The Carbon Bubble - Unburnable Fossil Fuels - Seminar and Discussion

Posted on 26 March 2014 by Andy Skuce

The British Columbia Sustainable Energy Association (BCSEA) organizes a series of free seminars on climate change and sustainability issues. BCSEA was founded by Guy Dauncey. On February 11th, 2014 BCSEA held a webinar on the recent work done by the Carbon Tracker Initative. Guy has written a detailed summary of their recent work on the BCSEA webpage.

The seminar starts at 8:30 minutes and a very good Q&A session begins at 39 minutes. The slides that accompany the seminar can be downloaded here.

The presenter is Mark Campanale, the founder and executive director of the Carbon Tracker Initiative.

The ideas that came out of the Carbon Tracker Initiative were given prominence in Bill McKibben's Rolling Stone article Global Warming's Terrifying New Math. Their work has concentrated minds on the contradiction between climate policies and market valuations, and has focussed the attention of the big, long-term investors like pension funds, on the sustainability of their portfolios and on their methodologies of assessing value in the light of inevitable, if unduly delayed, carbon policies.

If we set our emissions budget to achieve an 80% chance of staying below the 2°C target, then on a business-as-usual path, we will have used up that budget in the 2030's and on aggressive mitigation pathways, in the 2040's. Which is a roundabout way of saying—after twenty fruitless COP meetings over the past nineteen years—that the 2°C threshold is very likely to be breached.

Click to enlarge. Source: Mark Campanale presentation

A financial bubble?

The Guardian headlines a piece by Damian Carrington with: Carbon bubble will plunge the world into another financial crisis – report Trillions of dollars at risk as stock markets inflate value of fossil fuels that may have to remain buried forever, experts warn. The article continues:

The world could be heading for a major economic crisis as stock markets inflate an investment bubble in fossil fuels to the tune of trillions of dollars, according to leading economists.

"The financial crisis has shown what happens when risks accumulate unnoticed," said Lord (Nicholas) Stern, a professor at the London School of Economics. He said the risk was "very big indeed" and that almost all investors and regulators were failing to address it.

This take on the "carbon bubble" as an imminent financial crisis contrasts with the tone of Mark Campanale's presentation, which focusses more on the need for an orderly unwinding of capital investment in fossil fuels and the diverting of capital to investment in non-fossil energy sources or to increased dividends to shareholders. I emailed him to clarify this and he kindly replied (quoted with his permission):

We have always said that the bubble is a ‘carbon’ bubble (which is the title of the report) and it is to be seen whether there is a ‘financial’ bubble. The two don’t necessarily have to follow. A lot depends on how quickly the market responds to policy signals. What I mean here is that there are fossil fuel companies whose valuations are supported by the market’s belief that the demand for fossil fuels will remain the same, untouched by climate (or other) regulations and actually continue to grow. If this assumption is wrong – demand falls – then there are strong arguments to show these companies are overvalued. This is what HSBC have done, others are now doing. There are some graphs (not in my presentation) which shows how far out into the future you can go, to find how much of the stock price today is backed up by future earnings. In the case of oil, it is actually relatively high. So we can’t dismiss the financial bubble arguments completely. There are lots of variations of demand/supply and price, as well as cost of production, that will vary.We have a far greater concern that $7 trillion of capex proposed by the fossil fuel industry (just listed companies) could lead to the stranding of assets – namely redundant rigs, mines, infrastructure such as coal ports/rail. Even if these did become “stranded assets” and have to be written down or written off, it doesn’t necessarily follow that there will be a financial crisis as a consequence. Markets are used to +20% or -20% swings in the valuation of companies without there being a ‘crisis’.

To be clear, in the scenarios I played out – there is potential for financial collapse; these scenarios go along with civilisation (as we know it) collapse. The obvious one is where nothing happens in climate policy, there are no restrictions on emissions – and we run towards 3, 4 or even 5 degrees of warming. There, the science tells us that major changes to weather patterns (floods, hurricanes, droughts, higher temperatures) combined with rising sea levels, will make any business or investment of any description unworkable. In this scenario politicians panic and regulate overnight, leading to a chaotic transition to lower carbon energy and substantial financial dislocation.

What Carbon Tracker is seeking is a gradual winding down of unmitigated coal firing and oil that takes us outside of the carbon budget. Capital saved would go to higher dividends as these companies quickly unwind, freeing up cash to be invested in alternatives. There, there would be no financial collapse – though financial risk profiling of companies in the energy sector (volatility of earnings etc) might rise.

Just because x% of the fossil fuel resources need to remain in the ground does not imply that x% of a corporation's stock market valuations will be immediately wiped out once prudent climate policies are (finally) introduced. Any realistic transition away from fossil fuels will take decades. Companies are not so much valued on their assets, but rather, among other things, on the discounted cash flows anticipated to come from those assets. The reserves that will have to be left in the ground after a few decades, after the transition is complete, are already heavily financially discounted. To take a simplified example, an asset with an expected constant production and cashflow over 50 years would retain about 82% of its discounted value (using a discount rate of 8%) if its lifetime were restricted to just 20 years, even though this would imply producing only 40% of its reserves.

Economist Richard Tol has previously made similar arguments about the improbability of a bursting financial bubble resulting from the introduction of climate policies, with which I largely agree. Such a sanguine outlook should, however, be tempered by the fact that economists and businessmen have a far-from-perfect track record in identifying the inflating—and inevitable bursting—of financial bubbles, except, of course, in hindsight. John Kay, an economist and Financial Times columnist, wrote an essay, The Map is Not the Territory, that is highly critical of the economics profession and its fascination with unrealistic models. Kay accused economists in 2008, of "obsessively playing Grand Theft Auto while the world around them was falling apart".

Irrationally optimistic or pessimistic, "inefficient" market evaluations do happen despite theory and, as the formerly respected science writer and bank chairman, the 5th Viscount Ridley put it, a prized business model can be "hit by an unexpected and unpredictable concatenation of events". As Ridley learned from the sudden collapse of his bank, virtuous circles can rapidly turn vicious once a few boundary conditions change. It does not help that participants in markets and businesses often adopt a certain groupthink, a mentality that downplays or ignores systemic risks, even as those threats may be obvious to outsiders.

We can make rational arguments that the unwinding of the fossil fuel business will be orderly, but the degree of change required to decarbonize our economy is so huge and the time frame so short that nobody can really be sure that there will not be crises along the way. That's all the more reason to get started on it sooner, rather than later.

Business response

Once it becomes obvious to fossil-fuel companies that the sun is setting on cost-free carbon emissions, they will look for strategies to mitigate or offset their corporate decline. Apart from their future cashflows and capital assets, fossil-fuel companies are also valued for their technical and project-management expertise and it is probable that many companies would try to redeploy this expertise in new projects. For example, oil and gas companies may be able to extend their useful lives through carbon capture and storage (CCS), leveraging their technical abilities in managing fluids in the subsurface. In this way, they could extract profits, not only in return for their traditional expertise in getting carbon out of the ground, but also—in a new emissions-constrained world—for putting it back in.

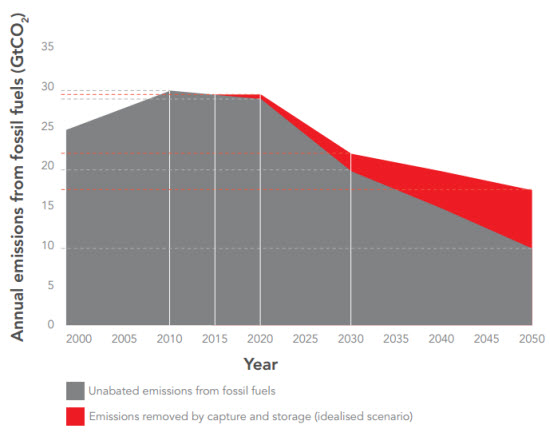

However, the potential for CCS to bail out the unburnable carbon problem is limited, according to the 2013 report:

Shown is the carbon budget for a two-degree scenario, with the red slice showing very aggressive deployment of CCS (some 3800 plants in 2050, compared to 16 today), expanding the carbon budget by just 12-14%.

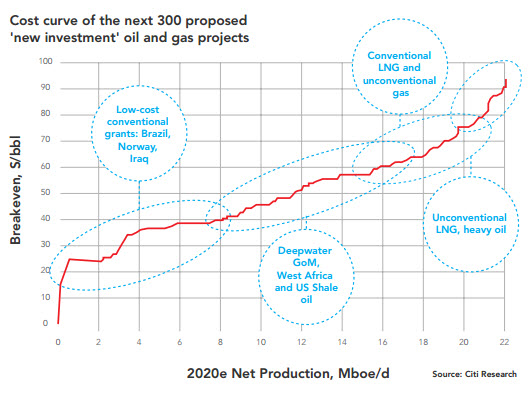

As we have discussed, the latest version of the Carbon Tracker report does not stress so much the risk of an imminent global financial collapse but, instead, foresees—or at least hopes for—a more orderly unwinding of fossil companies as they divert funds away from long-term capital investments in carbon fuels towards greater dividends for shareholders and reinvestment elsewhere. But that unwinding will come sooner and be felt more painfully in some sectors than in others. As carbon taxes reduce demand and reduce the prices captured by producers, the first oil and gas projects to drop off the cost curve as the unwinding commences will be the more expensive and carbon-intensive ones, like the Alberta oil sands.

Source: Unburnable Carbon 2013

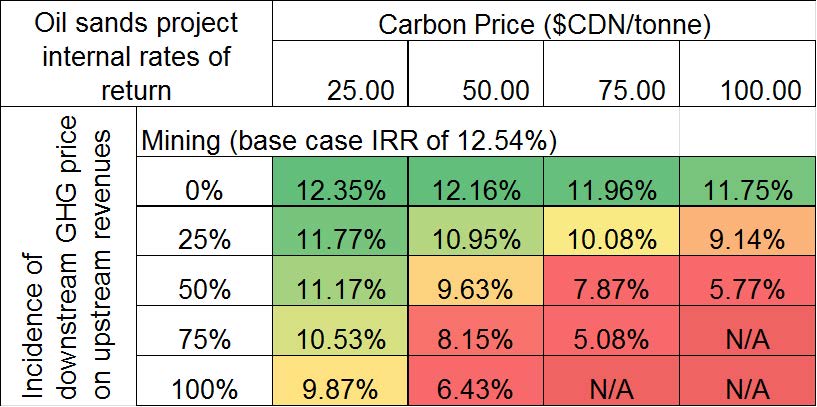

Writing in Maclean's, energy economist Andrew Leach demonstrates how vulnerable oil sands projects are to carbon taxes. Although the projects would suffer lower rates of a return if a carbon tax were applied to the upstream emissions (i.e., those associated with production), the projects would still be viable, even at carbon taxes as high as $100 per tonne of CO2e. However, if carbon taxes were applied globally on the downstream emissions, this would reduce demand—and thus prices—making the projects uneconomic even at carbon prices in the $25-$50 range. This is what the economic landscape will look like once the world wakes up and decides to get serious about reducing emissions

The matrix shows the effect of a carbon tax of an oil sands project that has an 12.5% internal rate of return before carbon taxes are applied. The top row of results (0%) shows the effect of taxing only the upstream (production) emissions. Other rows show the effect of also gradually applying a given carbon price to all emissions, including combustion emissions.The average cost of capital for petroleum producers is currently about 9%. Table by Andrew Leach.

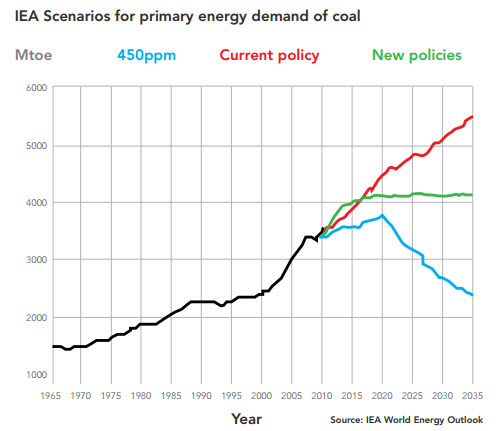

Demand for coal is also likely to flatline or fall once new climate policies are introduced, as the IEA shows:

Source: Unburnable Carbon 2013

Even if financial markets do not face imminent catastrophe, perhaps a more serious and certain consequence of the deflation of the carbon bubble will be the localized damage inflicted on countries and regions that have become used to living off of fossil fuel rents; for example, in the Middle East, Russia, Venezuela and Norway, as well as parts of Canada, the USA and Australia. The unwinding of private-sector corporations over a generation will be painless compared to the social dislocation that entire populations will suffer as they are forced to find new ways of making a living.

Governments and state-controlled companies are by far the biggest owners and beneficiaries of fossil fuel production. I hope that future Carbon Tracker Initiative will look more closely at the political consequences of deflating the carbon bubble. To be sure, the royalty-rent-dependent governments are already mobilized to delay the introduction of emissions-reduction policies.

Value of a bubble foretold

The great benefit of the Carbon Tracker Initiative is that it confronts investors, policy makers and businessmen with the incompatibility of business-as-usual assumptions in relation to the requirements of necessary policies to limit dangerous climate change. Exxon-Mobil has recently announced that it will now be disclosing the exposure of its business model to future carbon emission reductions policies. Such disclosure will allow investors to assess the risks posed by the carbon bubble to a corporation's future. It will also focus the minds of corporate executives on finding ways to invest capital in more sustainable projects.

Thanks to this work, numerous scientific studies (e.g., Allen et al., 2009) and Bill McKibben's article Global Warming's Terrifying New Math, we now know with confidence that the biggest problem we face with our carbon-based energy supply is not that it is about to run out, but, rather, that we have much more of it than we can safely exploit. We are left with a simple mantra: we need to leave most of the fossil fuels in the ground.

Acknowledgement is due to Mark Campanale for his help and to my colleague rustneversleeps for comments on an earlier draft.

Arguments

Arguments

What If We Burn All the Fossil Fuel Reserves? Simple Arithmetic Using the IPCC AR5 http://j.mp/FF_RR_CO2

Regarding "FF companies to redeploy their expertise in new projects", the only example Andy has given is the CCS by the oil companies in the exploited porous rock reservoirs.

That's very unconvincing example. Especially in light ofof this article:

Sequestering carbon nature's way

(the cartoon therein gives thousand words on the subject)

I would like to see something better, that would make a real difference on AGW, unline imaginary stories for what the technology does not exist yet. For example drilling expertise in construction of geothermals. Better than CCS by far, and realistic and truly changing the face of the company involved. That's the kind of FF company tranformation I'd like to see happeing...

chriskoz, I agree that developing geothermal energy would be a good use of oil company technical expertise and capital. And I agree that the most effective way to sequester carbon is to leave it in the ground.

But I don't think we can brush off CCS quite so easily, although I am very skeptical than it can be scaled up and deployed fast enough to make a big dent in emissions. However, many researchers, like the IEA and the people who did the socio-economic modelling behind the RCP2.6 scenario (the only one that keeps us below 2 degrees) foresee a big role for CCS.

This graph (modified Figure 2 from here) shows CCS (including biomass CCS) will be the source of about 40% of our energy supply by 2080. If that CCS business is captured by current fossil fuel firms, the total size of fossil fuel energy (CCS and non-CCS) will be about double the size that it is now. This scenario is hardly one in which the fossil fuel industry fades into extinction.

Now, you can be skeptical about this ever happening on this scale and on this timeline as I am, but CCS does have some respectable and thoughtful proponents.

There is a recent article on CCS in Wired by Charles Mann that is worth a read. He quotes Fatih Birol (IEA chief economist) as saying:

Andy @3

I view CCS as likely being used as an unsustainable excuse to continue an unsustainable activity that creates far more harm than the production of excess CO2. CSS should be a required added expense for any attempt to continue burning fossil fuels, but only be used for a short transition period, even shorter than the possible life of a new fossil fuel burning facility. The already fortunate people on this planet, particularly the most fortunate, need to be motivated to develop and follow truly sustainable ways of living as rapidly as possible.

The only viable future for humanity is progress to truly sustainable activity by all humans, as part of a robust and diverse web of life on this amazing planet. I have read many things and thought many thoughts, but I have not come up with any plausible way for the consumption of non-renewable resources to have any legitimate role in that sustainable future. In fact, I consider located, but otherwise untouched, fossil fuels to be a potentially critical emergency resource at some point in that future.

If you believe there is a viable way for humanity to enjoy the hundreds of millions of years that it should be possible to enjoy on this amazing planet while consuming non-renewable resources I would love to hear the details of it.

CCS worries me because CO2 is two thirds oxgen. CO2 in the air could eventually be used by plants and the oxygen returned to us. If it is locked away forever we have lost that oxygen and reduced the atmosphere as a whole. Let's just focused on reducing the production of co2.

Rolf - oxygen makes up about 21% of Earth's atmosphere and CO2 about 0.039%. Furthermore, we know life has flourished prior to the addition of fossil fuel CO2 to the atmosphere by humans so, if we could bring back to a pre-industrial level, there would be ample oxygen available for plant and animal life.

There's no need to worry about CCS other than that it is so far as useful as the tooth fairy and unicorns.