how much climate change will be averted as a result of these policies (particularly since they may trigger similar GHG emission reduction policies by other countries), the comparison to an unrealistic BAU scenario is the best we can do.

The majority of these analyses find that the evaluated climate policies impact the US GDP by less than 1% as compared to BAU. The main exception is the IGEM analysis, which finds a 2.15% reduction in GDP for the Lieberman-Warner by bill by 2030, and a 3.59% reduction by 2050. The IGEM model is an outlier because it assumes when the price of energy (and other goods and services) rises, people will respond by choosing to work less than they otherwise would (EDF 2008). This is a counter-intuitive and illogical assumption, since increasing costs generally result in people working more to increase income correspondingly.

Another outlier was the SAIC analysis of Waxman-Markey, which was funded by the National Association of Manufacturers, which has strongly opposed climate legislation. The study incorporated some unrealistically conservative and pessimistic assumptions, for example that American companies will be unable to deploy clean energy and energy efficiency technologies in a timely manner. Nevertheless, the report concluded that by 2030, GDP would grow 95% as much under Waxman-Markey as compared to BAU.

The MIT analysis in the generic 80% GHG emissions reductions below 1990 levels below 2050 (the scenario with the largest GHG emissions decrease) found that by 2030, GDP would increase by just 0.44% as compared to BAU.

Figure 1 and Table 1: Modeled Impacts of Climate Legislation on US GDP

| Legislation | GHG Reduction by 2050 | GDP loss vs. BAU by 2030 |

| Lieberman-McCain | 60% below 1990 levels | 0.23% |

| Lieberman-Warner | 70% below 2005 levels | 0.44-2.15% |

| Waxman-Markey | 83% below 2005 levels | 0.2-0.9% |

| Kerry-Lieberman | 83% below 2005 levels | 0.1-1.0% |

| Generic | 50% below 1990 levels | 0.47-0.81% |

| Generic | 80% below 1990 levels | 0.44% |

The CBO analysis of Waxman-Markey found that the bill would reduce the federal deficit by $9 billion by the year 2019. The CBO analysis of a similar bill proposed by Senators Kerry and Boxer found the bill would reduce the federal deficit by $21 billion by 2019 and "would not increase the deficit in any of the four 10-year periods following 2019." And the CBO also found that Kerry-Lieberman would decrease the deficit by $19 billion by 2020.

In the MIT analysis of Lieberman-Warner, the United States would spend $20 billion less on foreign oil in the year 2020, and $81 billion less in 2030.

The EIA study of Lieberman-Warner found that the bill would add 42 cents per gallon to gas prices in 2030 as compared to BAU (a 12% increase). Analyses of Waxman-Markey found that it would increase gas prices 22 to 35 cents per gallon by 2030 (6 to 9%). The Peterson Institute analysis of Kerry-Lieberman found it would increase gas prices by approximately 10 cents per gallon (3%) by 2030.

Analyses of Waxman-Markey found that its impacts on monthly utility bills by 2030 ranged from a $5.60 decrease to a $2.80 increase. The Peterson Institute analysis of Kerry-Lieberman found that by 2030, monthly utility bills would range between a $0.67 decrease and a $2.62 increase.

The potential decrease in monthly electric bills is due to the energy efficiency programs established through the bill's provisions. Though energy prices are expected to increase modestly, energy consumption is expected to counteract these increases as households take advantage of these energy efficiency programs.

The analyses of Waxman-Markey concluded that the bill would cost the average American household between $84 and $160 per year by 2020, which corresponds to $0.67 to $1.28 per person per week. The majority of the increase comes through increased gasoline costs. The studies also concluded that the costs would be lower for lower income families. For example, the CBO analysis of Waxman-Markey concluded that families in the lowest income quintile would see a net decrease in average annual costs of about $125 in 2020 due to low-income assistance provisions (CBPP 2009).

Over the entire span of the Waxman-Markey bill (to 2050), EPA found the average annual cost would be $80 to $110 per household in current dollars (64 to 88 cents per person per week).

To summarize, most of these economic analyses agree that a carbon pricing policy will reduce US GDP by less than 1% over the next 10–40 years as compared to an unrealistically optimistic BAU scenario in which climate change does not impact the economy. The analyses also concluded that the evaluated policies would reduce the federal deficit. Gas prices would rise somewhere between 3% and 12% over the next 20 years compared to BAU. Although energy prices would rise modestly, energy costs would be offset through increased efficiency. Total household costs would rise somewhere in the ballpark of 75 cents per person per week. Studies which conclude costs will be significantly higher either make unrealistic assumptions or only consider half of the picture.

In addition, energy independence and air quality would be improved. The reduction in GHG emissions would be a major step toward addressing both climate change and ocean acidification, although these beneficial impacts were not included in these economic analyses.

In short, even when compared to the perfect world where climate change has no impact on the economy, carbon pricing would have a very minimal economic impact, and would have several ancillary benefits. Compared to the real world in which unchecked increasing GHG emissions will certainly lead to numerous adverse economic impacts, putting a price on carbon emissions to reduce those impacts will almost certainly prove to be a net economic benefit.

This post is the Intermediate version (written by Dana Nuccitelli [dana1981]) of the skeptic argument "CO2 limits will harm the economy".

Posted by dana1981 on Monday, 15 November, 2010

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |