True Cost of Coal Power - Muller, Mendelsohn, and Nordhaus

Posted on 7 October 2011 by dana1981

NOTE:Note: This post has been updated with a substantial correction

Skeptical Science previously examined the fact that the market price of coal power is artificially low because we do not directly pay for all of its impacts, particularly on air quality and climate change. People who feel these effects do pay them indirectly (i.e. through increased health care costs), but since their costs are not reflected in the market price of coal power, economists call them "externalities," and view them as a major failing of the free market. As Nobel Prize-winning economist Paul Krugman put it,

"consumers are paying much too low a price for coal-generated electricity, because the price they pay does not take account of the very large external costs associated with generation. If consumers did have to pay the full cost, they would use much less electricity from coal — maybe none, but that would depend on the alternatives.

At one level, this is all textbook economics. Externalities like pollution are one of the classic forms of market failure, and Econ 101 says that this failure should be remedied through pollution taxes or tradable emissions permits that get the price right."

In short, if the people paying for coal power aren't aware of its full costs, then they can't take those costs into account when making decisions regarding how much to consume. A new paper published in American Economic Review (a very prominent economics journal) from well-known (and somewhat conservative) economists Nicholas Muller, Robert Mendelsohn, and William Norhaus (MMN11) seeks to quantify these externalities. Krugman provides his analysis of the paper in the link above, and our analysis follows.

Gross External Damages (GED)

MMN11 present a framework to include the externalities associated with air pollution into a system of national accounts. They estimate air pollution damages for each industry in the USA by quantifying the damages caused by air pollution, and multiplying those damages by the emissions per industry, which they call "gross external damages" (GED). MMN11 propose that "air pollution becomes another cost of doing business," as is the case for some pollutants.

The paper also compares GED to the value added (VA) by a given industry "to determine whether correcting for external costs has a substantial effect on the net economic impact of different industries." MMN11 describe their modeling methodology to estimate GED:

"This paper uses the Air Pollution Emission Experiments and Policy (APEEP) analysis model, which is an integrated assessment economic model of air pollution for the United States (Muller and Mendelsohn 2007). The APEEP model connects emissions of six major pollutants (sulfur dioxide (SO2), nitrogen oxides (NOx), volatile organic compounds (VOCs), ammonia (NH3), fine particulate matter (PM2.5), and coarse particulate matter (PM10 –PM2.5)) to the physical and economic consequences of these discharges on society. The effects included in the model calculations are adverse consequences for human health, decreased timber and agriculture yields, reduced visibility, accelerated depreciation of materials, and reductions in recreation services. In addition, for the electric power generation sector, we include the damages from carbon dioxide emissions."

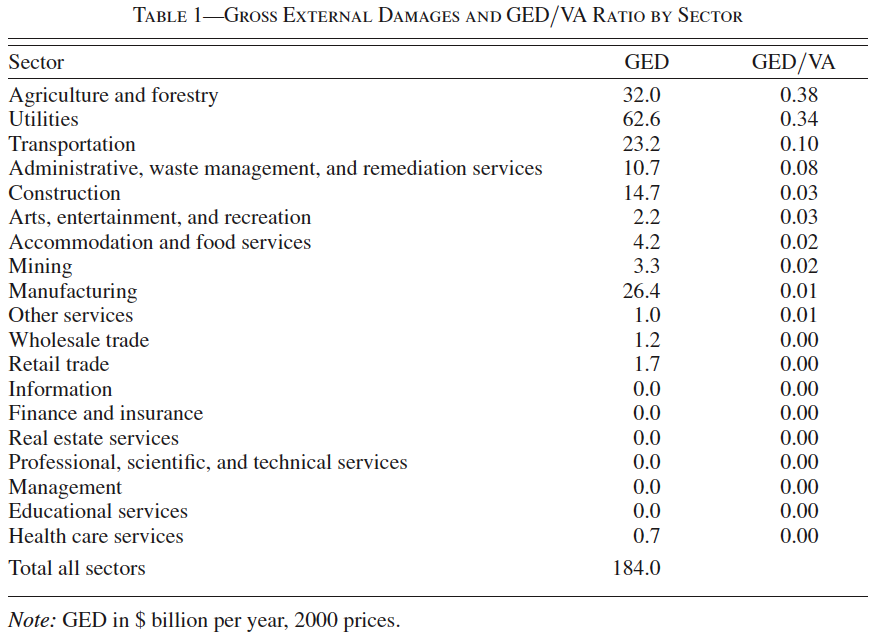

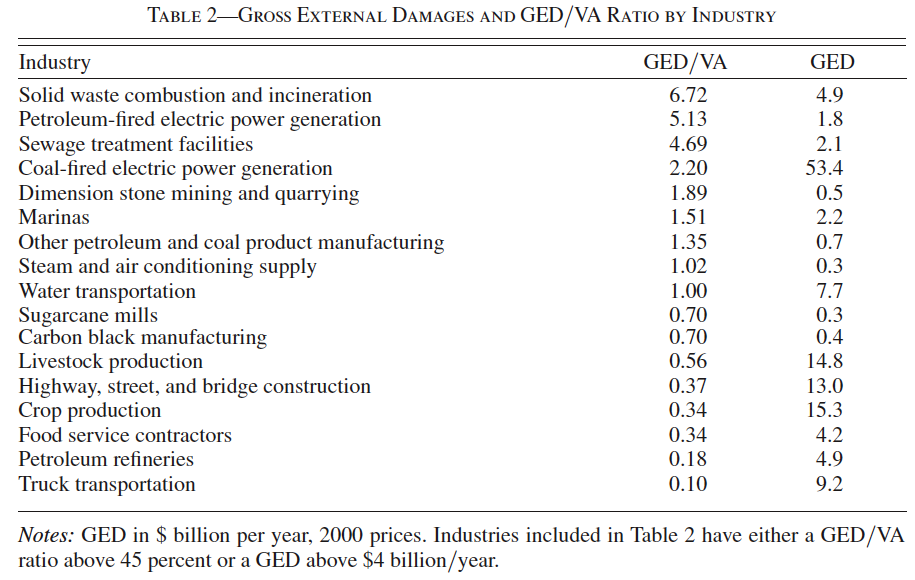

MMN11 provides an estimate of GED costs for various sectors in Table 1. The largest GED/VA ratio comes from agriculture/forestry and utilities.

MMN11 break down the GED/VA ratio by industry, and show the 17 industries for which the ratio is at least 45%, or GED is greater than $4 billion per year in Table 2. Petroleum-fired and coal-fired power generation have the second- and fourth-highest GED/VA ratios, respectively. Note that the GED estimates in Tables 1 and 2 do not include CO2 emissions and their associated impacts on climate change. We will examine those costs later.

What Does a High GED/VA Ratio Mean?

In short, the cost of the damage not accounted for in the market price from industries with GED/VA ratios greater than one (including petroleum and coal power generation) exceed the value they add through their products/services. However, that doesn't mean we would benefit from getting rid of them altogether, because if we internalized the external costs associated with their air pollution, then their GED would decrease. As MMN11 put it (emphasis added),

"if the external costs were fully internalized, prices would change, so the results do not imply that the US economy would be better off not having these industries at all...On a formal level, it signifies that a one-unit increase in output of that industry has additional social costs that are higher than the incremental revenues. At an intuitive level, it indicates that the regulated levels of emissions from the industry are too high."

MMN11 suggest a possible interpretation of the high GED/VA ratios is that these industries are not efficiently regulated - the damages associated with their pollution exceed the costs of abatement (through some form of emissions pricing). Another possibility is that 'VA' doesn't fully account for the value added from a given industry.

Breaking Down Coal Damages

MMN11 delve into more detail regarding the GED associated with coal power generation. They find that SO2 emissions are responsible for 87% of the damages associated with coal power emissions (excluding climate change), and 94% of the damages come in the form of increased mortality. For those who claim that burning coal is safe and harmless, the numbers tell a very different story, even without including the effects associated with climate change.

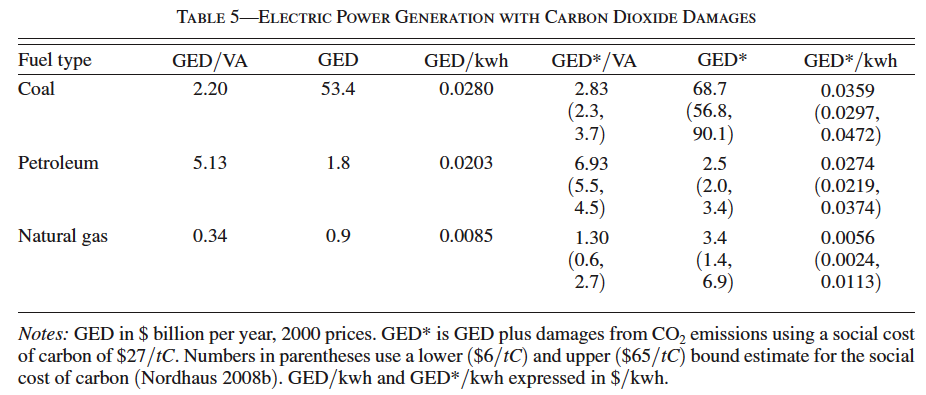

The study also compares the figures for coal, petroleum, and natural gas power plants. They find that coal accounts for 95% of GED in this sector (though it also accounts for the largest percentage of total power generation), and coal power has the highest GED per kilowatt-hour (kWh) of electricity generated (though as noted in Table 2, petroleum has a higher GED/VA ratio). The GED per kWh for natural gas is 20 to 30 times lower than for oil and coal, respectively, because its (non-carbon) emissions are so much lower (Table 5).

Climate Change Costs

MMN11 note that CO2 emissions are not yet available for all industries, but are available from electric power generation from the US Energy Information Administration (EIA). As Skeptical Science has discussed, the costs associated with climate change impacts are calculated through the "social cost of carbon" (SCC), which is a very difficult value to estimate. Estimates generally range from $19 to $68 per ton of CO2 emitted, but some "skeptic" economists put the value lower. MMN11 use $27 per ton (from a previous study by Nordhaus, which is a rather conservative estimate) as their central SCC estimate, and also use $6 and $65 per ton as lower and upper bound estimates.

MMN11 incorporate climate change costs into GED for power plants, which they call "GED*" (Table 5).

Using the Nordhaus SCC best estimate ($27 per ton of CO2 emitted) increases the GED for coal power from 2.8 to 3.6 cents per kWh (29%), for example. This means that CO2 emissions are responsible for approximately one-fourth of total air pollution damages from coal (and petroleum) power generation. For coal, CO2 emissions cause an additional $15 billion in external damages per year which are not reflected in its market price. The total GED for coal power ranges from $57 to 90 billion per year, depending on the SCC value (central estimate of $69 billion). MMN11 note how these values relate to electricity prices:

"In 2002, residential consumers of electricity faced an average market price of 8.4 cents per kwh. Hence, the GED*/kwh associated with electric power generation using coal, oil, and natural gas represents 43, 33, and 7 percent of the average residential retail price of electricity in 2002. Note that residential electricity prices vary by the primary fuel type used in electricity production. In states that primarily rely on coal-fired power, residential electricity prices averaged 6 cents per kwh. The average GED*/kwh of coal-generated electricity is 60 percent of the average residential retail price of electricity in a state relying entirely on coal."

Uncertainties

MMN11 note some of the largest sources of uncertainty in their cost estimates:

"we note that the uncertainties are particularly large for four elements: the value of mortality risks, the relationship of this value to age, the mortality effect of fine particulates, and the social cost of CO2 emissions. Sensitivity analyses using alternative values for these parameters change the magnitude of the results significantly."

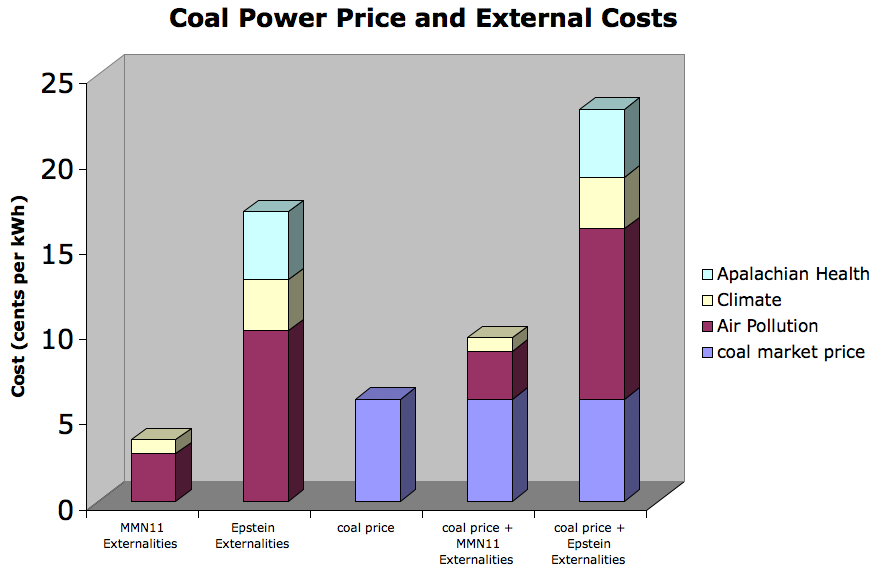

Skeptical Science previously examined Epstein et al. (2011), which arrived at a much higher estimate of the external costs of coal combustion, mainly due to a higher estimate of (non-CO2) air pollution damages. Their median estimate was 18 cents per kWh, as opposed to the median MMN11 estimate of 3.6 cents per kWh - obviously a very large difference.

Epstein et al. also accounted for several factors not included in the MMN11 analysis, such as public health in Appalachia related to mining, which by itself accounted for approximately 4 cents per kWh in their estimate. However, the estimates of air pollution externalities varied greatly in the two studies, from 2.8 cents per kWh in MMN11 to approximately 10 cents per kWh in Epstein. The median climate change impact estimate in Epstein (3 cents per kWh) was also larger than in MMN11 (0.8 cents per kWh) (Figure 1).

Figure 1: Average US coal electricity price vs. MMN11 and Epstein 2011 best estimate coal external costs (added to the Skeptical Science graphics page)

So there are clearly significant uncertainties in these estimates. However, it's important to bear in mind that uncertainties are expected in a Pigovian tax (a tax levied to address a market externality). Finding the exact emissions price is not necessary, because once the external cost is internalized, the emissions price can be adjusted accordingly. First we have to take the first step in attempting to internalize the GED.

Take-Home Messages

There are some very important points to take home from these economic studies. The first is that while these assessments involve significant uncertainties, they agree that the true cost of coal is not accurately reflected in its market price. In fact, the true cost lies somewhere between ~50% and 300% more than Americans are currently paying. The two largest contributors to this discrepancy are SO2 emissions (impacting air quality and public health) and CO2 emissions (impacting climate change). Therefore, regulating SO2 emissions more strictly, and putting a price on CO2 emissions, would benefit the US economy. As Paul Krugman put it, it's "Econ 101."

There is one final, very big message to get from this economic research. Most, if not all of the candidates running for the 2012 Republican presidential nomination (and in fact most Republican politicians in general) have been arguing that Environmental Protection Agency (EPA) regulations are too stringent and harming the economy. Texas governor and current Republican presidential frontrunner Rick Perry has been the most vocal in these attacks on the EPA, but even relatively moderate Republicans like Senator Susan Collins of Maine have joined in the attacks on "EPA over-regulation."

These studies show that this is exactly the wrong approach. Air pollution emissions (especially SO2 and CO2) are under-regulated, and increased environmental regulation of these pollutants would benefit the US economy (not to mention public health, both nationally and internationally). Unfortunately, as we've seen time and time again in recent years, scientific and economic research has little influence over today's Republican politicians.

NOTE: the findings of MMN11 have been added to the rebuttal to the myths Renewable Energy is Too Expensive and CO2 limits will harm the economy

Arguments

Arguments

0

0  0

0

Comments