Will Fossil Fuel Prices Fully Recover?

Posted on 4 March 2016 by Riduna

World market prices for coal have slumped and for months languished at around US$ 45/tonne, compared to US$95/tonne in February, 2014. Over the last 2 years, coal prices have more than halved and fallen almost every month.

For weeks, crude oil prices have been around US$ 30-33/barrel, sometimes falling as low as $26/barrel. Some forecasters (Goldman Sachs) predict that oil prices could stay low and do so for longer than predicted.

Some question if fossil fuel prices will ever recover given the emergence of disruptive technologies making electricity generation from renewable sources increasingly competitive with fossil fuels, even at their present depressed prices. Others point to agreement by OPEC to reduce production in order to stimulate price. However, that agreement has only been reached by 3 OPEC members (Saudi Arabia, Qatar and Venezuela) and Russia - then only when confronted by Iranian production coming on to the world market, following the lifting of international sanctions. It is seen by some as an ineffectual move to restore oil prices, since the agreement is not to exceed record high January pumping levels.

Far more certain is that the present price malaise is a taste of the state of things to come for those who have invested in the shares of fossil fuel producers. Without sustained price recovery, the value of shares in some fossil fuel companies will decline and could eventually wind-up as stranded assets of little or no value. Evidence of this is seen in closure of coal mines and the unsustainable position of oil and gas producers using older technology where cost of pumping oil and gas is close to or below its market value.

The Future of Oil

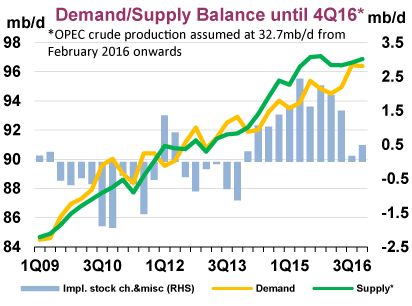

Fig 1. IEA Estimates of global supply (green) and demand (yellow) for crude oil with surplus production (Rt hand scale) held in store (blue). Estimates assume effective OPEC action to limit supply, yet be evidenced, which could see oil price recover to around $105/bbl. Source: IEA

Fig 1. IEA Estimates of global supply (green) and demand (yellow) for crude oil with surplus production (Rt hand scale) held in store (blue). Estimates assume effective OPEC action to limit supply, yet be evidenced, which could see oil price recover to around $105/bbl. Source: IEA

The present price fall for crude oil has been largely brought about by the decision of major producers to increase production to maintain income when faced with reduced demand for imported oil by China and Japan (economic slow down) and the USA (higher domestic production). The latter arises from advances in drilling and fracking technology, reducing drilling costs and vastly increasing production of gas and condensates from shale deposits and, to a lesser extent, oil.

The future for hydrocarbon producers is made more uncertain by a structural change in demand for oil products, particularly diesel and petrol. This is due to advances in battery technology, resulting in battery prices falling and increased capacity to store electricity. The result is that the range of electric cars is rapidly rising while their cost is falling. Within the next 2 years it is likely that electric cars could be selling for US$20,000 - $30,000 and have a range of 300-500 km. Competition among major car builders will ensure selling price decreases and performance improves.

Goldman Sachs analysts predict that by 2025, almost 22% of all cars in use world-wide will be propelled by electricity rather than hydrocarbons. Over the next ten years the number of electric cars is expected to increase from around 1 million to over 25 million per annum. This estimate may be conservative since it is based on improved performance criteria being achieved by 2020 (Exhibit 37) which have already been surpassed.

The result of this rapid growth in uptake of electric vehicles may well be a world-wide on-going decrease in demand for petrol and diesel. This fall in demand will be sustained and on-going. By around 2035, vehicles propelled by fossil fuels are likely to be curiosities rather than the norm, as will petrol pumps and the internal combustion engine. Thus within the next 20 years petrol and diesel will cease to be in demand for road vehicles and many off-road engines now in use.

In theory, OPEC members acting in unison, without any cheating on agreed production levels, could bring about a temporary price recovery. However, that recovery could not be sustained in the face of continuous erosion of demand for oil products due to the new economies of extracting hydrocarbons from shale and rapid adoption of electric vehicles.

The latter might be slowed by policies inimical to sale or use of electric vehicles but can not (and would not) be prevented in countries which are major consumers of road vehicles. Apart from cheaper running and operating costs, motors used in electric vehicles are over 3 times more efficient than the internal combustion engine and emit no greenhouse gases. The internal combustion engine is at best 25% efficient and a significant emitter of nitrogen oxides and particulates which are dangerous to health.

The Future of LNG

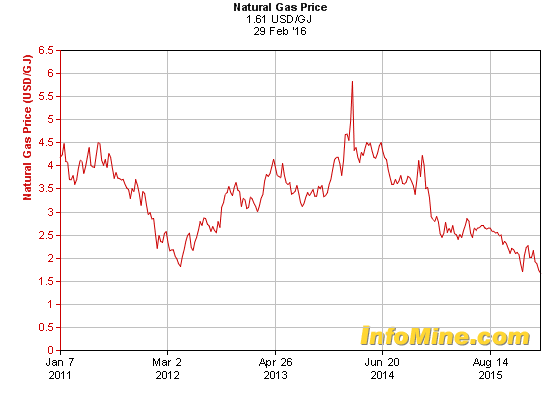

Fig. 2. LNG peak price, $5.83/GJ in 2013, arose from closure of Japan’s nuclear power stations and increasing demand from China/Europe. New technology has made USA a net exporter and China less dependent on imports, resulting in an LNG glut as new production comes on line resulting in a price collapse to $1.61/GJ.

Natural gas – largely methane – is found in coal beds, oil deposits (especially shales), other reservoirs and clathrates. Liquefied Natural Gas (LNG) is purified natural gas condensed to a liquid for ease of transport. It is widely used to meet domestic and industry energy needs and to a lesser extent for transport. LNG is largely produced from shale and sandstone deposits which are widely distributed around the world.

New technology enabling horizontal drilling and fracturing (fracking) has vastly increased gas production in countries with large shale deposits, notably Canada, USA, Australia and many others

The USA, once a major LNG importer, is now largely self-sufficient and is presently a net exporter. Japan, another major importer, has begun selling surplus LNG stock as it re-opens its nuclear power plants, adding to the LNG glut in the short-term. Into this glut 4 major Australian LNG projects (costing $118 billion) will come on line in 2016-17, mitigating against medium term LNG price recovery, lowering target return on investment and reducing its contribution to public revenue.

Demand for product has fallen at the same time as capacity to produce has increased. The result has been a dramatic collapse in the price of LNG.

This collapse could result in more extensive use of LNG and increase demand resulting in price recovery. This may occur in the longer-term but over the next 10 years this seems unlikely because existing and emerging suppliers (Iran) are likely to adopt new drilling technology, as China is doing, increasing self-sufficiency and prolonging present global LNG over-production.

LNG must compete with other energy forms, notably solar energy which over the coming decade is likely to become price competitive, reducing the need for LNG imports and expensive cryogenic storage and infrastructure. Burning LNG produces CO2 and commitments made under the Paris Agreement may discourage its use where competitive renewable energy is available. The prospect for longer term LNG price recovery to levels seen in 2013 seems unlikely.

If the LNG industry were confident of its longer-term future, it would now be investing in costly processing and storage facilities but this is not the case. Deferral or cancellation of major investment in new LNG processing plants in Canada, the USA and Norway have occurred recently.

The Future of Coal

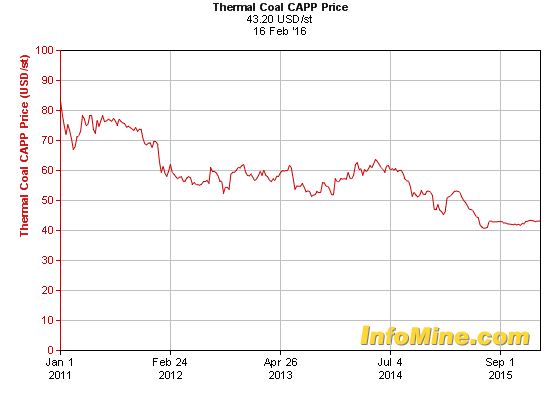

Fig 3. World price for thermal coal has fallen below $50/tonne since July 2015 forcing Anglo-American, Glencore and others to close small to medium coal mines. Only larger mines continue to operate profitably.

Fig 3. World price for thermal coal has fallen below $50/tonne since July 2015 forcing Anglo-American, Glencore and others to close small to medium coal mines. Only larger mines continue to operate profitably.

Prima facie, transition towards wide use of electric motors in road vehicles should mean a rapid increase in demand for electricity since the batteries of electric vehicles must be repeatedly re-charged. This should result in greater demand for coal from power stations, forcing a rise in price from the present low of $43/tonne – a price so low that smaller to medium sized coal mines have difficulty operating profitably.

This would be the case were it not for development of batteries able to propel vehicles over 1,000 km on a single charge. Those same batteries are now becoming available for storing electricity generated from photovoltaic cells (PVC’s) mounted on house roof-tops and a growing number of solar power stations. This enables dwellings to use auto-generated electricity after sunset and PVC solar power stations to supply electricity 24/7.

In 2015, the Tesla gigafactory was the largest producer of batteries for domestic and commercial electricity storage. However factories in Korea, China and Spain are now well established offereing competition in technology advances, battery characteristics and price. In 2016 this is resulting in consumers having a range of batteries and prices to choose from and enabling domestic dwellings to store and trade surplus electricity generated by PVC’s on their roofs.

In Australia, over 1,250,000 houses have PVC displays with capacity to generate 5 GW or 9% of Australia’s total electricity generation capacity. Many households will purchase batteries and sell electricity to the grid, to energy providers or to each other for domestic use, including recharging electric vehicle batteries. This will result in reduced demand for electricity generated by coal fired power stations, reducing demand for coal.

Demand for coal to generate electricity and for metal smelting will further reduce as solar powered utilities, using increasingly efficient technology, continue to be established – a process well underway in North America, Europe and North East Asia. Use of coal could be further reduced with reform of building regulations to mandate installation of PVC arrays and solar hot water systems on new dwellings and increased oil production as new mining technology becomes more widely used.

Inability of coal prices to recover is exacerbated by emerging disruptive technologies which have already resulted in doubling the efficiency with which PVC’s convert sunlight into electricity. The latter are likely to become commercially available before 2020, further reducing cost of solar generation and increasing surplus electricity available for recharging electric vehicle batteries. Battery technology is also making advances, particularly through use of Graphene in cathodes and PVC’s. This promises to significantly increase solar generation, storage capacity and durability, while reducing cost of storing energy.

These developments, the more efficient use of electricity and the Paris Agreement on reduction of greenhouse gasses increase the speed of transition from coal to solar generated electricity and mitigate against longer term price recovery for coal. In the short term some price recovery may occur but is likely to be short lived as use of solar energy increases.

Conslusion

Coal use for electricity generation is becoming uncompetitive with solar energy because new technologies make solar electricity generation and storage increasingly cost-efficient. Coal is in the invidious position of having to compete against a free product – solar energy.

Due to adoption of new technologies, the world is currently awash with hydrocarbons, making their price so low that the cost of finance needed for new exploration has become difficult to obtain. OPEC Members have agreed not to exceed present production levels but not to reduce them.

This mitigates against sustained recovery of fossil fuel prices in the short-term. In the medium term, demand for fossil fuels, particularly oil and LNG, are unlikely to increase because advances in battery technology make it possible to store solar generated electricity, ensuring 24/7 availability and increasing the rate of electric vehicle uptake.

The transition to electric vehicles and greater use and demand for non emitting solar power generation indicate on going decline in demand and price of all fossil fuels in the longer term.

This tends to substantiate warnings in the finance industry that existing investments in the fossil fuel industry could become stranded assets with the cost of future investment rising as predicted demand for fossil fuels becomes less certain.

Will fossil fuel prices fully recover? In the short term, its possible but recovery is unlikely to be sustained. In the longer term, price recovery is much less likely.

Arguments

Arguments

"Demand for [natural gas] has fallen at the same time as capacity to produce has increased. The result has been a dramatic collapse in the price of LNG."

No. not in the slightest.

Demand is still growing, it's just that supply has been growing much faster over the past few years. So now there's far more gas entering the market than there is demand for it.

That's why LNG prices have crashed, not because demand has fallen.

Oh, and importantly, the price of LNG used to be linked to oil prices in Asia in what they used to call the Japanese crude cocktail. But, with the big drop in oil prices, that price support is gone as well.

So, there are lots of reasons why LNG prices have fallen and it isn't because of declining demand.

So, I've gone and looked and, contrary to what i believed, demand actually fell 2% in 2015, which surprises me (Asian demand was falling, but European imports doubled). So you're right about that.

But, still, the big driver in the fall in prices is the big growth in supply and the drop in oil prices. Even if demand had been flat, or even slightly growing, it still wouldn't have been able to keep up with the growth in supply.

Sorry, a lower FF price does not encourage me. The driving force for energy users to move off of FF only gets less attractive as the cost of FF drops. I would rather see a rise in FF price and, at the same time, a drop in sales. If this were the case, then this would be true evidence that economic incentives were truly moving in the right direction to eradicate FF usage.

The metric that is missing here is demand and not just by each individual energy type but total demand presented as CO2 produced by all FF combustion (i.e. coal may be going down, but is gas simply taking its place). Until the CO2 generation metric actually starts to drop, we are only eluding ourselves that man is actually getting off FF's. This metric is, in the end, all that matters.

My worry is that as FF prices drop (w/ little economic incentive to actually quit using them), renewable energies will simply be "added on" to man's array of energies. As a result, man will only invent new & more ways to use yet more energy (per person), resulting in still using all of the FF energy he was previously using PLUS the additional renewable energy. This has been man's trend as new a different & lower cost energy options have come economically available (he just consumes more & more).

For me, the only truly effective means to really get the job done is CFD (carbon fee & dividend). We have got to price FF's to include true costs (which include future costs). ... Please join CCL (Citizen's Climate Lobby); I believe it is the main activist group that has Fee & Dividend legislation as its primary goal. Click on link to became a member & join a local chapter today!!!

Miguelito - Japan and USA were both significant LNG importers in 2014 but are now exporters and in 2015 China’s consumption of LNG fell by 1.1%. So no surprise that global consumption of LNG fell in 2015 or that this added to a market already awash with hydrocarbons. This is now being aggravated by new LNG production facilities in Australia and Qatar starting production in 2016. In the absence of increased demand, this addition to the LNG glut is likely to prolong depressed prices. Over the next decade, LNG will have to compete with solar generated electricity, likely to be delivered and stored more cheaply than LNG. Customers will opt for the cheapest form of energy available. That is likely to be clean solar generated electricity rather than CO2 emitting LNG.

Sauerj - You raise the point that persistently low prices for fossil fuels would result in their wider use, higher greenhouse gas emissions and delay use of solar to generate clean energy.

This would be the case were it not for the fact that solar energy is relatively cost-free. Its use is presently limited by the efficiency and cost of available technology to use solar energy to generate and store electricity – rather than the cost of fossil fuels. At $50/tonne or less smaller and less efficient coal mines cease production and at less than $30/bbl it is not profitable to pump oil - but the sun continues to shine, delivering energy everywhere.

Advances in photvoltaic cell efficiency is rapidly approaching a point where the cost of solar generated electricity is less than use of coal or oil, even at their present depressed prices. Battery and other technology enable production of electric vehicles which are increasingly competitive with vehicles fuelled by fossil fuels, both in terms of performance and cost. If you had $25,000 and could choose between an EV, range 500k per charge, and a fossil fuelled vehicle, which would you choose? Most business and vehicle owners do not care where their energy needs come from or how it is produced – as long as it is the cheapest available and reliable. They will abandon fossil fuelled energy for solar as the latter becomes increasingly competitive due to technological advances. Those advances are now being made with growing momentum and will result in wider demand for and use of electricity – not fossil fuels.

Riduna, I live in midwest US, the heart of a country that "doesn't have a clue", the "joke of the world" (increasingly so these last couple months).

I am not trying to be a troll or argue against you; I am just being a sad-hearted realist. 1) You mention that solar is 'cost free'. Yes, operating cost is free (unless you have to pay for backup power, likely in US); but capital cost is hardly free (and capital cost is the big deal here, required to get us over the 'conversion' hump). A PV conversion will cost me $10k-$15k installed (link). Even if that were to drop to $5k (there will be too many other installation/labor costs to fall below that), the average US clueless thug would never even consider such a move if the price of FF grid power stays low (my assumption based on the impetus of this article). 2) EV's: Even a CO2 aware guy like me is still going to likely buy a low priced, used small gas car ($15k) versus an EV ($35k in 2017); I simply can not afford to justify the difference. And, I can guarantee you that the average US thug will go buy a Hummer with gas still at $1.50/gal and not even consider an EV.

I am in full agreement that FF's need to go (not trying to be a troll here); I just know people in the US, and I know that as long as FF's are cheap they will use all they can afford plus, in addition, use all the renewable energy they can afford (as they become cheaper). That's my point here; people will just add on more energy usage if it is cheap. In other words, they will consume even more energy per person than they are consuming now, with still a very large chunk of that being FF's. They will buy more gadgits and more useless crap until they have drained all their finances; and cheap FF's will only feed that insatiable consumption.

I remain very skeptical that things are going to get any better (any significant drop in CO2 generation) until FF's are priced to include future costs (CFD). ... Trust me, I do hope that I am wrong, very wrong! But, I really doubt it! I just know the typical, average US mind, and it isn't even close to understanding or caring! It knows just one thing: consume! Just look at the average electorate; need I say more! ... Peace brother!

The average inflation adjusted oil price for the last 100 years or so is about $40/bbl. Oil prices are rising now and will likely be above $40 by the end of the year. maybe in a few years they will be back up to $80.

i don't think renewables will have any effect given the speculation and geopolitics that are involved.

COP 21 was a joke and there is basically no to little support for drastically cutting fossil fuel consumption in this country. besides bernie, who will most certainly not win the election, nobody running for POTUS cares.

sauer, I totally agree with you. CO2 pollution is a classic example of Tragedy of the Commons, which is a free market failure. Players on such a failed market will continue to pollute without a price correction (e.g. fee & divident) and/or env regulations.

Taking other examples of Tragedy of the Commons from history: whales would have been hunted to extinction if they were not protected, acid rains would still be falling if filtering regulations were not imposed, ozone would have been destroyed if CFC were not banned.

There is no reason to believe CO2 pollution is any different: if anything, it is a worse TOC than the examples I quoted above because it is more widespread and necessary byproduct of virtually every economy today. A free market, especially US-style, can only aggravate such TOC problem, therefore the failed market must be corrected, at least until a transformed economy renders the pollutant obsolete (we are far far away from that in case of FF). Possibly longer: even today, whale hunting must remain under strict control, otherwise they would be hunted to extinction just for sport. I concur that american thugs would make sure FF burnout continues "just for fun", even if solar was abundant & available for free. That's because FF burning can be more "spectacular" than renewables, by thje same token eg. ferrari turbo engine is more spectacular than electric motor. Strict regulations must keep the desires of such thugs curbed if we want to control CO2 pollution.

Russia is not a OPEC member

Ask yourself: what is Jevons Paradox?

This is a regulated markets failure!! The free-market ideal is exactly that: an idea that exists only within your head. Year 11 economics dictates that all government intervention into the market place makes that government intervention more difficult to withdraw when it finally realises that the wrong winner had been picked.

This is because the mixed market economy has evolved around that previous intervention, making the hypothetical invisible-hand of market forces inefficient.

If markets aren't regulated then its pirate ship diplomacy aka anarchy!

Go the witches wand of Hollywood. By that I mean that: we are all asleep at the wheel and had kids for no reason!!

jsousa36

You are quite right but Russia has agreed with Saudi Arabia to limit its oil pumping to no more than the (record) level it was pumping in January 2016. Text has been amended to show this.

bozzza@12,

What point are you trying to argue in this article or its comment thread?

Jevons_paradox

And later:

Whilst, in the article, Riduna is trying to point out that FF can be made redundant/displaced by a competing technology (renewables). There is no mention of increased efficiency of coal use that your argument of Jevons would apply. No such topic in any comment either. Unless you clarify how you relate your argument of Jevons to the topic at hand, I conclude your comment is an irrelevant rambling with no substance.

You can't say my remarks are irrelevant when you take sentences out of context and indeed capitalise words that were half way through said sentence as if it were the start of a sentence. Then you missed the full-stop to complete the faux pas!

Saying all that you were right: I was ranting and just asking people to read up on the Jevons Paradox... a controversial little article now you got me to read a little bit more of it.

As noted in the article, fossil fuels can, to some extent, substitute for each other. The on-going natural gas (methane) glut is expected to result in depressed prices for years to come. This could result in prolonged low price of coal, particularly for electricity generation, resulting in closure of less efficient smaller coal mines.

As an interim measure electricity generators may convert from coal to gas before converting from fossil fuels to renewables – or going out of business as solar develops into a 24/7 reliable and cheaper, source of energy.