Trillions of Dollars are Pumped into our Fossil Fuel Addiction Every Year

Posted on 2 April 2013 by dana1981

A new report from the International Monetary Fund (IMF) estimates that overall global fossil fuel subsidies amount to about $1.9 trillion annually. As large as this number sounds, it's actually an underestimate for many reasons. The IMF report lists several of these reasons, including the fact that it's simply impossible to obtain data for all fossil fuel subsidies in all countries. However, the biggest contributor to the conservative dollar figure is related to the social cost of carbon.

The social cost of carbon is an estimate of the direct effects of carbon emissions on the economy, and takes into consideration such factors as net agricultural productivity loss, human health effects, property damages from sea level rise, and changes in ecosystem services. It's the economic damage caused by CO2 via climate change. The IMF report uses an average US government agency value of $25 per tonne of CO2 emissions; however, there is substantial evidence and research suggesting the value should be much higher. Dave Roberts provides some references in his post on the report, and we go into detail on the subject here.

The true cost of carbon emissions could easily be four times higher, at $100 per tonne. Chris Hope, climate policy researcher at Cambridge University, has argued that an estimate around $150 per tonne may be more accurate. Thus the true cost of our fossil fuel subsidies could be over $4 trillion per year, or over 6% of global Gross Domestic Product (GDP). Compare that to the estimated cost of reducing greenhouse gas emissions to safe levels, which are generally on the order of 1% of GDP, and it becomes clear that our current priorities are completely backwards, pumping trillions of dollars into our fossil fuel addiction when we should be trying as hard as we can to break the habit.

Direct Subsidies

The IMF report estimates that approximately one-quarter of all global fossil fuel subsidies ($480 billion) are direct pre-tax subsidies, with about half of that total coming from the Middle East and North Africa. Most of the rest comes from emerging and developing Asia (20%), and central and eastern Europe (15%). The bulk of these direct subsidies go to petroleum products ($212 billion, or 44%), electricity ($150 billion, 31%), and natural gas ($112 billion, 23%). Electricity subsidies are included because they increase the consumption of coal and natural gas.

As Brad Plumer notes, the IMF report argues that these direct fossil fuel subsidies are crowding out other useful public spending in these developing countries and depressing private investment in the energy sector. In many of these countries, direct fossil fuel subsidies amount to over 5% of GDP. Phasing out those subisidies would have to be done gradually and carefully, but the money could be much better spent in other areas to benefit the countries' populaces, and the report estimates that global carbon emissions would fall by up to 2% if these direct subsidies were scrapped.

Indirect Subsidies a.k.a. Externalities

As we have previously discussed, carbon is a huge but usually overlooked fossil fuel subsidy, due to the aforementioned damage it causes via climate change. In countries which don't put a price on carbon emissions, those costs are not paid by the producers or consumers of the products causing the damage, but somebody pays the price. This is also known as an economic externality, when the cost is paid outside the economic system rather than being reflected in the market price. This short video produced by the Climate Reality Project illustrates the point nicely.

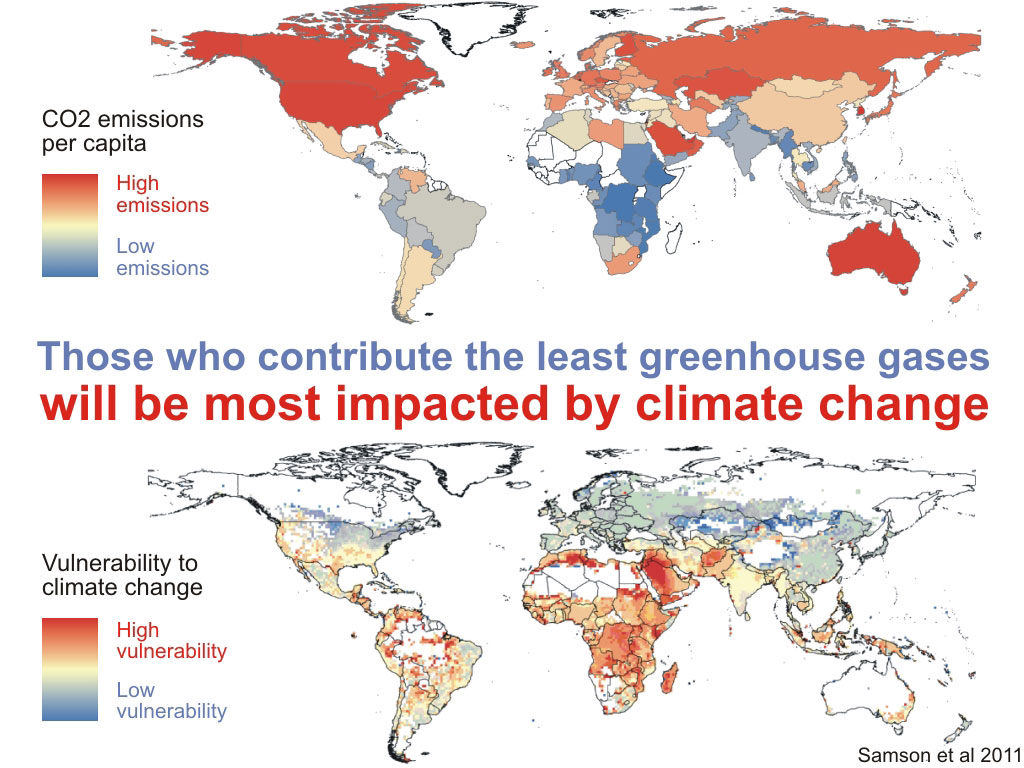

Unfortunately, in the case of carbon, those external costs tend to fall disproportionately on poorer countries which contribute the least to the climate change problem. As Paul Baer put it,

"the world’s poor are subsidizing the world’s rich."

Top Frame - National average per capita CO2 emissions based on OECD/IEA 2006 national CO2 emissions (OECD/IEA, 2008) and UNPD 2006 national population size (UNPD, 2007). Bottom Frame: Global Climate Demography Vulnerability Index. Red corresponds to more vulnerable regions, blue to less vulnerable regions. White areas corresponds to regions with little or no population (Samson et al. 2011).

Due to relatively high carbon emissions and a lack of emissions pricing, the USA accounts for the largest indirect fossil fuel subsidy, at $502 billion per year, according to the IMF report. China comes in second at $279 billion, followed by Russia at $116 billion.

Image created by tcktcktck

The IMF overall estimate is $1.4 trillion in global indirect fossil fuel subsidies per year. The bulk of direct + indirect subisides goes to petroleum products ($879 billion per year, or 46%), followed by coal ($539 billion, 28%), natural gas ($299 billion, 16%), and electricity ($179 billion, 9%).

As noted above, this estimate is based on a conservative social cost of carbon at $25 per tonne. Some of the cost is associated with local pollution damage from coal combustion – approximately $500 billion (8 billion short tons per year at $65 pollution damage per short ton), and another $200 billion is associated with exemptions from value added taxes. Finally, around $800 billion is associated with the cost of carbon (32 billion tonnes of CO2 emissions per year at $25 per tonne). If we apply an arguably more realistic estimate of $100 per tonne of CO2 emitted, that cost rises to $3.2 trillion, and the overall cost of fossil fuel subsidies becomes over $4 trillion per year – over 6% of global GDP.

And remember, this still does not account for all global fossil fuel subsidies. Note also that global fossil fuel subsidies amount to around $1 trillion per year even without accounting for climate damage costs.

Substantial Benefits from Eliminating Fossil Fuel Subsidies

The IMF report also examined the effects of eliminating these subsidies and found they would be substantial.

"The results suggest that this reform would reduce CO2 emissions by 4½ billion tons, representing a 13 percent decrease in global energy-related CO2 emissions. Eliminating subsidies would also generate significant health benefits by reducing local pollution from fossil fuels in the form of SO2 and other pollutants. In particular, this reform would result in a reduction of 10 million tons in SO2 emissions and a 13 percent reduction in other local pollutants."

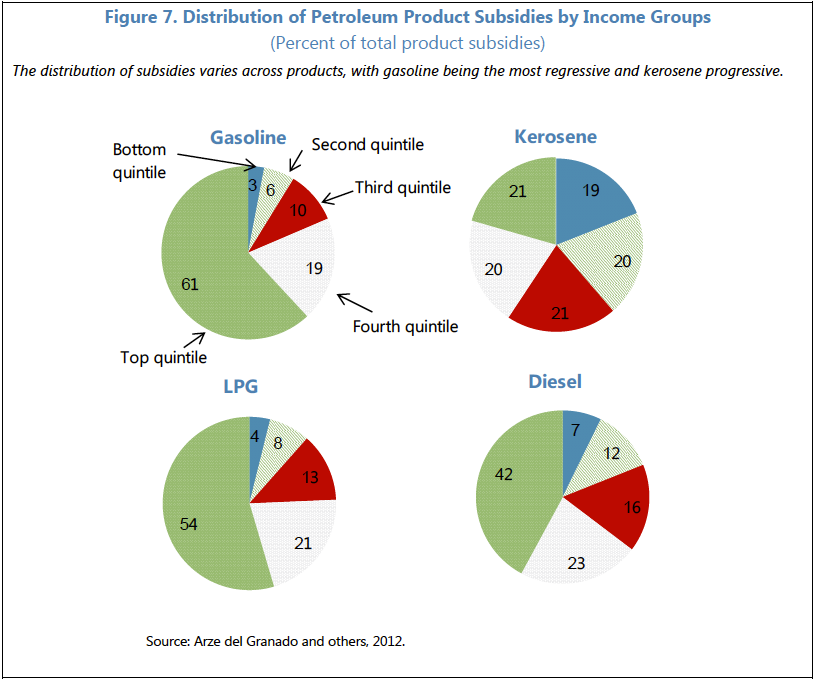

In developing countries, fossil fuel subsidies also overwhelmingly benefit the rich. The IMF report noted,

"On average, the richest 20 percent of households in low- and middle-income countries capture six times more in total fuel product subsidies (43 percent) than the poorest 20 percent of households (7 percent) (Figure 7)."

Paying the Drug Dealer vs. Paying for Rehab

Pumping trillions of dollars of subsidies into the fossil fuel industry keeps the market price of their products low, but we can't avoid paying the price elsewhere. These subsidies keep us addicted to fossil fuels at the cost of public health and increasing climate change damage. Alternatively, we could spend this money in much more productive ways, including to transition away from fossil fuels toward low-carbon energy sources, solving the climate crisis in the process.

The transition won't be easy; we've become accustomed to low energy prices, artificially depressed by these massive fossil fuel subsidies. It's akin to going through rehabilitation for an addiction – it may be a somewhat painful process, but it's a necessary one, because the alternative is much worse. The alternative involves continuing to pump trillions of dollars towards our addiction until the inevitable climate crash finally comes.

Note: this post has been incorporated into the rebuttal to the myth 'CO2 limits will harm the economy' and 'renewable energy is too expensive.'

Arguments

Arguments

I'm going to leave a comment to keep my poor lonely post company!

Dana,

Does this price include the cost of wars like Iraq where the US unsuccessfully tried to gain control of Iraqs oil? Much of the world defense budget is aimed at protecting fossil fuels.

dana: sorry for the lack of comments, but I've been looking over my tax return stuff that needs to be filed before the end of April (Canada), and thinking about how much Steven Harper takes from me is depressing enough - it doesn't help to think too much about the amount he's passing on to rich gas and oil corporations...

michael @2 - no, military costs are not included. Just direct subsidies and indirect costs via pollution and climate change. It would be very difficult trying to quantify military costs associated with fossil fuel interests.

Bob @3 - no worries, economics posts on SkS are always less popular than science posts. I still think it's an important subject to cover though. Ultimately a lot of climate denial boils down to a misunderstanding of economics - the fear that transitioning away from fossil fuels will be too expensive. In reality the opposite is true, it's continuing to pay for our fossil fuel addiction where the real high costs lie.

dana: my comment was entirely a personal one, in my current state of mind. I agree that posts on such topics are worthwhile...

dana1981@1,

Your comment is OT ;) but I can add to it that I think most of the valuable commenter crowd was stolen by realclimate.org where they just posted the analysis of Marcott 2013 paper, which appears to be over-popular in US. Strangely, Marcott 2013 does not draw so much interest here in OZ (where SkS also belongs at least geographically)

But back to the topic, it's a shame that the economics of climate change do not draw as much attention as it deserves. Even climate scientists like Mike Mann & Gavin from RC are saying: "if you want to want to help Earth, don't look at the research in climate (whatever you do there won't change the problem humanity is facing), look at the engineering slutions and their economy".

Your reported internalising of CO2 polution at the level of $100 per tonne would bring the total cost to 4trillions of 6% of global GDP. To put this number into perspective, the World War II cost us 3% of GDP that that was somewhat signifficant effort, according to the stories from my parents. So, it seems unbelievable that nowadays, the FF subsidies take twice that effort. Still, at $25 per tonne (current tax in OZ where I live) we spend 1.9trillions or 3% of GDP, so the effort at the same level as WW II. It does not feel like. The humanity dependency on FF must be enormous if those numbers are justified.

pansy@6,

Currently, those "mega rich people" you're "giving money" are fosil fuel industry. Not directly, but through the subsidies this article talks about. Are you feeling good about it?

You don't necessarily need to give that money to "carbon tax support and carbon trading" instead. That depends on the type of solution. E.g. Jim Hansen's "charge at the source and divident" scheme bypasses any carbon trading and distrubutes money back to your (citizen taxpayer) pocket with minimal administrative overhead. And you could use that extra money for e.g. buying solar panels and investing into other renewable energy sources. Would you not like it?

Dana, add me to the list of folk who are interested in the (sadly, bastardised) economics underpinning human fossil fuel use.

Without pointing too fine a point on it, and at the risk of wandering toward political territory, it's troubling that the conservative opposition parties in Australia pander to economic the <i>status quo</i>, and diligently submit to the industry memes about the apparent ruinous economic consequences of trying to reduce emissions. From the politicians it's a combination of "...great big new tax...", "we need the jobs", "it would cost too much to go to renewables", "working families have so many bills already", and "if we don't sell it someone else will", with additional protestations along the lines of "no stinking government is going to tell me how to spend my money" from the public peanut gallery.

Again, I am leary of commenting politically here, but in the run-up to the federal election later this year it would be more than interesting to see Tony Abbott squarely challenged to comprehensively detail the costings for his policy of effectively <i>not</i> pricing carbon, and in so costing to include an honest assessment of the pork-barrelling that fossil fuel interests enjoy in Australia. It would be even more instructive to have Abbott tie this policy response to a similarly detailed demonstration of his understanding of all aspects of the relevant science, and of the implications of this science for the future, and how this understanding informs his resultant carbon-pricing policy.

I'd really like to see coming from both sides of the election a policy informed by a scientifically-based cost-benefit risk analsyis, but especially from the conservatives who are virtually certain to win come September. Time for everyone to dust off their Garnaut reports, update, and show that they actually know what they're talking about...

Bernard@8,

I agree and have to add at this point that politics, especially election campaign aspect, have nothing to do with economy. If Tony Abbott win in September (he will be the silliest OZ PM ever) he and his party would start implementing the policies that have nothing to do with their current promisses. Needless to say those promisses have nothing substantial: no real program, just sloganeering.

I'm not writing this because I support the incumbent Labor Party. I'm writing to show the sad reality that the "easiest" political campaign based on negativity and prying on and profiting from human addction to fosil fuels I pointed above @6, is the effective tool to gain popularity in our electorate. It's unbelievable but the sicence, be it climate or economics, must be simply ignored by average electorate (if you believe the polls), people just want to follow the "easiest" path, just like doping is the easiest for an addicted drug user. The effort required to break the dependence on FF is nowhere to be seen in such environment. And politicians who are prying on such dependence are doing lots of damage.

"The bulk of these direct subsidies go to petroleum products ($212 billion, or 44%), electricity ($150 billion, 31%), and natural gas ($112 billion, 23%). Electricity subsidies are included because they increase the consumption of coal and natural gas."

and

"The bulk of direct + indirect subisides goes to petroleum products ($879 billion per year, or 46%), followed by coal ($539 billion, 28%), natural gas ($299 billion, 16%), and electricity ($179 billion, 9%)."

How come the indirect subsidy on electricty? Isn't that included in the coal/gas/petroleum already?

And then to think of that renewable electricity doesn't get a dime: FiT tariff is charged as an extra on all electrical power directly to the consumer (in Philippines it is as the FiT-All).

Thanks, Dana1981, for a very useful article. I'm an American, and although I did pay some attention to the interesting report of Marcott et al (2013) and its analysis at Skeptical Science, I'm also very interested in the topic of fossil fuel subsidies. After all, as shown in one of your illustrations, we're the world champions at subsidizing fossil fuels.

Although it's difficult to calculate the total cost of wars over fossil fuels, I think it would be fair to attribute America's two wars in Iraq and Afghanistan to oil and gas (pipeline rights in Afghanistan's case). After all, if those wars were not for fossil fuels, what were they for? Could they have been completely irrational?

Ger@10,

Can you explain what FiT and FiT-All means? And how it works in Philippines ? Without knowing anything about it, I cannot understand your last paragraph...Thanks.

chriskoz, FIT almost certainly refers to a 'feed in tariff'. The Phillipines have had a FIT law for several years now, but haven't actually implemented it yet... thus making complaints about its non-existent cost somewhat difficult to fathom. They expect to approve the first FIT projects some time next year. Basically, how these work is that the government agress up front to pay a certain price for power over a relatively long contract period. This provides certainty of profit and thus makes it easier to attract investment. Power costs in the Phillipines are very high and thus the hope is that enacting a FIT system will help create a stronger renewable energy industry (though they already have very good geothermal development) for the country that will then bring prices down.

Ger @10 - it's basically a double subsidy. The fossil fuels are subsidized directly to keep their prices down, and electricity is also subsidized to keep electricity rates down as well. Plus the climate subsidies, and the pollution subsidies, and the lost tax revenue - it's just amazing how many different subsides fossil fuels get.

And then everyone talks about how great they are because fossil fuels are cheap. Sure they're cheap if they're subsidized up the wazoo!

That depends on the type of solution. E.g. Jim Hansen's "charge at the source and divident" scheme bypasses any carbon trading and distrubutes money back to your (citizen taxpayer) pocket with minimal administrative overhead. And you could use that extra money for e.g. buying solar panels and investing into other renewable energy sources. Would you not like it?

No, I wouldn't, because I won't have any extra money. The energy companies will jack their prices to compensate for the tax they pay, my income and everyone else's won't change (assuming a %100 rebate), and the net result is merely to cycle more money through energy companies' bank accounts.

A better plan is to use all or most of that tax money to build low energy communities, mass transit, and renewable energy infrastructure, as a society, not just as individuals. Only individuals who are already rich would be able to afford a personal transition to renewables.

Energy commodity speculation should be outlawed. That will bring down prices some.

gaillardia - how can you claim - "my income and everyone else's won't change (assuming a %100 rebate)" The 100% rebate idea means you get back the tax money. You can get more than your fair share if you less carbon than average. That gives companies a serious incentive to build low carbon infrastructure.

The idea that tax money is used by government to improve infrastructure unfortunately is an anethema to the right who do not trust government (with some justification ) to do this efficiently.

scaddenp at 06:07 AM on 7 April, 2013

gaillardia - how can you claim - "my income and everyone else's won't change (assuming a %100 rebate)" The 100% rebate idea means you get back the tax money. You can get more than your fair share if you less carbon than average. That gives companies a serious incentive to build low carbon infrastructure.

The idea that tax money is used by government to improve infrastructure unfortunately is an anethema to the right who do not trust government (with some justification ) to do this efficiently.

Sequence:

1. Carbon tax is levied on energy company.

2. Energy company raises price by amount of tax, at least.

3. Middlemen and retailers raise their prices also, and since they frequently do this on a percentage basis, not by amount of expenses or some other real quantity, the retail price increase may be proportionally more than the tax increase.

4. Best case scenario: Because of the additional tax, I pay more for the product, by an amount equal to (not more than, see #3) that product's share of the tax.

5. The tax is rebated to me, maybe at %100, but I've already spent that money paying for the tax.

6. My income has not changed, in fact there's a good chance it will go down a little. I have no additional disposable income to buy anything, let alone something as expensive as a personal renewable energy system.

7. This scheme merely cycles more money, with greater opportunity for energy companies to skim off the top. They don't care that more dollars are cycling through the system, as long as their net profit is maintained (They don't care that some individuals might get a bigger rebate, and some might get less. That makes no difference). They have no incentive to change.

We need systemic change, yesterday. We have to do it as a society, all together, or it won't happen. Let's take the tax money and build what we need the way that it's actually possible, by pooling the money to buy the big systemic changes: better-designed communities, mass transit, and renewable energy infrastructure.

I know the right thinks it's anathema. They think taxes are anathema. That problem must be confronted, since it won't go away by waiting for it to go.

Waiting for the market is waiting for purposefully ignorant grifters to see the light.

gaillardia @17:

1) Introducing a carbon tax or emissions trading scheme will set a higher mean retail price for energy.

2) That means that corporations that can deliver energy with less carbon production will pocket more of that retail price, and hence will have an incentive to reduce carbon emissions by switching energy production from coal to gas, or from coal to renewables.

3) It will also mean there is a greater incentive for private individuals to independently source their energy needs by installing their own renewable energy capacity.

4) It also means that private individuals will have a greater incentive to conserve energy, ie, by installing better insulation and running their heater/air conditioner at a lower rate, or by turning down (or up in hot climates) the thermostat slightly, or by turning of electronic equipment at the wall when not in use. Conservative estimates show that households can reduce power consumption by at least 10% by these means, which would make them slightly better of even without a rebate.

5) Finally, it would mean the savings on power from installing insulation or renewable power would likely exceed the interest payments on the loan taken out to do either or both of the above (if you don't have the ready cash). So it is not true that you won't have the extra money to change consumption habits provided that those changes reduce your energy bills.

The most fundamental point is that your claims amount to the claim that market mechanisms cannot efficiently adapt to changes in prices. If true, we had better switch to socialism because the efficiency of free markets is premised on the ability of markets to adapt to price signals. That is why it has been conservative economists who have proposed and pushed the use of pricing mechanisms rather than regulation to control carbon emissions.

Of course, the evidence is that markets do adapt efficiently to price changes.

" the retail price increase may be proportionally more than the tax increase."

I find that very unlikely. An increase in bulk energy (crude oil, electricity generation) usually comes to retail as less. If all middle men are working to fixed margins, then retail go up precisely by same percent. In practise, industries would be extremely lucky to be able to sell on fixed margins.

The set up under discussion is a 100% rebate scheme so let's discuss that rather an alternative which I agree you would not want. In this scheme, your income after tax increases. If you spend less than average joe on carbon, then you are better off not worse. The obvious way to improve your income is to look around for ways to pay less carbon tax than average joe because then you become even better off. So an energy company that sell to you with no carbon tax will get your business. They get more market share so that is what provides the incentive.

Actually in an unfair carbon tax, where only say 70% is rebated, there is actually an even bigger incentive to get your energy from sources with no carbon tax.

If live in a country where the reality is that people vote right-wing into power, then you have to also find climate change solutions that the right wing can live with.

Tom Curtis,

It also means that more people will not be able to afford to heat there homes during the winter, which also means that more people will die from an inability to properly heat their homes during the winter.

Kevin, you're ignoring the rebate side of the equation... that is, the carbon tax dollars collected are then given back to the populace. This essentially transfers money from high energy consumers (i.e. corporations and the wealthy) to low energy consumers (e.g. the poor)... making it easier for them to heat their homes.

Kevin @20, there are far cheaper ways to stay warm in the winter than central heating. Blankets, jumpers, thermal underwear etc can keep you warm enough to survive in Antarctica if thick enough, and that with no heating at all. No mere Chicago winter (or what ever example you have in mind) is cold enough to cause people to die from lack of central heating. So, in the first instance, even if your premise (that more people would not be able to afford central heating) where true, your conclusion that there would be more deaths is false. What there would be is more people wearing jumpers and thick socks indoors so they can keep the thermostat a little lower, with a net saving on the powerbill.

Of course, your premise is also dubious, as argued by DBDunkerson. In fact, a fee plus flat rate per capita dividend, as he envisions, will result in people currently at risk from cold having more money to do something about it. Of course, we cannot assume that a flat rate per capita dividend will be implimented anywhere, least of all in the US. Consequently we cannot be certain that people on low incomes will be better of because that depends on the particular design of the carbon tax or emissions trading scheme implimented. It does mean that the poor being worse of (if it occurs) will be a consequence of deliberate choice just as the poor in the US often not having enough money for power bills is a matter of political choice.

CBDunkerson,

Under the rebate plan discussed by scaddenp, there is no way it is easier for people to heat their homes. At best, it is break even. However, when was the last time that a govt. sponsorred rebate plan worked as advertised? The next time will be the first.

Again, not true. The corporations and the wealthy have the money to invest in infrastructure to take advantage of these incentives. Those on fixed income, or low income do not!

TOM CURTIS,

Just a comment on this point. Energy consumption is not infinitely flexible. There is a lower amount that people have to have. The market can, and does, flex its muscle and push in certain directions, however, it can only push so far.

Kevin, Alaska has been doing this for decades. Not exactly a hotbed of Communism.

Kevin, as Tom Dayton notes... your rhetoric is at odds with reality. Indeed, Skeptical Science has an article about this thing which cannot possibly happen.

Tom Curtis,

Here are a couple of articles for you...

http://news.bbc.co.uk/2/hi/health/1754561.stm

http://www.bbc.co.uk/news/world-europe-16817162

http://www.dailymail.co.uk/news/article-1332343/Nine-pensioners-died-cold-hour-winter-prices-soar.html

[DB] Note that link-vomiting (posting links without proper context) is frowned upon in this establishment. And a Comments Policy violation.

Kevin @23,

1) It is patently obvious that a carbon tax will draw money from people approximately in line with their energy use. That means wealthy people who have high energy use will pay more tax. It follows that if the rebate is equal for each person, people on low incomes will be rebated more than they originally paid in carbon tax. You would get a lot more respect around here if you did not feel it incumbent on you to assert such blatent faslehoods so frequently.

2) As is also patently obvious, you don't need to invest anything to take advantage of a flat rate per capita rebate. Further, you can cut energy usage as a simple means of reducing additional costs, something anybody can do.

3) Energy consumption is not infinitely flexible; but nobody said emissions would be reduced solely by eliminating consumption. An increased cost of supply that is not applied to emissions free generation will drive up supply by emissions free generation. It will also drive the substitution of lower emissions generation (gas) for higher (coal).

Kevin @26, from your first article:

As Siberia is undoubtedly colder than Britain, clearly the excess deaths are not caused by the cold per se but by not taking adequate measures against the cold. Or, as the article says, quoting William Keatinge,

Kevin:

If the vast majority of human history shows anything, it is that humans can get by - and even thrive - with extremely low energy consumption by the standards of modern materially affluent societies. Indeed, there are many societies and proto-societies still extant in the modern world where people appear to be getting along just fine with but a fraction of the energy consumption that materially affluent societies engage in. Some of them are in quite inhospitable environments, to boot.

So as far as I can see energy consumption is rather more flexible than you make it out to be.

Tom Curtis,

It is not patently obvious at all. People are going to consume energy in proportion to heating / cooling needs primarily, and only secondarily to wealth.

As wealth increases, so does one's ability to purchase better more energy efficeint equipment, or to better insulate one's home. In fact, some lower income families do not own the home, so they can't make efficeincy improvements (while some don't pay for heat).

My point on reduction of energy usage - Let's say you make plenty of money. You get a top of the line refridgerator that is tops in efficeincy. I do not make as much. I have to settle for a Searsbottom of the line refridgerator.

Bottom line, I consume more electricity every day, yet you make more money than I do.

CBDunkerson,

Thanks, that was an interesting article. Glad it worked for them, but I do know that US congressmen / Senators or even state representatives can / will screw anything up/

Kevin, there is a vast difference between 'it could be done wrong' and 'it cannot be done right'. The essential point is that it is entirely possible to eliminate the massive direct and indirect subsidies to the fossil fuel industry without negative economic impacts. A carbon tax with rebate is one way to do that.

As to 'rich people have greater energy efficiency'... I don't care how efficient the machinery is, a mansion is going to take more power to heat than a two bedroom apartment. Find a study showing that total energy use decreases with wealth anywhere on the planet and we'll talk. Until then it just sounds like nonsense.

Kevin,

You don't seem to have much faith in the concept of a free market economy. You also seem to be focusing on rather narrow (and ill-conceived) anecdotal episodes.

If a lot of people need more energy efficient appliances, then manufacturers will be motivated to create and supply them. People will also be motivated to find other alternatives, like wearing a sweater instead of just cranking up the heat. Rich people can ignore that sort of thing, but most people simply need to adjust their behavior. As their behavior changes, and demand for inefficient products goes down, the market must similarly adjust.

This is basically how capitalism works... unless you break the system by providing subsidies while ignoring external costs (i.e. the damage done by greenhouse gases), so that people can pretend that there is no problem while other people get disproportionately rich by absorbing all of the wealth while the ultimate burden will be shared by everyone, eventually.

The basic idea of a free market economy is that things cost what they cost, and the market will adjust -- through changes in demand, innovation and evolution -- to meet reality. Subsidies and external costs break that system. They should be anathema to anyone who believes in a true, free market economy.

Kevin @30

People are going to consume energy in proportion to heating / cooling needs primarily, and only secondarily to wealth.

People also consume energy through Travel costs (both commuting and leisure) and indirectly through consumption of manufactured goods

Kevin @30, here are US expenditures by income bracket on rates and gasoline in 2009:

Rates include both electricity and water, and it is possible but very unlikely that the increased expenditure on rates with income comes solely from increased water consumption. The increased expenditure on gasoline and motor oils with income is straightforward.

You make unsubstantiated claims to support the contention that high income groups spend less on energy than low income groups. Of course, your anecdotal evidence is incomplete. You mention energy efficient fridges, but fail to factor in the size of the fridge, or the number of fridges. A low income household is likely to struggle by on a single fridge while a high income household will have a large fridge, a freezer and one or two bar fridges.

Likewise your claim on energy use for heating fails to factor in the size of the dwelling being heated.

I note that Sphaerica calls your claims anecdotal evidence. They do not rise to the level of anecdotal evidence which would require you to actually mention specific cases, including showing that the high income familly actually spent less on energy, something you do not bother doing.

Assuming, as is reasonable, that expenditure on household energy use rises with rates, it is clear that household energy expenditure rises with rates. It is further clear that. Ergo higher income families would pay a higher absolute value in the carbon tax, and recieve less than their expenditure on the carbon tax back from a flat rate dividend. Conversely, those on low incomes would spend less on the carbon tax and recieve back more from the flat rate dividend than they pay. Ergo they would be better of. They could invest that extra money recieved in high energy efficiency fridges (which are not significantly more expensive than low energy efficiency fridges) and insulation and be better of still.

It is noteworthy that household expenditure on energy as a percentage of income declines with increasing wealth; so a dividend based on taxable income would make the poor worse of - but that would be a political decision to do so, and is not what is being proposed.

It is further noteworthy that household expenditure on rates including electricity never rises above 4.5% of household income, showing that doom and gloom stories about the impacts of a carbon tax on the poor are works of fiction.

Hmm, so by Kevin's logic an Inuit hunter has massive need for energy consumption and so must be spending more on heating than an apartment dweller in New York?

However, I am very pleased the Tom Curtis has now supplied us actual data (as a science should) on energy expenditure per income bracket.

Tom Curtis,

From the tables in the article you supplied, the percent income spent on "utilities" for the 70 79K bracket is 5.58%. The percent income spent by the 120 - 150K bracket goes down to 3.77%. This just proves my point. The primary need for heating / cooling, with some elasticity for wealth thrown in - I'll grant you the elasticity is more than I anticipated.

As to never rising above 4.5%, the figures you supplied also included water, so whether the 5.58% is less than 4.5% once water is removed is impossible to tell.

Scaddenp,

If you look at the data that Tom Curtis supplied, you will notice that the highest consumers were in cities like Philadelphia, New York, and Boston, and the least consuming cities were San Diego, and San Franscisco, so it does stand up that the colder the city you live in, the more you will spend on energy.

Kevin:

The evidence that Tom Curtis presents straightforwardly shows that expenditure increases, in absolute terms, with income in the US. It then follows that, contrary to your assertion, a per capita or otherwise income-neutral carbon dividend or rebate will disproportionately benefit lower income individuals & families - indeed, all the more so if they spend a higher proportion of their income on energy.

How does this prove any point you have sought to make on this thread? How does it tie into the discussion in the OP of reducing subsidies to fossil fuel production? It seems to me to be contradictory to the primary claims you have made on this thread.

You have also claimed, without substantiation, that the regional energy consumption patterns show that "it does stand up that the colder the city you live in, the more you will spend on energy."

Whether or not this is the case, you cannot conclude so based solely on your comments: all you have is a correlation and no analysis showing that it fits together the way you want it to.

At any rate, just looking at the data, one notes that the regional breakdown shows that the largest expenditures, by region, of utility & fuels (in the housing category) and gasoline & motor oil (in the transportation category), occurs in the Housten-Galveston-Brazoria region. For the reasons I have outlined above this is not a conclusive blow against the notion that expenditures on energy relate to climate of one's residence, but if you wish to support the relationship you are claiming exists, you must take it into account in your analysis.

Kevin @36, assuming for ease of calculation that all people within the same income bracket pay the same amount on utilities, then the maximum percentage payment for the 70-79K bracket is 4.9%, not 5.58%. On the same basis, the minimum percentage payment in the 120-150K bracket is 2.76% while the maximum is 3.47% so both of your figures are out.

More importantly, you continue to ignore the fact that you are criticizing a proposal compensation in the form of a flat rate per capita dividend. The people in the 70-79K bracket pay approximately $3500 per annum on utilities. The people in the 120-150 K bracket pay approximately $4200 per annum on utilities. So, first, 3500 < 4200 so the people in the lower income bracket will pay less carbon tax than the people in the higher income bracket. Further, because they are paying less and recieving the same amount back, they will be relatively better of after the carbon tax plus dividend than the people in the higher bracket.

Resorting to percentages to confuse the issue is the lowest form of legerdemain. It ignores the fact that the flat rate dividend represents a far greater percentage of low incomes than it does of high incomes.

Composer 99,

Think it through. The low income people spend a higher percentage of income on energy. The proposal is to "tax" carbon, effectively raising the price of energy. This will push the percentage up that lower income people spend on energy, not down. How that tax revenue then gets distributed through lower income tax rates (as in the example presented) is a different issue.

Composer 99,

I missed Houston. Minneapolis also jumps out as an anomoly. However, the rest remains. Also, keep in mind that cost of utilities is not definitively amount of utilities, as the repective price of utilities is not listed.

Composer99 @37, the 2009 Census data does show that households in the North-East spend, on average, 22.5% more on utilities than do households in the west. The next most expensive region after the North-East is the Mid-West, then South, then West. The increase is almost entirely due to increased demand for electricity, gas and fuel oil so it is a reasonable conjecture that the increased energy use is due to heating requirements.

That increase is partly compensated because the West and particularly the South spend far more on gasoline than do the Mid-West and the North-East (particularly). Never-the-less, a carbon tax would slightly favour the warmer regions of the US over the colder in the short term. (Of course, longer term heating bills in the north will fall, while cooling bills in the south will rise.)

Kevin @39, apparently it is your intended stragegy to argue against a policy because half the policy will have consequences that the full policy does not. That makes your arguments trolling in any man's language. Given that, and that you have been comprehensively refuted, there seems little point in further responding to you.

Kevin's "The low income people spend a higher percentage of income on energy."

That's silly. Low income people spend a higher percentage of income on almost anything they buy, compared to even slightly higher income people. The immense majority of products and services aren't offered on an income based scale sliding scale.

The only way for low income people to make that adjustment is to opt for cheaper solutions (i.e. rent a 2 bedroom appt instead of owning a 4 bedroom 2000 sq.ft house) or to consume less. Wherever someone lives, there is no cheaper solution for electricity and fuel, as price is decided by the utility and gas prices are pretty consistent by region.

Income disparities are such that for many items, no reduction in the quantity consumed will bring the percentage on par. In the US, the kind of person who can drive a brand new Lexus will spend a far smaller percentage of their income on gas than the person driving a used Chevy, except if the latter drives around the neighborhood a couple of times a week.

An intresting piece on one of the denier groups (Intitute for Energy Research) can be found here: www.instituteforenergyresearch.org/2013/04/03/the-imfs-outlandish-claims-about-energy-subsidies/

Standard approach - question the science (Big Oil pay way too much tax) while denigrating the work (outlandish?). I guess the IMF are now part of the great big global AGW conspiracy now. :o That's the IMF - part of the Washington Consensus!

btw: The IMF did a good paper on petroleum subsidies in 2010 entitked "Petroleum Product Subsidies: Costly, Inequitable, and Rising". Worth reading. http://www.imf.org/external/pubs/ft/spn/2010/spn1005.pdf