Citi report: slowing global warming would save tens of trillions of dollars

Posted on 31 August 2015 by dana1981

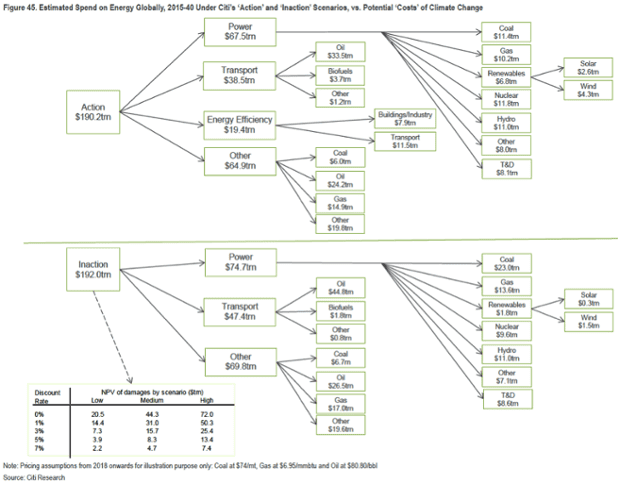

Citi Global Perspectives & Solutions (GPS), a division within Citibank (America’s third-largest bank), recently published a report looking at the economic costs and benefits of a low-carbon future. The report considered two scenarios: “Inaction,” which involves continuing on a business-as-usual path, and Action scenario which involves transitioning to a low-carbon energy mix.

One of the most interesting findings in the report is that the investment costs for the two scenarios are almost identical. In fact, because of savings due to reduced fuel costs and increased energy efficiency, the Action scenario is actually a bit cheaper than the Inaction scenario.

What is perhaps most surprising is that looking at the potential total spend on energy over the next quarter century, on an undiscounted basis the cost of following a low carbon route at $190.2 trillion is actually cheaper than our ‘Inaction’ scenario at $192 trillion. This, as we examine in this chapter, is due to the rapidly falling costs of renewables, which combined with lower fuel usage from energy efficiency investments actually result in significantly lower long term fuel bill. Yes, we have to invest more in the early years, but we potentially save later, not to mention the liabilities of climate change that we potentially avoid.

The following figure from the Citi report breaks down the investment costs in the Action ($190.2 trillion) and Inaction ($192 trillion) scenarios.

Investment costs of climate Action and Inaction scenarios. Source: Citi GPS.

This conclusion soundly refutes the main argument against climate action – that it’s too expensive, with some contrarians even having gone so far as to claim that cutting carbon pollution will create an economic catastrophe. To the contrary, the Citi report finds that these investments will save money, before even accounting for the tremendous savings from avoiding climate damage costs.

What about those avoided climate costs? As shown in the bottom left corner of the above figure, the difference in climate damage costs between low (1.5°C) warming and high (4.5°C) warming scenarios could be as high as $50 trillion. Even moderate (2.5°C) warming could cost $30 trillion less than a business-as-usual high global warming scenario.

As a result, the Citi report concludes that taking action to cut carbon pollution and slow global warming would result in a positive return on investment.

By comparing the cost of mitigation to the avoided ‘liabilities’ of climate change, we can derive a simple ‘return on investment’. On a risk adjusted basis this implies a return of 1-4% at the low point in 2021, rising to between 3% and 10% by 2035.

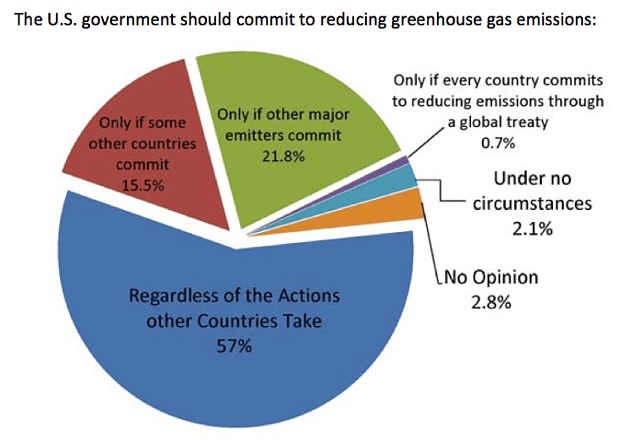

This isn’t a groundbreaking finding. Other reports have arrived at the same conclusion, and have found that a revenue-neutral carbon tax would be modestly beneficial for the economy (again, before accounting for the economic benefits of curbing global warming). This is why there’s a consensus among economists that we should be reducing carbon pollution.

Survey results of economists with climate expertise when asked under what circumstances the USA should reduce its carbon emissions. Source: New York University; Economists and Climate Change report.

The Citi report then asks the trillion-dollar question – if tackling global warming is such an economic no-brainer, what are we waiting for?

With a limited differential in the total bill of Action vs Inaction (in fact a saving on an undiscounted basis), potentially enormous liabilities avoided and the simple fact that cleaner air must be preferable to pollution, a very strong “Why would you not?” argument regarding action on climate change begins to form … Coupled with the fact the total spend is similar under both action and inaction, yet the potential liabilities of inaction are enormous, it is hard to argue against a path of action.

Dave Roberts at Vox took a stab at answering that question, and the answer is touched upon in the Citi report:

The clear loser between the scenarios is coal, which sees its total investment bill fall by some $11.5 trillion over the next quarter century. Gas investment also reduces though by a far smaller amount, $3.4 trillion in total

While the global economy would clearly benefit from climate action, it would create “stranded assets” for the fossil fuel industry, because a large percentage of known fossil fuel reserves must be kept in the ground if we’re to avoid dangerous climate change.

Some studies suggest that globally a third of oil reserves, half of gas reserves and over 80% of current coal reserves would have to remain unused from 2010 to 2050 in order to have a chance of meeting the 2°C target.

Arguments

Arguments

There are additional factors fueling the opposition to doing what the constantly improving understanding of things indicates needs to be done.

There are many consumers who perceive themselves to be prosperous because of the jobs they can have and the energy and personal benefit they can get cheap as long as they defend the developments that have been gotten away with by "the group of wealthy people who have clearly understood the unacceptability of their pursuits for at least the past 25 years".

As a resident of Alberta, Canada, I am very familiar with the push for perceptions of prosperity through the expansion of the rate of extraction and sale of fossil fuels. The oil and gas and coal were pushed out through the 1990s. As the conventional oil and gas was depleted it was realized that they had to move fast to benefit from the burning of the oil sands, moving it out quickly to be burned by others.

Popularity and profitability can clearly be misleading measures of the merit, value and acceptability of things (or people). The misguided belief in the virtue and value of those things clearly needs to be overcome. And the misguided belief that 'everyone being freer to do as they please will develop good results' is another significant factor that needs to be changed.

The opposition to that adaptation of humanity to deal with the challenge of the impacts from the unacceptable popular pursuits of profit will always be strong. There is likely to always be a significant minority of humanity looking for ways to get away with the least acceptable (cheapest), things they can. Simple rules easily monitored and enforced are likely to be the most effective ways of dealing with that challenge.

Globally, maybe there needs to be a rapid transition to a ban on the export of fossil fuels by any nation (or region in a nation). After all, in less than 50 years that will need to be the global reality combined with the reality that nations or regions with fossil fuels won't even be allowed to burn them up internally, especially regions in currently developed nations.

..this perception of wealth is done via Hollywood!

**Sex sell!

It's called Jevons Paradox!

(From wikipedia:) “In economics, moral hazard occurs when one person takes more risks because someone else bears the burden of those risks. A moral hazard may occur where the actions of one party may change to the detriment of another after a financial transaction has taken place.”

The mortgage crisis of 2007 was caused by moral hazard.

The same mechanism is now at work in the fossil fuel industry: although the potential damage in a business as usual scenario is enormous, it is not the fossil fuel industry that will bear the consequences.

Therefore I am strongly in favor of eliminating the moral hazard, as follows: make it clear to the fossil fuel industry that they WILL have to pay the bill. Either in the shape of a carbon tax that will allow society to evolve to a low carbon society, or in the shape of damage compensation. As the report from Citibank shows, in the latter case the bill will be much higher.

bvangerven... I'm not perfectly sure, but I think it's the reverse. There was a missing moral hazard in the banking crisis because, in the end, the lender banks were able to transfer the risk of their loans to the capital markets. And when those investment banks took on those consolidated loan packages and converted them into securities, they had no idea of their intrinsic value, but that also didn't matter to them because in a crash the taxpayer ends up having to bail them out.

There was a lack of moral hazard permiating the entire home loan industry when the banks operate in a way that they have no risk. It didn't matter to them because they're so large and so important to the economy of the nation, the government can't allow them to fail.

The risk in the FF industry, as I understand it, has to do with the fact that the valuation of FF companies is buoyed by the idea that they can continue to explore and extract reserves. The reality is, they can't continue to extract those assets and those assets are going to have to stay in the ground. So there is "wasted capital" in terms of exploring for reserves that ultimately can't be extracted that, in turn, become "stranded assets."

See Carbon Trackers: Unburnable carbon 2013: Wasted capital and stranded assets report.

Rob, I agree it was a missing moral hazard and you described the mechanism well. An excellent account of the mortgage crisis comes from economics prof Richard Wolff: "Housing Crisis, System Failure"

The massive decline of profitablility of the coal industry has already begun with the remaining players posting hundreds of millions of losses quarter after quarter.

Tuesday 8/4/15 #2 US coal company Arch Coal resorted to a a 10:1 reverse stock split that went into effect yesterday ( so their stock that had been worth about 17 cents/share went up (about) 10 fold in value and all of a sudden was worth about $1.60 per share. Otherwise they would have been kicked off the NYSE for being below $1 per share for too long.

Alpha Natural (ANR) was taken off the NYSE and filed for bankruptcy on Monday 8/3/15.

# 1 coal company Peabody at some point dipped to $1.10 per share - you get the picture.

Reuters tracks such figures, eg: Peabody stock figures

It is ironical that the arguments presented are based on intangible future financial costs. The reality is tangible natural physical resources are being used up for the operations of industrial civilization with the unintended consequence of causing climate disruption and ocean warming and acidification. The term 'renewable energy' refers to alternative infrastructure that can only be a small, worthwhile alternative to fossil fuels in some circumstances. They cannot provide alternative liquid fules for land, sea and air transports. A realistic evaluation of what should be done would take this reality into account because the actual future financial costs will be very dependent on this reality.

[RH] You're going to have to substantiate the statement, "The term 'renewable energy' refers to alternative infrastructure that can only be a small" or retract it in order to continue with this thread.

Denisaf,

Please read the 100% of power can be provided by Renewables thread. It shows that all power in the economy can be produced by renewables. Alternate fuels are found for current liquid fuels. Please provide citations for your unsupported claim that there are additional hidden costs.

moreover wrote: "# 1 coal company Peabody at some point dipped to $1.10 per share - you get the picture."

They actually hit $0.99 briefly on July 28th. That said, while I've been noting the collapse of coal in the United States for several years now... it is not yet a global phenomenon. China and India have easy access to cheap coal... but are not as well situated for natural gas, wind, or solar. As wind and solar costs continue to decline that is changing, but coal seems like it is going to continue to be a major player in those and other regions for years.

Hopefully, they will look at studies like the one above and consider costs other than just the nominal price. When total costs are accounted for wind and solar are already cheaper than any of the fossil fuels nearly everywhere. China already seems to be reaching that conclusion due to their massive pollution problems, and India has recently shown signs of changing course too.

The concept of "Moral Hazard" is an interesting concept.

The reality is that many economists fail to consider that some humans have no morals. And they are encouraged to ignore that reality because admitting it leads to the obvious understanding that popularity and profitability are poor measures of acceptability. It also leads to the understanding that a system based on people being as free as possible to do as they please will degenerate as those who care less about the consequences of how they benefit clearly become the 'bigger winners'.

And rules alone are not an answer. Sports provides the best way of describing the behaviour. In a game without referees and meanigful penalties the result will be cheaters winning by deliberately doing things they understand are unacceptable. And the amount of unacceptable behaviour will increase with the perceived potential reward for getting away with the unacceptable behaviour (and immediate opportunity to benefit overrules any potential negative consequences in many risk taking evaluations). And in most sports new rules and methods of monitoring need to be developed as new ways of being unacceptable develop. And inspiet of the rules some people will try to argue against the application of the rule to something they did.

The economic system is similar to sport except that every aspect of it is subject to bigger reward for anyone who can get away with any form of less acceptable behaviour.

So the obvious conclusion is: Until humanity develops to the point where every human seriously pursues the best understanding of what is going on and diligently and responsibly strives to have all of their actions be leading toward the development of a lasting better future for all life on this amaing planet, there needs to be lots of effort put into constantly improving the effective restriction of what is allowed to be gotten away with in economic (and political) activity.

Acknowledging that leads to the understanding that much of the currently developed economic activity and perceptions of wealth and prosperity are an illusion, a very damaging reality poorly understood by many that some very wealthy powerful people fight to expand their personal benefit in. It is a system where the developed wealth and power will fight against admitting they do not deserve the perceptions they have gotten used to, the perceptions that were irresponsibly allowed to develop.

It is definitely a challenge to develop broad acceptance of that understanding of what is going on in a global society that has most people immersed in mass-marketing consumption based efforts to link and limit perceptions of acceptability, merit and value to perceptions of popularity and profitability which can be completely ammoral and likely be immoral.

The required action to address the developed better understanding of what is going on because of the burning of fossil fuels is challenged because it raises the awareness and understanding of the unacceptability of more developed economic activity than just the burning of fossil fuels.

Many books have written about this including Rachel Carson's "Silent Spring", Paul Hawken's "The Ecology of Commmerce", and most pointedly Naomi Klein's "This Changes Everything".

The failure of the current socio-economic-political games to develop lasting improvements of conditions for all of humanity is not a new understanding. What seems to be new are the simplistic claims that the system and what has developed are not the problem, the growth of human population is all that needs to be addressed.

Obviously what needs to be limited is the potential for success by humans who try to benefit or win by getting away with deliberately not caring to limit their actions based on the possible to understand unacceptability of how they try to benefit. It would be nice if all such humans would responsibly and considerately change their mind if given enough information presented in an appealing way, but that is clearly an unrealistic expectation.

Therefore, the required action is ensuring that the only actions permitted to succeed in the socio-economic-political games are actions that will promote and develop virtually eternally lasting activity all of humanity can benefit from (that will not be as popular or profitable as what might be able to be gotten away with). That will mean limiting the total human impact on renewables to the rate of renewing (that will also not be as popular or profitable as what might be able to be gotten away with). That does imply addressing the total human population number, but only after excessive consumption and impact by the highest impacting and consuming humans has been restricted (which will definitely not be popular or as profitable as what has been able to be developed).

This need is nothing new. The thoughts about how to limit the success of the unacceptable economic pursuers among us have even been the basis for religious edicts like bans on 'usury' many centuries ago. And before Rachel Carson, writers like Shakespeare and Dickens were trying to get the message out.

Question: Do energy companies continue to explore in the expectation that they will be paid by governments for those 'stranded assetts' when the governments finally begin to restrict extraction?

The 'too-big-to-fail' question is of course an excellent question!

"Too big to fail" is a misleading term. That term is used to prolong irresponsible unsustainable gambles just because they have become very popular and profitable and to reward and protect those who obtained wealth and power from the unacceptable success of such pursuits.

The losses that should be faced by investors and employees and consumers whose perception of success are based on getting away with the understandably unacceptable gambles will clearly have to be forced on the current system. It is clear that the current system encourages leadership that will defend and promote the least acceptable economic activity that can be gotten away with.

What is needed is leadership that focuses on the constant improvement of the understanding of everything that is going on. And the required type of leadership would apply that understanding to encourage and promote development toward a lasting better future for all life on this amazing planet (something I contend is the only viable future for humanity on this or any other planet). That action by responsible leaders would include forcing changes of what has been developed. And that would include ensuring that those who hoped to benefit from unacceptable economic development wold suffer the losses they deserve in spite of the ability of misleading marketing to create perceptions of popular support for understandably unacceptable economic gambles.

The future of humanity clearly depends on the development of ways to ensure the success of that type of leadership in business and politics (to the detriment of unacceptable gamblers who desire short term personal benefit any way it can be gotten away with). Without such leadership the future is guaranteed to be more inhumane and immoral as there is more and fiercer 'competition to benefit the most from diminishing limited opportunities to get away with unacceptable actions'.

Hopefully, that type of leadership will develop in time to keep undeserved wealth and power from remaining in the hands of people who have clearly not responsibly limited their actions based on the developing understanding of what is going on. That leadership will admittedly be regionally unpopular to different degrees. So the requirement will become global leadership collectively pressuring and penalizing unacceptable regional and business leadership in the hopes that such actions will 'change the minds of those who have decided to try to get the most personal gain as quickly as possible in the least acceptable way they think they can get away with'.

And responsible global leadership clearly must not try to protect or defend undeserved perceptions of prosperity and wealth in already developed regions that deliberately continued to burn fossil fuels to obtain more competitive trade advantages or places that encouraged the increased export of fossil fuels for burning, particularly the export or burning of coal, oil sands or pet-coke (the worse than coal waste product from upgrading heavy oils like oil sands bitumen).

If a study disconfirming your expectations were funded by the fossil fuel industry, I'm sure a howl of protest would rise from this blog - never mind ad hominems. However, a study confirming your thesis comes from an bank, that stands to make hundreds of billions if not trillions of dollars depending on government policy on this issue, and it's lapped up unquesiontingly? Not to mention no one seems to question the bank's clairvoyance, guessing what expenditures and costs may or may not turn out to be over a hundred year period, when they couldn't predict the meltdown of 2008 when they had all the data in front of them! Am I the only one that sees a problem with this?

Ignaz @13, I think you are right to point out the financial interest of Citi group in the issue. However, you have the sign wrong. Citi group is an insurer. That does not mean they are likely to make large profits from tackling climate change. Rather, it means they are exposed to large losses if we do not tackle climate change. That is due to the increased rate of climate related natural disasters in a warming world:

Of course, tackling climate change is no no benefit in reducing insurance losses if climate change does not in fact drive increased natural disasters. That is, they only have a financial interest in telling us about climate change if climate change is in fact real, and harmful.

Hi Rob #4, I know about the stranded assets and the Carbon Tracker Initiative (very interesting stuff) But these assets will only become stranded if our political leaders have the nerve to act against climate change. See also ExxonMobil’s answer to the question: what do you intend to do to mitigate the risk of stranded assets ? Answer: NOTHING, we don’t think this is a risk because we don’t believe that our politicians will do anything against climate change.

http://cdn.exxonmobil.com/~/media/global/Files/Other/2014/Report%20-%20Energy%20and%20Climate

[PS] Fixed link. Please use the link button to create link.

wrong- they will be stranded assets because the public stops demanding them and competitive products come to the marketplace to make them unviable.

@bozzza:

I don’t know how it is where you live. But in Europe the public has been encouraged to reduce its energy use for the last 20 years at least. I estimate that perhaps 5% of the people reduced their energy consumption by a significant amount. Having a “Thick Sweaters Day” once a year (on this day people are asked to turn down the heating and to wear a thick sweater instead) will not lead to a low carbon society.

Hoping that renewables will become so cheap and deployed so quickly and on such a scale that fossil fuel assets become stranded ... is a big gamble. (By the way, this is not the scenario the Carbon Tracker Initiative warns about. The Carbon Tracker Initiative predicts that at a certain point in the future the government will intervene and restrict the burning of fossil fuels somehow, rendering a lot of the current fossil fuel reserves worthless).

Fossil fuels are basically free. The law of supply and demand dictates that a product will be consumed at the price and in the amount determined by the intersection of the supply curve and demand curve. If a product is free, the supply curve is a horizontal line at 0 (see picture below). As a consequence, the equilibrium point shifts to the far right which means: the product will be consumed until exhaustion of that product.

Yes I know. Fossil fuels are not really free, there is an extraction and refinement cost. But it illustrates the principle. At some point in the future, perhaps, renewables will replace fossil fuels. Electric cars will replace fossil fuel powered cars. But will it happen in time to prevent the worst ? Or will it happen only after most of the current fossil fuel reserves have been burnt ? In my opinion, without a price on carbon it will be too little too late.

bvangerven wrote: "Hoping that renewables will become so cheap and deployed so quickly and on such a scale that fossil fuel assets become stranded ... is a big gamble."

It really isn't. Indeed, in some parts of the world this is already happening... and it seems all but inevitable on a global scale.

Look at the coal industry in the United States. Peabody Energy, the largest private coal company in the world, has become a penny stock. The second largest and several others have filed for bankruptcy. Coal has gone from generating 53% of US electricity in 1997 to 37% in 2012. There hasn't been any new coal power built in years, and old plants are shutting down early because they cost more to operate than they can make in profits.

Those early shuttered coal plants are 'stranded assets'. The reason no new coal plants are being built is that they'd all be stranded assets. Now, this is a special case because the collapse of coal has largely been driven by cheap natural gas from 'fracking'. However, solar and wind power costs in some parts of the country are now even lower than natural gas costs. Basically, the U.S. got a head start on the death of coal due to the natural gas boom, but low renewable power costs will have the same impact.

Many areas in Africa which have never had electricity at all are now skipping fossil fuels entirely and going directly to solar power. The same is true in other developing areas, including formerly off grid portions of India and China. That doesn't create stranded assets but it means the fossil fuel plants never get built at all... because if they were they would have become stranded assets.

As to fossil fuels being 'basically free'... even with your caveats there is a problem with that analysis. Here in the United States many areas 'bid' on power in distinct blocks (e.g. X kilowatts for 15 minutes). In the northeast, some of the big fossil fuel companies got the bright idea of taking a loss to underbid renewables and drive them out of the market. Small problem... the cost to run a renewable power plant is essentially the same whether the power is being used or not. So the renewable plants could bid zero and be no worse off than if they had been outbid. Indeed, some of them that were being subsidized could even bid negative (we will pay you to take our electricity), and still make a profit! In short, fossil fuel plants will never be able to compete because their fuel costs are not zero. Wind and sunlight really are "free". There is absolutely no reason for wind/solar plants not to bid as low as they have to in order for them to sell every electron they produce. Thus, once a renewable energy plant is built it will always be able to underbid a fossil fuel plant... thereby effectively turning that fossil fuel plant into a stranded asset.

@18, look up a concept called "Jevons Paradox" and see if you can figure out what the word "elasticity" means?

Your simplistic arguments are only fooling yourself.

In regards to Government intervention into the non-existant free-market: they don't lead- the people lead. Governments follow!!

The concept of "Elasticity" starts to get a bit weird/fun/too-big-to-fail now...

@CBDunkerson:

You make valid points (thanks), but I am having the following reservations:

1. I am having serious doubts how long the low fossil fuel prices are going to last. You mention that coal companies are struggling. What about the losses fracking companies are making ?

One of the reasons the fossil fuel prices became so low is the shale investment boom. Investors put hundreds of millions of dollars into fracking companies that make big losses, something they wouldn’t dream of doing in any other industry.

See a.o.: www.bloomberg.com/news/articles/2014-04-30/shale-drillers-feast-on-junk-debt-to-say-on-treadmill

One company is spending $4 for every dollar of income from shale gas (figures from 2014). I.e. oil and gas are cheap because they are heavily “subsidized” by investors. This is going to implode some day.

2. You wrote: “the cost to run a renewable power plant is essentially the same whether the power is being used or not”. That logic also applies f.i. for tar sand companies. They suffer from the low fossil fuel prices, but the huge up front investment is already made. They are not making enough profit to cover their total cost, but they are still making enough profit to cover their running costs, so they will continue their business.

3. Global CO2 emissions are still growing, close to the worst case scenario modelled by the IPCC. By now I would expect to see renewables make a dent in this graph. Let me rephrase my question: Do you think that renewables will become so cheap and deployed so quickly and on such a scale that a significant quantity of fossil fuel assets become stranded ? (a significant quantity meaning: enough to stop climate change and to attain a low carbon society). I don’t know the answer to that question, but I think it is a big gamble. Right now the evolution seems positive because of the low FF prices, but these prices are going to rise again. And the FF investors will be back.

@Bozzza: I would appreciate it if you would respond to my arguments, instead of just calling them “simplistic”.

And, yes, I know what Jevon’s paradox is, and what price elasticity is.

One example of Jevon’s paradox: When renewables are deployed on a large scale, this could give the economy such a boost that the consumption of fossil fuels goes UP, not down.

bvangerven, I'm not sure where you are going with your first point. I agree that fracking is a temporary phenomenon and US natural gas prices will rise again (indeed, they already are)... but if anything that makes the case for stranded assets due to renewables taking over stronger than if natural gas prices had remained low. We're now moving from natural gas killing off coal power to wind & solar killing off both coal and natural gas. You seem to be assuming that higher fossil fuel prices = more investment in fossil fuels. That was true when they didn't have any competition and higher prices just meant higher profits. However, the equation has changed for fuels other than 'oil'. Now high coal and natural gas (electricity generating fossil fuels) prices means more investment in less expensive (and thus more profitable) wind and solar.

As to tar sands, no they aren't comparable in any meaningful way. It's an almost entirely separate industry... tar sands go almost entirely to power the transportation industry while wind & solar power go almost entirely to electricity production. Thus, there is virtually no overlap... the technologies aren't currently in competition with each other. I doubt there has ever been such a thing as a tar sands driven electrical power plant.. they wouldn't be even remotely cost competitive. Conversely, wind & solar can't make in-roads on transportation because battery costs for electric vehicles are still too high. However, that separation of markets does not mean that tar sands enjoy the same 'free fuel' effect as wind and sunlight... tar sands have to be processed and transported. That costs money. They inherently can't make a profit unless they can charge more than their costs... which they can only do because all of their competitor fuel sources have similar limitations. If that changes (e.g. electric car batteries become cheap) then truly free fuel sources like solar could undercut all fossil fuels in the transportation industry as well. Imagine a hybrid that can run on electricity or gasoline... given that electricty costs less per mile than gasoline (and independently generated solar electricity costs nothing) why would anyone pay for gasoline when they didn't have to? They'd plug in and/or solar charging as much as they could... greatly decreasing the amount of gasoline purchased. The fuel source would be undercut... just as we are seeing with electricity generation. Also, I don't expect to see high 'oil' prices again. At this point, everyone is in full scale production mode to grab as much profit as they can before oil joins coal and natural gas on the obsolete list. That means over-supply and low prices. The only way to drive prices up would be to cut back on production... but that would just hasten the day when the balance of costs make battery electric vehicles a better choice.

Finally, I think you are still phrasing your question wrong. Yes, unless displaced by some new technology, renewables will definitely allow us "to stop climate change and attain a low carbon society"... the uncertainty is in how bad climate change will get before that happens. I'd say the 2 C limit is all but impossible to achieve at this point (i.e. world governments would have to make a real meaningful effort), but we should stop short of 3 C even with governments continuing to prop up the fossil fuel industries.

I have been following this thread for a few days now. I am surprised that there has been no mention of "negative externalities" in the debate. As I understand it "negative externalities" are costs that aren't paid for by the company or consumers but are paid for by others, like taxpayers and insurance companies when alleviating the health, social and environmental costs associated with the consumption of a product. In other words "negative externalities" are costs of production/use where the cost burden has been been transferred from the company to others outside the company. If fossil fuel companies had to account for all their "negative externalities" then the economic viability of fossil fuels would make their consumption questionable. The trouble is no-one at the corporate level or in Government seems to be interested in determining the real and expected "negative externality" costs associated with the production of fossil fuels. Now I would have thought that this should be possible if there was a will to do so. Insurance companies do it all the time when assessing future risk. Companies make expected cost projections all the time when they are tendering for contracts. Governments do it all the time when determining future infrastructure needs. There should be enough historical cost data held by Governments and insurance companies to determine expected future "negative externalities" associated with the production of fossil fuels. Introducing levies and tax surcharges by Governments related to "negative externalites" would go a long way towards addressing the detrimental imacts of using fossil fuels. To determine what to charge could be done using the same methods that insurance companies use to determine premiums. Future expected external costs (negative externalities) associated with using fossil fuels could be determined using historical data and growth projections; and the exact tax for each company could be based on their turnover. The main problem is finding politicians who have the political wherewithall to introduce such a controversial scheme. If developed it could also be used in the tobacco industry and other socially and environmentally detrimental industries. I guess it is much simpler to gain the necessary political bipartisanship to introduce carbon taxes or ETS's rather than schemes to account for negative externalities.

Just an observation related to transferring from fossil fuels to renewables. It would seem that the costs of using fossil fuels is initially cheaper with the long term costs being more expensive but hidden and paid for by others (us all) at a later date. Whereas, the initial costs of using renewables is expensive but the long term costs/benefits are cheaper but are paid for by and benefit the consumer. Now since operation of modern corporations revolve around short term profits and current rates of return it does mean that long term investments are not considered with the same importance as the short term bottom line. Governments, if they are doing there job properly, should always be concerned with the long term, with the world a generation from now. Unfortunately, many in Government have their thinking based around the short term business model.

Also, another observation, just transferring from the use of oil to renewables for transport is not quite so simple as introducing carbon taxes and ETS's. At the moment there are petrol/gas stations everywhere and people can just fill their car or truck up whenever and whereever they want. To have electrical charging stations and hydrogen fuel stations everywhere requires a certain market saturation to make it viable. That is not going to be a simple process. It will require the intervention of Governments for a while, and they seem to be reticent to intervene in the market when it doesn't suit them.

Kevin C Tom Curtis As you know, Citigroup provides a plethora of services. In regard to the subject at hand, see links below outlining a $100 billion, ten year plan for investment, and scope of operation representing varying income streams in the sector. In addition, Citigroup, or any ohter insurer, would not sell insuruance unless their actuarials show them they can make a profit - contrary to apparent belief, insurance companies are not in the business of lossing money. The fact that insurance companies epose themselve to losses is not evidence of their magnanimity. I am also fairly certain you understand the tremendous political lobbying power that not only Citigroup but of other public and private equity firms have to influence - to put it mildly - government policy and regulations.

The problem, Kevin, is that if Citigroup is lobbying the govenrment to impose regulations that help those investments gain value and help expand their insurance portfolio into a heretofore non-existant industrial sector, while at the same time knowing that there is little hope of non-fossil fuels replacing the ~25 TWh consumed in the U.S. today and the growing energy demands tomorrow, then that represents a tremendous conflict of interests. It smacks of cronism, not "saving the planet." Moreover, for the $150+ billion spent so far, and the ~$39 billion yearly subsidy, renewables are only 8% of the U.S. energy portfolio, and not a relieable 8% - that number is a yearly average. It is unlikely to grow much further, since innovation is agnostic and is happening just as fast in the fossil fuel energy industry as it is in the non-fossil energy industry.

In addition, the word "renewable" as applied to alternatives to fossil energy sources is misleading. The only thing that is renewable is the sunshine and the wind. Neodynium, for example, while abundant, is not renewable and has a limited effective lifespan, with electricity generation efficiency falling thoughout its life cylce. The same is true of solar panels. Moreover, there is a host of elements and compounds used in the generation, storage and transmission of so-called renewables, which are not present on this planet in limitless supply. And as you know, China produces 95% of the world's lanthanides and South Africa is the exclusive source of other vital components in the renewable supply chain. Therefore, there is also a foreign dependency component to the sector as presently envisioned. Is the American environmental movement ready to support a massive exapansion in U.S. open pit mining? (For a primer on this subject, see the history of Molycorp, the ONLY U.S. based rare earth mining company, which incidently the Chinese own a controlling interest! http://www.molycorp.com/about-us/our-history/ )

Furthermore, the AGW lobby demands that externalities be taken in to account in the price of energy from fossil fuels. However, they completely ignore the cost of toxic and carcinogenic externalities present in renewable energy sources. Below is a brief but not exhaustive list of some those externalities garnered from the Nocera Lab at Harvard University. All of these elements have to be mined and process somewhere, and eventually some will have to be disposed while others will be reprocessed, i.e., recycled. (Recycling is not without its own externalities.) Has anyone in the renewable energy sector calculated these costs and included them in the already high price of fossil fuel alternatives? (If anyone know of such cost calculations, I would appreciate an article or at least a link.)

The inconvenient truth is solar and wind require lots and lots of mining and processing of toxic and carcinogenic elements and compounds. As you may know, Daniel Nocera runs the Nocera Lab: The Chemistry of Renewable Energy, at Harvard University. This non-exhaustive list of elements and chemicals is taken from study abstracts linked to the Nocera Lab site for 2015. Abstract from previous years expand the list of toxic and carcinogenic materials under study. (Links follow at the end.)

POLYPHENYLENE-VINLENE

BUCKBALL-based materials

(Buckyballs are carbon and PPV is toxic.)

COBALT and NICKEL catalysts for artificial photosynthesis.

Between cobalt and nickel, which is the non-toxic one? (Sorry for the snark, but it is difficult to not be flippant when such obvious issues are studiously ignored and avoided by the green lobby.)

PHOSPHINE mediator and NICKEL metal catalyst.

Phosphine is highly toxic and potentially fatal if inhaled.

Co phosphate oxide (CoPi)"

Cobalt - that was the non-toxic one, right?

CADMIUM TELLURIDE (CdTe)

CADMIUM SULFIDE

COPPER INDIUM GALLIIUM SELENIUM (CuInGaSe2; CIGS)

More toxic chemicals that someone has to mining and process.

RUTHENIUM [Ru(II)]

BIPYRIDYL

TITANIUM OXIDE (TiO2)"

BIPYRIDYL is highly toxic. RUTHENIUM is highly toxic and carcinogenic, and extremely rare being only the 74th most abundant element in Earth's crust. Incidently, solar panels employing RUTHENIUM are currently the highest in energy conversion efficiency in the lab.

HYDROCARBONS

CARBON nanotube matrix

ORGANIC electrodes."

Hydrocarbons should not need explaining. And the word "ORGANIC" of course related to CARBON.

LEAD SULFIDE (PbS), and LEAD SELENIDE (PbSe)"

More brain damaging poisons.

STRONTIUM TITANATE (SrTiO3), doped TiO2

PLATINUM (Pt)

RUTHENIUM(IV) oxide (RuO2) IRIDIUM(IV) oxide (IrO2)

CADMIUM SULFIDE (CdS)

INDIUM PHOSPHIDE (InP)... TANTALUM (oxy)NITRIDE (TaON) CHROMIUM(III) oxide (Cr2O3)

Again, more toxic compounds.

Furthermore, the newest RNA/DNA-based electricity generating technology produces its own set of toxic externalities. Moreover, if you think environmentalists are upset of GMOs, wait until this information wafts into their general consciousness. Hold on tight, we are in for a bumpy ride.

http://nocera.harvard.edu/Home

http://nocera.harvard.edu/Publications2015

https://www.nae.edu/Publications/Bridge/140630/140646.aspx

http://www.citigroup.com/citi/environment/opportunities.htm

http://www.citigroup.com/citi/environment/operations.htm

Tom Curtis By the way, insurers are just as liable for the externalities from the pseudo-renewables projects they underwrite as they are from any effects of climate change. The blade cuts both ways.

Another issue almost completely ignored by alternative energy advocates here, but which to their credit the IPCC warns, is "energy sprawl." Alternative energy is a land use hog! Estimates vary, but I have heard solar panels, wind turbines, and storage batteries needing to cover an area equivalent to Connecticut just to supply the eastern seaboard! We also know of the tremendous slaughter of birds - some of them endangered - from wind farms. And while some reports have attempted to disingenuously minimize this effect by claiming cats kill more birds than windmills, cats generally kill small urban birds that are plentiful. They generally don't kill hawks, eagles, whooping cranes, herons, etc.

So, to recap and stay on topic, we have toxicity costs; land use costs; wildlife costs. Where are Citigroup's actuarial analyses on their pseudo-renewables projects, accounting for these costs?

And again, there is still the unanswered issue of Citigroup's clairvoyance in coming up with these $190 and $192 TRILLION dollar figures, when they couldn't even predict the real costs of the risk they were exposing themselves to when they actually had all the data in hand! I thnk one has to be fairly credulous to accept their findings at face value. Particularly, when the have a conflict of interest as I outlined previously.

Another bit if interesting information. Dr. James Hansen has stated that he does not support a carbon tax and he does not support the government picking winners and losers. He supports that the so-called fossil fuel externality price be redistributed back to the public on a per capita basis and letting the market decide what alternative technologies will win. He even said, and I'll find the clip from the symposium in which he said it and post it, he said, "The Democrats are really bad at this..." He was referring precisely of the penchant liberals have for using the government to intervene in markest when they can't possibly know ahead of time which technologies, or combination of technologies, will serve our needs best.

mancan18 Governments are hesitant to intervene in markest, because there is a long history of unintended consequences when they do so. It is difficult to find examples of successful government market interventions. They tend to create shortages when they were aiming at stimulus, and creating overages where they intended throttling. Economies are non-linear dynamic, chaotic systems. No easier to predict than the weather. If it weren't so, then no one would be caught in financial crises. No one would be caught nakes when the tide went out, sort of speak.

Huge estimates of wind turbine land use are derived by pretending that all of the area between individual turbines in a wind farm is being 'used' by them. This is, of course, false.

Huge estimates of solar land use are derived by pretending that solar power cannot be deployed in areas already being 'used' (e.g. on building rooftops or over parking lots) and thus take up no additional space. This is, of course, false.

The 'kill rate' for birds from wind power is less than that from fossil fuel power... and both are tiny compared to cats and collision with windows.

In short, you are spouting a whole lot of nonsense.

Ignaz, I don't want to derail the thread, but governments have always intervened in markets. There has never been--and there will never be--a general, unregulated, large-scale market economy. The fact that the global market exists and that economic growth continues is one measure of the success of government intervention. You may have different criteria for "success." The problem with free markets is the same as the problem with democracy: these processes only work in their participants' best interests when the participants fully understand the long-range outcomes of their actions. That's not working out so well, especially as the emphasis seems to be on dumbing down the participants and allowing the privileged representatives (capitalists and politicians, respectively) free rei(g)n to determine what is right for the participants.

A portion of every dollar spent on fossil energy goes to organizations that are dedicated to misinforming the public on the issue of climate change. The narrative (or "memes" really, as there is no coherent narrative and, for their purpose, doesn't need to be) produced by these organizations is strongly anti-regulation. The bottom line is that corporations and companies (and their shills) speak with forked tongues as they complain about government regulation but also attempt to regulate the market by controlling public discourse and altering the politics of market participants.

Do wind and solar companies also attempt to misinform the public in order to gain an edge? I'm sure they do, but this action has nothing to do with the drive toward a more sustainable energy platform. It has everything to do with the essential culture of the economic mode in which they are engaged (or as the shills say, "it's just human nature"). The mode encourages confusion.

Ignaz @28:

I was going to leave responding to Ignaz's nonsense until tomorrow, but I dislike people who (apparently) lie about the opinions of others inorder to bolster their arguments. In this case, the fact is that James Hansen is a vociferous and determined supporter of carbon taxes. It is cap and trade (ie, emissions trading schemes) that he opposes. See, for example, his detailed discussion here. It should be noted that of the two, a carbon tax represents a more interventionist approach by government than does cap and trade.

Further, Hansen is vociferous also in calling for a moratorium on all future coal power stations that do not capture and store their emitted CO2. In a letter to the Obama's in 2008, he wrote of a "Moratorium and phase-out of coal plants that do not capture and store CO2" that it was the "...sine qua non for solving the climate problem." Such a moratorium would represent a clear regulatory intervention by the government to obviate a market failure. It would represent the government picking a loser (coal) in favour of winners (nuclear and renewables).

In short, what Ignaz claims to be the opinion of Hansen is directly contradictory to Hansen's actual opinion.

This is not the only example of such egregious misrepresentation by Ignaz. I have previously discussed his misrepresentation of William Nordhaus, and his misrepresentation of the findings of inquiries into flooding in New Orleans. This is developing into a pattern which is very hard to attribute to innocent error.

Ignaz @29... I don't want to dogpile here, but governments do, constantly, intervene in markets. In fact, markets cannot operate without some form of government. The SEC is a government agency. The US Treasury is a government agency. The Federal Reserve was instituted by the government and acts as a governing system. The IRS is clearly a government system.

All of these can, and do, have influence on the marketplace on a constant and ongoing basis. Markets cannot function effectively and reliably without these governmental systems.

And to back up Tom Curtis, Dr. Hansen has long been a strong supporter of a revenue neutral carbon tax and dividend system.

Ignaz... "He supports that the so-called fossil fuel externality price be redistributed back to the public on a per capita basis..."

You're describing a tax and dividend system, just the same as Democrats are trying to get enacted, and which Republicans are blocking. A tax or "fee" is the "external price" and the dividend is a tax credit on individual tax returns thus returned "to the public on a per capita basis."

Ignaz @25, for want of an actual argument, gives a laundry list of supposedly toxic components used in manufacturing renewable energy sources. He does not show that components on the list are particularly toxic, relying instead on rhetorical questions and the hope that our ignorance matches his own. Thus, he lists cobalt and nickel, asking "Between cobalt and nickel, which is the non-toxic one?" Well, obviously both are toxic, as is everything in sufficient dose. But "Some evidence suggests that nickel may be an essential trace element for mammals", and Cobalt is "... is a very small part of our environment and very small amounts are needed for many animals and humans to stay healthy" (in the form of vitamin B12 as it happens). So, in small doses both appear to be necessary for good health. In large doses they are not, but Ignaz provides no information to suggest the use of Nickel or Cobalt in artificial photosynthesis will lead to exposures to large doses.

The desperation of Ignaz' rhetorical tripe is shown when he lists "organic electrodes" and writes "... the word "ORGANIC" of course related to CARBON" to explain the toxicity issue. Well, yes. Organic relates to carbon. But that does not show organic electrodes to be anymore toxic than chlorophyll, vitamin C, or even glucose. All of them are also organic compounds, consumed in high volumes (chlorophyll) or manufactured by the body (vitamin C except in great apes including humans; and glucose); and with sufficient dose, all also are toxic (as is everything).

This is not do deny that some of the items on his list are toxic in small doses, or pernicious so that it is difficult prevent harm either in manufacture or from waste products. But Ignaz does not discuss those cases only. Nor does he compare with the toxicity issues from normal manufacture of other products, or other forms of energy (where coal in particular is very pernicious). Most importantly, he does nothing to show that with appropriate techniques, these substances cannot be used safely in the manufacture of renewable energy plants. In short, he does not show whether switching to renewables will increase or decrease the risk of toxicity in the environment; nor whether any risk involved is intrinsic or can be controlled by proper manufacture.

Instead of a proper argument, he merely vomits forth a list of words in hopes of evoking an emotional response from the non-thinking.

[PS] This is clearly over the line on "Inflammatory comments" as per comments policy as you should know.

Please step back and stick to arguing the facts.

Tom Curtis see video at 40:22 to 41:54 for what Dr. Hansen believes about the economics. Evidently, Dr. Hansen, at least in this symposium, does not agree with out interpretation of his position on the economics.

https://www.youtube.com/watch?v=zGY2cjSfsRA&ab_channel=UyrekaNante

As for the toxicity of the list of elements I list, which are taken from abstracts linked to the Nocera Lab and NAS website, a simple goolge seach with bring up each and every one of them as being toxic and/or carcinogenic. I guess I incorrectly thought that a person with and open and inquiring mind as your purport yourself to have, would take the ten minutes or so that it would take to google these elements or ask a chemist you may know. To even question that cadmium, lead, cobalt and phosphine are toxic, or that ruthenium is a know carcinogenic, just says that you ought to spend less time pandentical correcting others, and inform yourself instead.

And the point of highlighting "organic," which obviously went right over your head, is to point out that carbon mined from somewhere is still part of the "renewables" picture. Moreover, a technology that I didn't include, but which may interest you, is the work being done with graphene. It may very well turn out that the electric future of your dreams will be based on the near-supercondutivity at room temperature of this allotrope of carbon. Is it's a well known economic fact that one tends to get less of something that's taxed, it would be shooting oursleves in the foot to tax carbon and thus disincentivize this technology.

You continue by saying about me, "In short, he does not show whether switching to renewables will increase or decrease the risk of toxicity in the environment; nor whether any risk involved is intrinsic or can be controlled by proper manufacture." However, I believe you are confused about you had the onus to show such evidence. I am not the one claiming that these are "clean green" technologies, thus implying to the general public that they are without externalities. To the contrary, failing to expose data that you know undermines the claim of "clean energy," is intellectually dishonest.

More over, this futher claim you make, "Some evidence suggests that nickel may be an essential trace element for mammals", and Cobalt is "... is a very small part of our environment and very small amounts are needed for many animals and humans to stay healthy," is another example of intellectual dishonesty, because we both not that to fullfill the world's need of ~25TWh and growing, massive amount of these substances will have to be mined and process. So the impact to the envirionment is unlikely to be "small doses" needed for animal health.

You also studiously ignore that fact that the majority of lanthanide production is control by China, which has imposed export controls. Lanthanides, as you may or may not know, are not only vital to the "clean" energy industry but they are also vital to any modern weapon of war worth building. Again, are you ready to come out in support of a massive increase in open pit mining in this country? Or, would you rather keep the externalities in China and give them a trump card over our armed forces?

[PS] Fixed link. Note that in that video, the question Hansen is answering is whether he supports carbon tax money going to CCS instead of redistribution to public. His reply reiterates the position claimed here by Rob and Tom. As with Nordhaus it seems you are not understanding video that you are putting forth in support of your own arguments.

[PS] Please step back, take a deep breath and stick to arguing the facts. Skip the rhetoric and sloganeering. If you make a claim, back it up with references. (eg the "vital" to clean energy).

This discussion is going off the rails. Please note that posting comments here at SkS is a privilege, not a right. This privilege can be rescinded if the posting individual treats adherence to the Comments Policy as optional, rather than the mandatory condition of participating in this online forum.

Fruitful discussion happens when participants acknowledge points where they agree and state why they disagree with references and without the rhetoric.

By the way, Tom Curtis, I don't like people who lie about the opinions of others either, as you seem to have done regarding what I heard from Dr. Hansen's own mouth. But perhaps you're just that good. You know his mind better than he knows his own

[PS] Nothing but inflammatory comment.

Hansen explicity says that the government should not be picking winners and losers, that Democrats are prone to that error, and that he supports the market operating to find optimal solutions.

Are you all denying he said that in the video I posted?

[PS] Hansen explicitly supports tax and dividend. (which means government is not picking a winner like CCS). That is what other commentators are telling you but you seem to fail to understand. The video in no way contradicts this.

DSL Although this is not a political tread, I have to respond. In your statement, "The problem with free markets is the same as the problem with democracy: these processes only work in their participants' best interests when the participants fully understand the long-range outcomes of their actions. That's not working out so well..." you are implicitly assuming that governments fully understands long-range outcomes, and furhter assuming that they have the best interests of all stake holders in mind. There's enormous amounts of historical evidence that belie both your implied assumptions. They are not so much statements of fact as they are statemenst of leftwing dogma.

[PS] Correct, it is not a political thread. If your interest is climate politics, then there are plenty of other web sites for your amusement. This is not one of them.

For those that missed them, here are the links describing Citigroups investment psotions and scope of their world wide operations.

http://www.citigroup.com/citi/environment/opportunities.htm

http://www.citigroup.com/citi/environment/operations.htm

And keep in mind that this is only one investment bank. It would amont to professional malpractice for other investment banks - public and private - to not be positioning themselves to take advantage of forthcoming regulation and industry subsidies.

And Mr. Al Gore, who has already become the first "green billionaire" on the back of his well publizied hyperbole, is doing the same. (See below)

https://www.generationim.com

[PS] Skip the politics and the posturing.

Please note that posting comments here at SkS is a privilege, not a right. This privilege can and will be rescinded if the posting individual continues to treat adherence to the Comments Policy as optional, rather than the mandatory condition of participating in this online forum.

Moderating this site is a tiresome chore, particularly when commentators repeatedly submit offensive or off-topic posts. We really appreciate people's cooperation in abiding by the Comments Policy, which is largely responsible for the quality of this site.

Finally, please understand that moderation policies are not open for discussion. If you find yourself incapable of abiding by these common set of rules that everyone else observes, then a change of venues is in the offing.

Please take the time to review the policy and ensure future comments are in full compliance with it. Thanks for your understanding and compliance in this matter.

Ignaz: "you are implicitly assuming that governments fully understands long-range outcomes, and furhter assuming that they have the best interests of all stake holders in mind."

Strawman, Ayn. Show me how you constructed the implication from my text. I will say this, though: governments have the potential to collect and organize information to an extent far, far beyond that of any individual. At this point, individual cases need to be assessed. Social organizations, whether governments or businesses, all have the potential to be both beneficial and destructive. Governments have proven extremely useful in organizing the response to large-scale disasters. A response by private enterprise on the same scale would be chaotic to the point of amplifying the disaster. If private enterprise was organized in its response, it would be nothing more than a government. When one fails to recognize what would happen in the absence of government, it's easy to criticize government. It's also an error in thinking to assess and evaluate a government without considering the development of that government within the broader context of the economic mode.

I'll wager this conversation will now disappear.

[PS] Any further politics and slides into offtopic conversation will indeed vanish.

Moderator The politics is precisely appropraite, because Citigroup is making an argument for the biggest government intervention in the economy in our entire history! The whole purpose for the "green lobby's" existence is getting government to intervene in the economy and impose artificial conditions. It is perfectly legitimate to discuss historical examples of govenment economic intervention.

[PS] I repeat politics is expressly forbidden. Politicians on all side defend their stance by appeals to history. Argue it somewhere else. Try Thinkprogress.

Note also: "Any accusations of deception, fraud, dishonesty or corruption will be deleted."

Your attacks on citibank run periously close. Discuss content and science or dont bother.

Ignaz @29

As many other commentators have already indicated, Governments do pick winners and losers. In fact every time they support a piece of new military technology they pick what they think are winners all the time. In fact, historically, many of the products and the science that gave rise to those products were a direct result of the research paid for by Governments (and a few wealthy individuals - not the Koch brothers) who were more interested in studying the science and what can be done than actually developing saleable products. The LHC and the Human Genome Project are cases in point. They are supported by Governments from many nations, and would not be possible if they had to rely purely on the operation of the market.

As regard the operation of markets, I would have thought that if Governments did ensure that companies paid for the negative externalities of the products they produced then that would not be the Government intervening in the market as you seem to see it. It would ensure that the market operated properly. In fact, Governments already do enforce taxes upon some products that have a negative externality involved in their consumption. The car market is such an industry. It requires car owners to pay a premium to an insurance company to ensure that any third party damage that arises from your use of your car will be covered, not by the taxpayer, but by the industry and consumers. We are all required to pay a premium each year based on the ascertained risk and the possible damage cost so that we can all drive our cars without taxpayers having to foot any damages bills. If it can be done with the car market, then it can certainly be done with the risk and potential damage that comes from using fossil fuels.

As regard James Hansen and his views. I agree with Tom Curtis @32. You have misrepresented Hansen's views.

Also, you miss Tom Curtis's point @35 regarding the toxic by-products of producing renewables. Those toxic by-products are not being produced in sufficient quantity in the manufacture of renewables to have a huge impact on the environment and can be easily contained if disposed of properly. This is quite unlike the CO2 by-product from energy produced using fossil fuels which is changing the very composition of the atmosphere in a remarkably short time, warming the planet and changing the climate to one not seen since humans first walked the savannah.

[PS] I think this particular line of discussion with Ignaz is closed. No more please.

Oh, and transcript of relevant part of the video with Hansen:

Questioner: (Directed to Jim)

"If funds allocated from a carbon tax were directly allocated to carbon capture instead of being redistributed to the American people as you outlined in your remarks, would you still support it?

Hansen: No, because we should not decide what the winning technologies are. Give the money to the public and let the market decide on what is the best way to reduce the carbon emissions. ....

Ignaz @36:

1) Hansen supports not picking winners with the dividend fee. He explicitly supports picking a loser with regard to coal power plants. As with your misrepresentation of reports on the flooding in New Orleans, you misrepresent by taking an opinion about part of the topic, and representing it as the whole opinion on the topic. I should note (for completeness) that favouring a carbon tax over an emissions trading scheme and using a flat per capita dividend rather than (for example) a dividend scaled with taxable income both increase the economic distortion of his preferred policy relative to alternatives and can therefore be described as "picking winners". None of that in anyway contradicts that his reason for preferring a dividend structure rather than direct funding of emissions reduction schemes with the revenue from the carbon tax is a desire to not pick winners, but neither does that restricted application of that principle imply that he supports "not picking winners" unequivocally, or across the range of policies he supports as you implied.

2) You misrepresent me as denying the toxicity of items on your list when I explicitly stated (several times) that all substances are toxic in sufficient dosage. Some of the items on your list are highly toxic, and some are included even though they are hardly toxic at all except at extreme doses. In one instance (buckyballs) you include it on the list even though only toxic (LD50) at 0.5% of total body mass. The reason you use such a laundry list is that, first, you are unable to show that the toxic substances cannot be safely used, and second, you are unable to show that manufacture of renewable plants involves more release of toxicity into the environment. You are even unable to show (because it is not true) that the toxic elements are even necessary for the renewable industry (as opposed to being used in particular products).

3)

If the mere presence of these items had massive toxic effects, then we would all have died out alread for they are present (except for the few artificial compounds) in massive quantities at the Earth's surface already. To be toxic, the substances need to by ingested or respired in circumstances normally only found during manufacturing processes.

On a personal basis, if it were not so the amount of time I spent playing on tailings dams in Kitwe (contaminated with copper and cobalt) in my youth would have killed me of.

I disagree with mancan18 (@43) that toxicity from manufacture of solar cells cannot become a problem with scale up of the solar industry, but it need not become one; and will probably require far less mining and toxic waste than the normal mining processes associated with modern industry. That is particularly the case as all of the technologies used in solar and wind have alternatives that do not use noxious or rare compounds.

4) It is a well known fact of economics that high demand for a substance increases the price. The greatest demand for carbon is currently for standing power, and for fuels. If those uses can be replaced due to a carbon tax, then the price of carbon in chemical uses will fall. Particularly as many of those uses will not result in emissions (the compounds are chemically stable) and hence will not attract the tax.

Ignaz @28 states, "Dr. James Hansen has stated that he does not support a carbon tax and he does not support the government picking winners and losers."

I just went to the Youtube link you provided and watched. He's not at all saying what you think he said. The question posed to him was, "If funds collected from a carbon tax were directly allocated to carbon capture, instead of being redistributed to the people, would you still support it?"

The question pre-supposes his support for a carbon tax and dividend system, but he's saying he wouldn't support having the funds diverted.

Tom Curtis

1) As per the Army Corp of Engineers, New Orleans flooded because of flawed levee design, i.e., govenrment incompetence, not because of a category 3 hurricane. Dance around it all you want, that is essentially what they reported.

2) The reason for including buckballs, and "organic," is to piont out the fact you seem to studiously ignore, that the extraction of carbon is still part of the mix. (See graphene as well)

3) Asserting that these toxic substances can be used safely is mere opinion. Thousands of so-called Superfund sites around the country, including ones which occurred after 1968 and the EPA's creation, belie your confidence. Moreover, assserting solar and wind "will probably require far less mining and toxic waste than the normal mining processes," is an absurd, unsupported specualtion, not a fact. You clearly have not looked into the envirionmental impacts of China's rare earth industry.

4) You ignore the supply side of economics. Carbon fuels have increased in efficeincy as they have dropped in price. Remember when "peak oil" was a thing? I was a thing precisely because government created a shortage by edict. Now Obama tries to take credit for the innovation of private industry and the exploration and extraction that has occurred on prvate land. The inconvenient fact is that innovation and progress are agnostic. It is happening just as fast in the carbon-based economy as it is in the alternative fuel economy. No alternative fuel, except nuclear, can keep up with the energy denisty of carbon.

5) You ignore the so-called "energy sprawl" problem, as well as the environemental impact of sprawling solar and wind energy projects, which yield orders of magnitude less energy per acre. Solar and wind have an outsized land use footprint, which includes mining and generation, compared to any other energy source.

6) On a personal note, if trailings from copper and cobalt mines were not a health hazard, then why would the government, let alone environmentists, be so concerned with their clean up? Silly boy, clearly you're using a personal anecdote to dispel concerns. The EPA evidently doesn't have as cavalier an attitude as you do.

7) Again you make a disingenous, unscientific statement by assertind, "If the mere presence of these items had massive toxic effects, then we would all have died out alread for they are present (except for the few artificial compounds) in massive quantities at the Earth's surface already." I is obvious, and I should have to address this nonsense, that the prescence of the elements in TRACE AMOUNTS in the earth is qualitatively different than their industrial aggregation and refinement. If that is the best you have to dispell concerns about externalities, than you make a pathetic case for their safety.

The experience of dioxin, the toxic waste by-product from the manufacture of chlorine products, is relevant when discussing the toxic by-products from manufacturing renewables. It is true that dioxin is a toxic waste product that has had a global impact, as it has been found in the food chain and associated with some cancers in humans. There is no doubt that the unfetted production of solar panels would no doubt lead to an accumulation of toxic substances in the environment if there were no effort to control them. Due to the unforeseen problems that dioxins have caused in the global ecosystem, dioxins are now treated in a highly regulated manner, i.e. Governments have intervened in the market to ensure that dixoins do not accumulate any further in the environment and cause any significant future harm. The toxic by-products from manufacturing renewables could be treated in the same manner making it mandatory for manufacturers to expidite proper disposal or seek alternative methods. Also, this is likely to be much more viable than any of the so called CO2 sequestration or geoenginnering schemes where the CO2 storage problems are immense and unintended environmental consequences are unkown and likely to be detrimental. Simply, toxic waste from widespread solar panel manufacture is unlikely to have the global impact that CO2 is currently having if a proper regulatory framework is in place.

I have responded to Ignaz' first point @46 above where it is on topic. I cannot help but observe that I already made a detailed rebutal of his point on that page, showing Ignaz to have clearly misrepresented the situation. Ignaz appears unable to counter that rebutal, and has certainly avoided doing so. Instead he merely repeats his refuted claim elsewhere, where he can hope some have not read the rebuttal. Again (and typically) he provides neither citation nor link in support of his claims.

[DB] Ignaz has recused himself from further participation in this venue, finding compliance with this site's Comments Policy a too-onerous burden.

We're now starting to see evidence that renewables are replacing fossil fuels even in some countries that aren't particularly rich in renewable energy and whose governments are actively opposing the transition;

Guardian: Renewable energy outstrips coal for first time in UK electricity mix

Just further evidence that economic realities are starting to drive fossil fuels out of business.

CBDunkerson,

This is very good news indeed. Hopefully wind and solar will continue to get cheaper and more and more will be built. Thanks for the link to a good, positive read.