What if, just work with me here, instead of passing a hugely unpopular HC bill in the dead of night, the GOP tried to do something popular?

Exxon, Stephen Hawking, greens, and Reagan’s advisors agree on a carbon tax

Posted on 23 June 2017 by dana1981

What do ExxonMobil, Stephen Hawking, the Nature Conservancy, and Ronald Reagan’s Secretary of Treasury and Chief of Staff have in common? All have signed on as founding members to the Climate Leadership Council, which has met with the White House to propose a revenue-neutral carbon tax policy.

The group started with impeccable conservative credentials, bringing on cabinet members from the last three Republican presidential administrations (Ronald Reagan, George HW Bush, and George W Bush): two former Secretaries of State, two former Secretaries of Treasury, and two former chairmen of the President’s Council of Economic Advisors. It was founded by Ted Halstead, who explained the group’s proposed policy in a TED talk:

Some of the world’s brightest scientific and economic minds have since become founding members, including Stephen Hawking, Steven Chu, Martin Feldstein, and Lawrence Summers. So have ExxonMobil, BP, and Shell. But it’s not just the oil industry joining the call for a carbon tax; GM, Proctor & Gamble, Pepsico, and Johnson & Johnson are among the major companies signing on. As have environmental groups like the Nature Conservancy.

Citizens’ Climate Lobby, republicEn, the Niskanen Center, and the Weather Channel are among the Climate Leadership Council’s strategic partners. It’s an impressively diverse and influential group. The proposed policy is similar to that of Citizens’ Climate Lobby, calling for a rising price on carbon pollution with 100% of the revenue being returned to taxpayers via regular rebate checks. Research has shown that this policy would create jobs and stimulate the economywhile quickly and affordably reducing carbon pollution.

It should be a no-brainer for Republican policymakers. Over the past five months, they’ve exclusively pursued unpopular policies; particularly a health care bill with just 31% support that the GOP crafted in secret because party leaders thought it would be stupid to let Americans see their unpopular plan. As conservative columnist Ross Douthat put it:

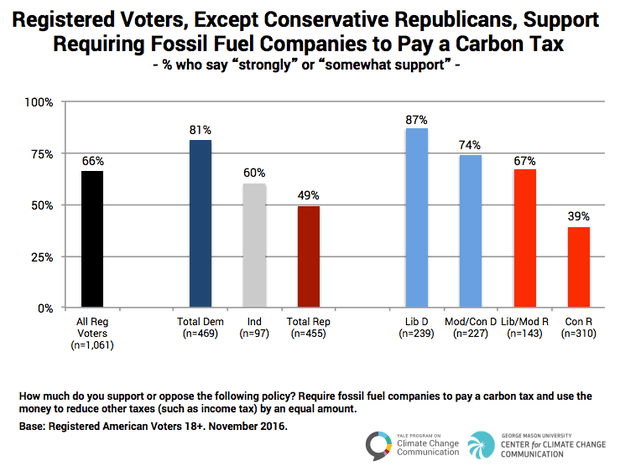

And climate policy is popular. Just 29% of Americans support Trump’s withdrawal from the Paris climate treaty while 46% oppose it, and 79% say the US government should address the climate problem. 75% of Americans support regulating or taxing carbon pollution, including 62% of Trump voters. About half of Republicans support a revenue-neutral carbon tax.

Survey results showing partisan support for a revenue-neutral carbon tax. Illustration: Yale and George Mason Universities

Moreover the American government is legally required to establish regulations or policies to cut carbon pollution. The Trump administration has acted to unwind all of President Obama’s climate policies, but Republicans will eventually lose that battle in court. Inaction is simply not an option – it’s against the law – and so the GOP should be looking for the most palatable policy solution. That’s a small government, free market, revenue-neutral carbon tax.

However, the most conservative voters (i.e. the Republican base) have the lowest support for this (or any) proposed climate policy. And the Koch brothers and their vast network of allies – who have essentially bought many Republican policymakers through political donations – squarely oppose all climate policies. Those two factors likely explain why 22 oil-funded Republican senators encouraged Trump to withdraw from the Paris climate treaty, while very few of the party’s politicians objected to that stupid, historically irresponsible move. Instead of looking for solutions to the existential climate threat we face, they’re stuck in denial.

There are glimmers of hope within the Republican Party. In addition to the conservative elder statesmen, thought leaders, and oil companies joining the Climate Leadership Council, 21 House Republicans have joined 21 Democrats on the rapidly growing bipartisan Climate Solutions Caucus. But while they represent the preferences of the majority of Republican voters, among GOP members of congress, they’re still in the vast minority.

The current party leaders are also a lost cause. Trump stupidly withdrew from Paris at the urging of Mitch McConnell, and cabinet members like Ryan Zinke and Rick Perry have recently made headlines for their blatant denial of long-established climate science. The GOP’s forward-thinking climate realist policymakers won’t outnumber its science-denying, coal-loving, faux-masculine political leaders anytime soon. The only way the party will join us in the 21st century is if American voters make the 2018 and 2020 elections a climate referendum.

Arguments

Arguments

There are two major problems with a revenue-neutral carbon tax

1: It only addresses about half the problem, as other climate-related pollutants are ignored and substantial amounts of carbon emissions come from non-point-sources such as land use, animal husbandry, or forestry practices that cannot be addressed easily by a carbon tax.

2: The government will need tens of billions of dollars a year if not more to pay for the related infrastructure, R&D, enforcement, and regulations that will be necessary to tackle this problem. Where would this come from, if not the carbon tax?

Such a plan could be a devil's bargain, where by tackling one half the problem, we make the other half unsolvable.

Carbon taxes have worked quite well in British Columbia as below. They have reduced emissions and fossil fuel use, and ironically because it was set up as revenue neutral, people now have low income tax rates. I wouldn't claim its all perfect, but it is proof of basic viability and potential, and shows the predicted negative problems haven't happened.

www.theglobeandmail.com/opinion/the-insidious-truth-about-bcs-carbon-tax-it-works/article19512237/

www.sightline.org/2014/03/11/all-you-need-to-know-about-bcs-carbon-tax-shift-in-five-charts/?gclid=CKOV7JPm1NQCFYYIKgodX84Fzg

Not only do carbon taxes incentivise people to reduce carbon use, they provide an income stream that can be given back to the public, or used to subsidise electric cars, or subsidise renewable energy or some combination of these. This seems to make total sense to me in a practical sense.

In my opinion, carbon taxes are transparent and upfront costs with a clear price on carbon underpinning the concept, where cap and trade schemes are harder to comprehend and appear less upfront. A revenue neutral tax overcomes most of the ideological criticisms directed at taxation. We know from history and economic analysis that taxes can influence rates of consumption of products.

Carbon taxes are flexible, and can be combined with government regulation regarding large emitters.

But to be effective carbon taxes do need to set quite a high price on carbon that will raise petrol prices very significantly, so its important that renewable energy alternatives and electric cars and hybrids are made attractive options. The two things must be combined.

Alternatively you can force companies to keep fossil fuels in the ground by simple government regulation. This is simple and almost ideal, but it's unlikely to win industry, political, or public approval and may be perceived as harsh and excessive use of state power. It would be hard on consumers as well.

The other alternative is an emissions trading scheme, sometimes called cap and trade. This is one of those mechanisms that makes total sense confined to a textbook, but I think it has problems when implemented in the real world. For example the scheme in Europe has been only minimally effective, and the whole scheme looks easy for governments and participants to manipulate and rort to me, because of its inherent nature. The public in my country are suspicious of the scheme as it looks like crony capitalism. This may be unfair, but the perception is there.

Cap and trade also looks suspiciously like a neoliberal free market dream, artfully structured to look good, but designed to achieve precisely nothing, but so complex that all this becomes well hidden. Poor results in Europe seem to bear this out.

Carbon taxes seem the best alternative overall.

Ogemaniac @ 1, yes a revenue neutral carbon tax is clearly insufficient as a stand alone scheme to fight climate change. But it doesn't have to be a stand alone scheme.

Firstly a similar tax scheme could be applied to methane emissions in theory, as a tax on animal products, or you could deal with methane emissions in other ways.

Secondly I would question whether a carbon tax should be completely revenue neutral. Part of the money could be given back to the public directly, or with income tax cuts, part could go into things like electric cars, and part could go into the administration costs of a carbon tax scheme anyway.

Thirdly and alternatively have a revenue neutral carbon tax, and the government could just subsidise renewable energy. This is not ideologically incompatible. There are also cases where subsidies make economic sense, because of recognised market failures.

I think we are faced with trying to develop the best possible overall package of measures that is ideologically acceptable but also practical, and we won't ever address all of these perfectly, but can do a reasonable job overall. We probably need a combination of taxes, some mild regulation and subsidies. There are no perfect ideologically pure and pain free options, but a carbon tax of some sort combined with measures to address methane etc and rebewable energy seems the best overall.

"Secondly I would question whether a carbon tax should be completely revenue neutral...."

In my humble opinion, having a scrupulously, exactly and demonstrably revenue neutral carbon tax is the one way it might suceed. Otherwise, the voter's already slim trust in Lucy...mm, goverment fixes... will go 'poof' and any future proposals from the same quarter will be met with rage. It's already at this point with many taxes; in the USA we have a "temporary" tax on telephone services which was to pay for the Vietnam war. That was about 50 years ago, the tax is still collected. Same for 'temporary' state tax hikes, they are all but permanent.

As for renewables, when the public's income tax is lower they have more to spend, sales of goods increases so business has more ability to invest. At least some will use that for electric delivery trucks, solar hot water, perhaps solar electric, etc. After low-carbon replacements demonstrate success - IF they succeed - then they'll be adopted in bulk. Something's better than nothing.

Personally, I think that as long as the world has 7 billion people, nearly all of whom want refrigeration, TV, cars and meat, we're going to have a degraded environment. You're not going to change the fact that 99% of humanity wants more, not less. If we got to 3 billion instead of 7, this and other issues could be tackled with ease. This is politically a non-starter, of course.

Ogemaniac @1, first, carbon taxes are normally designed to tax CO2eq emissions, and consequently do not ignore emissions other than CO2. Further, given a sufficiently large carbon tax, industry will itself pay for the necessary infrastructure, etc. At least it will if given sufficient time to adapt. The major problem with a carbon tax, other coordination between separate economies, is that as the time span to convert to a carbon free economy contracts, carbon taxes become more and more inefficient. At some point they become less efficient than regulations, but it is certainly not clear that we are at that point yet.

Always read the fine print...

"Buried in pages of supposedly 'free market' solutions is new regulation exempting polluters from facing legal consequences for their role in fueling climate change."

Climate Groups: Don't Be Fooled, Industry-Backed Carbon Tax Just Latest Scam by John Queally, Common Dreams, June 20, 2017

There are a number of concerns to be aware of. There are the many ways of behaving that people who have previously Won by getting away with behaving understandably less acceptably than others (to get the competitive advantage that doing so provides to those who get away with it) are likely to try to get away with regarding this measure:

An internationally applied revenue neutral tax-rebate program could indeed be a good measure to help change the attitudes of people who have not willingly decided to best understand how they can help advance humanity to a sustainable better future as a robust diversity of humanity that fits into a robust regional diversity of other life on this, or any other, amazing planet. But rigorous effort is required to keep those who care less about helping improve the future for all of humanity from being able to believe and do as they wish.

A revenue-neutral carbon tax will "help" make marketplace competition more helpful at achieving the 2015 Sustainable Development Goals. But as Tom Curtis points out, the need is to end the human activities that are causing increased GHGs will require other measures.

Additional measures will be needed to compensate people who did not benefit from contributing to the problem (the 'loss and damage' compensation owed by the current generations in nations that had previously 'benefited from activity that increased the current problem').

It needs to be understood that since the 1972 Stockholm Conference no business or government leader/winner (including investors) can claim to not be aware of the unacceptability of trying to expand or prolong their ability to benefit from activity that increased the GHGs. As John Hartz points out, the cheaters are now trying to get 'legal immunity from penalty' by claiming to support carbon-taxes 'if and only if they will be free from potential penalty for the understandably unacceptable things they got away with benefiting from'.

Driving By @7, yes you are probably right. A telephone tax going back to the Vietnam war. Thats astounding!

I accept only a revenue neutral style of carbon tax is likely to gain traction in America, where there is a strong suspicion of taxes, and a lot of ideological and partisan contoversy on the issue. I was thinking about the issue more from the perpective of what might work in my country. It's all about the art of what is politically possible, sadly to say, and thats how democracy works.

However a revenue neutral carbon tax is without doubt a tremendously good concept on several levels and a viable way forwards out of this mess. You could still deal with other issues in other ways. You could subsidise renewable energy and electric cars, and this has justification in orthodox economic theory, and it could be done out of the existing tax base / government revenue by some small re-prioritising spending, so it could also be revenue neutral if required.

A carbon tax is a good base to build on. Project specific taxes and subsidies can also have time limit clauses in legislation so that they dont get cemented in forever, and need to be renewed by a vote in government of some sort.

Tom Curtis @5, yes true enough a carbon tax may only work up to a certain limit, but then we have other alternatives. I believe its better to do something than nothing, and to start with the most workable and politically plausible solution, even though its not what I personally ideally prefer. I prefer the best technical or theoretical solution, which is sometimes the simplest as well, and zooming straight to that, but sadly politics gets in the way.

I'm also reminded of tobacco taxes. In my country have seen these contribute strongly to a drop in smoking rates from 40% to 15%, which shows the powerful effect of taxes. However getting rates to fall from 20% to 15% required quite significant taxes and things seem to have reached a plateu. A sort of law of diminishing returns has been generated, I assume this is because of we are left with people very highly addicted and / or financially well off.

But "e cigarettes" have been legalised, and may make a difference. There are always alternatives and if smoking gets down to under 10% that may be sufficient anyway as the taxes pay for health costs.

However the tobacco issue isonly a rough anaology to fossil fuels, and even a moderate tax may have larger effects than we think provided renewable energy is attractive. Plus its important to get fossil fuel use as close to zero as possible.

As Dana says in his article, "The proposed policy is similar to that of Citizens’ Climate Lobby, calling for a rising price on carbon pollution with 100% of the revenue being returned to taxpayers via regular rebate checks." I recommend that all readers go to the Citizens' Climate Lobby (CCL) web site and read the information about their "carbon fee and dividend" plan. Nearly every one of the concerns raised in the above discussion is clearly and constructively addressed by CCL. I further recommend that those of you who have not yet done so click on the big red "Join CCL" button at the top right of their main web pages.

The economy is a complex system with multiple interdependencies and feedbacks (in this respect it is much like the climate system).

It often happens that scientists look at a system in a far too reductionistic way – I think it stems from the laboratorium conditions, where it is actually possible to vary one parameter in function of one other parameter and keep all the other parameters constant. In the real world, this isn’t possible. A influences B influences C influences A again … etc.

And this reductionistic vision has resulted in big mistakes before. Take biofuel. Biofuel was supposedly better than fossil fuels because it is carbon-neutral. Except that biofuels go in competition with food crops, lead to deforestation, and several studies have even indicated that biofuels might actually be worse for the climate than fossil fuels.

Another example is the idea that natural gas can be a transition technology towards a low carbon future. It turns out the amount of methane escaping from fracking sites makes natural gas as bad as coal.

In a complex system, you have got to choose carefully WHERE to interact with the system. If you don’t take all interdependencies and feedbacks into account the result of your action may be different from what you anticipated, it may even be the opposite of what you anticipated.

This is the major reason why I am in favor of a carbon tax. It interacts with the system where it matters: at the point where CO2 (or other greenhouse gases) is released into the atmosphere.

All other measures, for instance improving energy efficiency, or encouraging the deployment of renewable energy are indirect attempts at reducing greenhouse gas emissions. They may have the hoped result. Or they may have the opposite result.

When energy efficiency is improved, households will spend less money on energy, and hence will have more money in the bank … which they may decide to spend on a holiday by plane …

When renewable energy is deployed on a massive scale, this may give a boost to the worldwide economy … resulting in a higher demand for fossil fuels.

I am not against these indirect measures, but they should be combined with a carbon tax. The carbon tax forces the consumption of fossil fuels down. Other measures make it possible to maintain our living standard while transferring to the low carbon economy.

bvangerven @12, I agree the economy is complex, and there can be unintended consequences in various emissions reduction strategies, or negative side effects.

Of course as you would appear to agree this is not a reason to do nothing or try nothing, and we have to simply try to think the issues through as much as we can, and minimise problems through classic harm minimisation strategies, and also accept some "experiments" may not work. That is the price we may for making any form of progress. Given the way renewable energy is plumetting in price, many of these "experiments" have been a spectacular success.

However I agree biofuels have had unintended consequences. I thought they were a dubious idea this from day one, instinctively. I also understand the use of corn or maize for biofuels was driven more from political and farm lobby motives than to reduce climate change, so if the motives are dubious then it's likely the results will be of dubious value as well. However it was possibly still an experiment worth trying, and something viable may come from other forms of biofuels.

However I'm going to disagree in part about your comments on carbon taxes and renewable energy. Even carbon taxes could have unintended consequences or some problems. For example a revenue neutral tax will give money back to people one way or the other, and there's nothing to stop some being spent on fossil fuel products, negating some of the effect of the tax. However both the theoretical modelling and real world evidence suggests much is not spent on petrol, as use of petrol has declined in countries trying these taxes. So the bottom line is a carbon tax is not going to be perfect, but is a very good idea that still ticks all the boxes.

Regarding renewable energy you say "When renewable energy is deployed on a massive scale, this may give a boost to the worldwide economy … resulting in a higher demand for fossil fuels."

That would only happen if renewable energy was developed and spread widely and was very affordable, and there was no carbon tax or other control on fossil fuels. Nobody is suggesting that scenario. If renewable energy becomes cheap, and a huge general boost for the economy, and fossil fules are taxed, demand for fossil fuels will be pretty low.

And it is absolutely senseless having a carbon tax on fossil fuels, if there is no viable alternative, like renewable energy, so this fuel source must be encouraged. A carbon tax will partly do this by making it more attractive to purchase, however I don't think a carbon tax would go far enough to do this, and you also need to subsidise renewable energy to some extent (which happens right now anyway). Or it may be a case of just needing to subsidise things like recharging stations.

I agree the bottom line is the best solution is a carbon tax combined with indirect measures.

@nigelj,

I don’t think we disagree. I just want to make the point that we should be skeptical about climate policies. In my opinion a climate policy should be engineered, it should be modelled like a climate model to identify all expected and unexpected consequences.

We don’t have much time left, and we only have one opportunity to get it right. If after a couple of decades it turns out we implemented the wrong policy (also the EU ETS comes to mind) we won’t have a second chance.

Regarding my statement that renewable energy may well cause an increase in demand for fossil fuels, you say: "That would only happen if renewable energy was developed and spread widely and was very affordable, and there was no carbon tax or other control on fossil fuels. Nobody is suggesting that scenario."

But … that scenario is the reality is many countries. There are many countries – that signed the Paris agreement ! - that don’t have any policy to discourage the use of fossil fuels, they are just focussing on improving energy efficiency and the deployment of renewable energy.

I just don’t believe you can drive the consumption of fossil fuels to zero that way. It’s the same as trying to stop people drinking coffee by putting tea on the market. People won’t stop drinking coffee. In the best case they’ll drink a little less coffee.

Or to put it another way: there are policies that shift the system’s stable equilibrium point to a low-carbon state. A carbon tax that is high enough does this. An emission trading scheme may perhaps achieve the same results – if it is well designed, and the cap is really a cap, and measures are taken to avoid carbon leakage. But an emission trading scheme is much more complex and hence it’s effect is much more difficult to assess.

And there are other policies that don’t shift the system’s equilibrium point, but these measures will help us to reach the equilibrium point faster and with less disruptions (f.i. improving energy efficiency and rolling out renewable energy).

These two kinds of policies should not be confused. And the second kind cannot replace the first kind.

Bvangerven @14, thank's for clarifying that. I totally agree, particularly your comments on some countries relying on encouraging renewable energy as the only real strategy, and hoping this would drive emissions down, and your coffee / tea analogy. This wont really work well enough. I really just meant it's absurd that they are going down that road, as nobody with any sense should be promoting that.

The obvious example is America. I think it has had only very modest results looking at the numbers, and has mainly lead to emissions reductions for electricity generation, but not much uptake of electric cars or things like that.

But go one stage further to Germany. They have mostly relied on cap and trade combined with subsidising wind power etc. This has again reduced emissions from coal fired power (sadly somewhat reversed due to the nuclear issue), but this combination has not been enough to cause much uptake of electric cars. It becomes clear they need specific subsidies for electrtic cars, or maybe it requires a state funded recharging network.

In other words it is fairly clear that subsidies alone are helpful but insufficient, but also that carbon taxes (or cap and trade) alone are useful but insufficient as well. Further even both together only go so far and development of electric transportation needs some form of initial support as well (and it may not require much, this is the important thing). So you need a combinational approach that deals with discouraging fossil fuel use and all elements of renewable energy.

Yes an emissions trading scheme is complex, but a carbon tax will have some complexity, although not quite as much. The biggest problems with emissions trading are that they are opaque schemes where its very hard to get to the bottom of whats going on (and I have tried), perhaps so called commercial sensitivity is part of this. They also rely on globally traded agreements and forestry units, that come form all sorts of countries, and many of these countries dont have terribly reliable or trustworthy commercial practices. By the time we figure outs whats going on the damage is done, and my country has had a specific problem of this kind with imported credits that turned out to be worthless, admitted by our government.

Emissions trading schemes have a form of accounting that also looks to me to be very open to all sorts of abuses. In addition Europe has allowed all sorts of exemptions under their scheme to keep industry competitive against imorted products, but the end result has been a weak scheme. But you probably know all this anyway and, I have only scratched the surface.

In comparison carbon taxes are a pretty visible sort of cost and any exemptions would appear tobe more visible or harder to hide, a benefit of such a scheme. You have less commercial sensitivity problems, or difficult to access contracts with dubious conditions attached.

Emissions tarding schemes do have the virtue of encouraging innovation, but I think more in theory than in practice. And any form of tax or regulation can encourage innovation to at least some extent.

Encouraging energy efficiency is just so obviously desirable. A "no brainer".

The problem is some people want a singular magic answer. People who promote cap and trade see this as the only thing needed. This just isn't convincing.

We need a strategy that combines a number of tools. As I stated above, the most viable and politically plausible is a revenue neutral carbon tax combined with lightly subsidising some aspects of renewable energy and electric cars ( and transport in general), and rules around energy efficiency. This brings all elements close together, and closes the gap. The whole package could be revenue neutral or close to it, if required.

Ultimately a carbon tax may reach its own limits of effectiveness, but that is far off and can be dealt with if it happens.