Citizens’ Climate Lobby - Pushing for a price on carbon globally

Posted on 12 May 2017 by BaerbelW

This blog post provides an update to Dana Nuccitelli’s article from June 2013 about Citizens’ Climate Lobby (CCL) as a lot has happened in the almost four years since it was published.The basics about CCL as explained in Dana’s post haven’t changed and because of that won’t be repeated here.

In 2013, CCL had been active mostly in the U.S. and Canada and the rest of the world didn’t yet play much of a role as shown in this snippet from Dana’s article:

“CCL is also exploring the possibility of launching some UK chapters. Although the UK is part of the European carbon cap and trade system, that system is experiencing difficulties, and CCL aims to maintain UK support for carbon pricing.”

Worldwide presence and impressive number

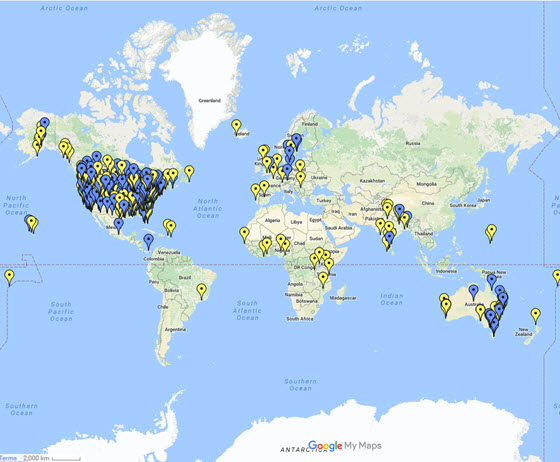

But, as this current map illustrates, CCL has by now gone global and has chapters on all continents except Antarctica:

Blue pins designate active chapters and yellow pins show chapters in development. Link to live map

The following video is a snippet from last year’s CCL conference in Washington D.C. and gives a glimpse of why people from around the world are joining this effort to get a meaningful price on carbon:

And it’s not just the number and locations of chapters! CCL has grown in leaps and bounds since Dana published his article in 2013. Here are some numbers to illustrate this point:

- In 2013 about 375 people had joined the 4th annual conference. There’ll be more than 1,200 in this year’s conference (the 8th), happening in Washington D.C. from June 11 to 13, 2017

- There were 711 citizen-led meetings with Congress in 2013, compared to 1,390 in 2016

- 6,991 letters to Congress were written in 2014 vs. 40,195 in 2016

- Published media went from 1,670 in 2013 to 2,918 in 2016

- The number of CCL volunteers rose from a couple of hundred in 2013 to 58,000 in April 2017, with 18,000(!) joining since the election of Donald Trump as the 45th President of the United States (details of this amazing growth can be found here)

The group shots on Capitol Hill from the annual conference in Washington D.C. have become quite impressive:

Source: CCL homepage

Climate Solutions Caucus in the U.S.

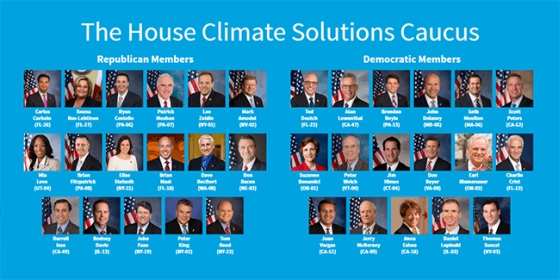

One achievement of CCL in the U.S. is the helping hand CCL volunteer Jay Butera gave to establish the Climate Solutions Caucus. It is a bipartisan group in the US House of Representatives which will explore policy options that address the impacts, causes, and challenges of our changing climate. The caucus was founded in February of 2016 by two south-Florida representatives Rep. Carlos Curbelo (R-FL) and Rep. Ted Deutch (D-FL) who now serve as co-chairs of the caucus (Read the back story of how this caucus came about). Recently the number of caucus members has grown to 38 - at the end of March 2017 the number was 34 who are pictured here:

Source: CCL homepage

This caucus is a sign that bipartisan collaboration regarding climate change still seems to be possible in the U.S. even if the current administration’s main thrust is to deny the overwhelming scientific consensus on human-caused global warming. It however remains to be seen if this caucus will actually have an effect on how Congress votes on any contentious upcoming climate-related legislation.

Lobby days in Canberra, Australia

Just a few weeks ago, CCL in Australia organised Lobby Days in Canberra and met with more than 30 MPs. Here is a group shot - admittedly not quite the crowd as in D.C. – but just as committed a group assembled at the top of the marble stairs outside the parliament building (and if you look closely, you’ll spot fellow SkS team member Glenn Tamblyn among them):

Source: CCL Australia homepage

Developments in Europe and Germany

In Europe we currently have groups in Sweden (5 active, 1 in development), in the U.K. (1 active, 3 in development), in Germany (3 active, 2 in development), as well as 1 each in development in Portugal, Spain, Switzerland, France, The Netherlands, Poland and Serbia. To co-ordinate CCL work in Europe we have a weekly conference call to keep each other updated about happenings in each of our countries and to learn about new developments from across the globe. We are in regular contact with CCL’s Global Strategy director Joe Robertson who keeps us in the loop about activities in the U.S. and globally. Joe tries to join our weekly EU-wide calls whenever his time allows.

For my part, I first became involved with CCL in Germany when Dana e-introduced me to Nils Petermann in April 2014. Nils had brought the idea of CCL with him when he moved back from Washington D.C. to Germany a couple of years ago and was keen to find likeminded people to help spread the idea of carbon pricing in Germany and Europe. Since then, we’ve established three active chapters in Berlin, Munich and Hamburg and currently have some others still in development.

We organise a monthly video-call for CCL in Germany and we will meet for our 3rd annual conference in Berlin at the end of May. We have workshops planned for the weekend and have already scheduled about a dozen meetings with members of our German parliament, their staffers or some other relevant groups for May 29 and 30.

Here is a picture from our meeting in May 2016 taken in front of the German Reichstag, our parliament building in Berlin:

Credit: CCL Germany

Credit: CCL Germany

What makes Citizens’ Climate Lobby quite unique is that it gives people like “you and me” a chance to get actively involved with climate change legislation in our countries. It’s also not just about interacting directly with politicians to get them at the very least interested in putting an effective price on carbon emissions. We for example also practice how to effectively write letters to the editor (LTEs) which in turn have a much higher chance of getting published. This is a surprisingly good means to make ourselves heard as e.g. MPs do read those letters to get an idea of the topics which are of interest to their constituents.

Further information

For further information about the group, see CCL's About page, follow its local chapters on Facebook and the main group on Twitter, and consider attending its annual conference in Washington D.C. in June.

Arguments

Arguments

Is there a shred of evidence - a single shred - which shows that any carbon tax has been more effective than targeted subsidies at actually getting new RE infrastructure built?

Gingerbaker : surely the mechanisms of carbon tax and targeted subsidies are so very different, that in asking which is more "effective", you are trying to make an apples & oranges comparison. You would need to carefully define an agreed definition of "effective" — particularly in relation to short medium and long-term time scale. Additionally, the two approaches are not exclusive (and probably a good case could be made for using both together, to differing degrees at different locations around the world, according to physical circumstances and perhaps political/cultural circumstances as well).

There is a further difficulty, in that a competent carbon tax system has not had much of a trial so far : and thus it is premature to judge effectiveness. Common sense and general economist opinion both indicate that a carefully constructed carbon tax (with or without "dividend") would be reasonably efficacious — provided that it is politically "locked in" and gradually from a low base ramped up at a rate which is well-understood and gives private investors the full certainty they need in order to make their plans for construction of facilities (and phasing out of old plant).

Direct intervention with RE constructions gives the benefit of moving things faster, but needs to be well flagged/publicised to give private investors ample time to make their own best plans to integrate into the future national infrastructure.

Both approaches, used in parallel, seem most appropriate (don't you think?) .

"Both approaches, used in parallel, seem most appropriate (don't you think?)"

First of all, I do not think both approaches would be available. At least in the U.S., enormous political capital would need to be spent to pass a carbon tax, and I think it is nearly certain that RE subsidies would be on the chopping block as the Republican price for any agreement.

I don't think that is surprising - incredibly, it is difficult to find staunch supporters of subsidies now even on the environmentalist side. I am constantly amazed at the libertarian bent of people interested in this issue. Do they think we should not spend government's money to give preference to RE? They are obsessed with phasing out RE subsidies, are constantly comparing costs of RE vs fossil fuels as if Keynesian economic theory should inform us on this issue. There is a theology about the free market at work here, which is gobsmackingly obtuse imho considering what we know about political corruption and its track record re RE these past thirty years.

Yet, we do know a few things. We know that every single penny spent on a RE subsidy actually builds the only thing that we truly need to solve AGW - RE infrastructure built and deployed. We know that with any of the zillion proposed carbon tax schema, there is zero guarantee that a dime will be spent actually building that infrastructure. We know from years of past experience with carbon taxes in place around the world, that, for the most part, they have been huge failures and do not result in new RE being built any faster than in places where there are not any carbon taxes. They are not even evaluated by that calculus.

Yes, a carbon tax seems like a good idea in a general, hazy Econ 101 sort of way And everyone seems to think a good idea, even if no one actually knows how it might actually work. But, if we spend more than five seconds thinking about it, carbon taxes do not hold up to scrutiny. Worse, they appear to me to be a guaranteed way to make people despise environmentalism. No one, in any schema I have seen, is going to be rebated exactly what they have paid. In most scenarios, despite initial promises, it turns out that half the people will be paying in more than they will be rebated. Combine that with a steady drumbeat in the anti-environmentalist echo chamber, and we are going to see the carbon tax as the most despised boondoggle ever devised. With zero results to show for it. The public is going hate us. There lies doom.

I'll tell you what we DO have evidence of success for: government mandates and subsidies. China is actually accomplishing their part in solving AGW. They don't have any need for the vaguaries of a carbon tax - a mixture of mandates and subsidies is building RE more successfully than the total grand sum of free marketeerism has accomplished over the past three decades.

I would also like to point out to you that twice in your reply to me you have couched the issue of carbon taxes only in relation to "private investors". The majority of electric utilities in the U.S., however, are publicly-owned co-ops or nonprofits. And a giant question that nobody addresses is to what extent should the electric sector remain in public hands? How can we justify the idea of a for-profit paradigm when sun and wind are free and the total expenditure for a brand new RE system would cost us only about seven years of current U.S. fossil fuel spending - which could be payed off in less than a decade while the longevity of RE systems looks to be 0.5 to 1.5 century?

Please note that a carbon tax is antithetical to providing RE power at the lowest possible cost. By making FF more (regressively, btw) expensive, we provide no incentive to keep RE prices low - quite the opposite.

We have an opportunity to build ourselves an egalitarian energy system which could deliver energy at such low cost to us we really could take the meters off the wall. Instead, we are doing everything we can, it seems, to transfer our public utility system into private hands, and set ourselves up for paying maximum prices for energy forever. We really can do so much better than that.

Gingerbaker - have you checked out the REMI-study commissioned by CCE in 2013? Here is the link to the summary from where you can get to the full report:

http://citizensclimatelobby.org/remi-report/

Thank you SkS on publishing this good update on the CCL organization!

Eclectic @2, very good points. I'll tag along: The wikipedia article on Carbon Tax also gives a good summary, global history, aspects of effective policies & list of endorsements. My Summary: Most of the global C-tax policies have not been nearly as effective as they could be, because they fail to meet the obvious requirements of an effective tax policy. For a C-Tax to be effective, it must be: a) comprehensive (on all FF's, at their source point, proportional to their CO2 footprint), b) have significant impact (at least 10% of GDP, CCL's $100/USton would be 22% of US GDP), c) do not subsidize impacted industries either directly or via tax deductions, which is likely reason the efficacy of most global C-taxes has not lived up to their full potential (subsidizing impacted industries is simply moving money in a circle; of course, the result falls short), and d) the tax must be progressive (i.e. all revenue must be returned to the citizens, and none to industry). On the latter point, only citizens should receive the dividend. They ultimately are the source of the markets. So, in terms of pure capitalistic economic principles, they should be the only sector to receive the dividend. In other words, no specific industry sector by itself is intrinsically endowed w/ capitalistic value except for those that serve basic human survival needs, which are typically publicly funded (water, education, civic order & security, etc). CCL's proposed policy covers these publicly funded sectors by stating that the citizen dividend would be taxed like any other income; this covers the sustinence of these intrinscially valuable sectors. To return the dividends to today's status-quo industries (and I would argue that such industries are already & invisibly subsidized today because the external or social cost of their processes is not included in their product costs), is to capitalistally circumvent the optimum cost vs value trajectory of the economy in a non-sustainable and, thus, injust direction (we would all agree on that statement).

I would agree that subsidizes may likely be necessary to aid in transitioning public utilities. That can still happen as a separate policy. CCL's proposal is, of course, not meant to be an exclusive, do-it-all policy solution. But subsidizing much beyond transitioning public utilities, I believe, would be less effective than RNCFD (revenue neutral carbon fee & dividend), because when subsidizing renewable processes, the selection of which processes to subsidize is limited to the presently known technologies and futhermore is easily politically influenced, resulting in less than optimum solution pathways versus the more effective use of free-market competition & ever organic human ingenuity to discover & develop ever new & better solutions. Instead, let the competitive force of the free-market drive the re-direction of investments away from the carbon-laden & thus less profitable industries, and toward the increasingly more profitable sustainable industries, thus driving the development of optimum R/D endeavors and the resulting commercial solutions.

In the industry that I work in (corn wetmilling for starch & syrup products), I can affirm to everyone that if there was a $100/USton tax, that the plants where I work would immediately implement 100% cogeneration using CCGT technology, thereby cutting our sizable carbon footprint in half (because with a proper C-tax, energy cost would go hand-in-hand with the processes carbon footprint). I believe my anecdotal story would be representative of what would happen all up & down the economy resulting in significant carbon reductions. However, if this transition was fueled instead by regulations or subsidy programs (which are also more administratively burdensome than RNCFD), who's to say if the ultimate & economically viable pathway to the highest degree of carbon emission reductions is, instead, a gradual phase-out of the entire corn wetmilling industry, or at the least, a complete shake-up of our product line. Because the policies of subsidies & regulations do not comprehensively result in "loading" the entire economy with the true cost of FF's (agriculture, other raw ingredients, shipping, packaging, etc, etc ... i.e. but only impact those processes that the subsidies are only directed to), industries like mine would still be partially subsidized (as they fully are now), due to not applying the full & comprehensive extent of carbon's future external costs into our process economics. This makes these other policies less effective in driving the optimum economic sustainable trajectory. On the other hand, RNCFD, by its nature in touching the whole economy, would most effectively force the economy toward optimum solutions and thus maximum carbon emission reductions.

No, No, No. Taxing carbon does nothing to solve the problem ... it simply displaces it. Renewable energy is the only solution, but low oil pricing will defeat it. Don't tax carbon; tax oil imports! #TaxImportedOil

The criticism of carbon taxes from some people doesn't make sense, and is just angry rhetoric. Carbon taxes are the most workable option in my opinion. They would reduce use of fossil fuels, and also provide funds that could be rebates to the public, or subsidies for renewable energy construction, or a combination of both.

Reduction in fossil fuel use would then become an incentive to build renewable energy, but a rather slow incentive. You would actually also need legislation forcing provision of renewable energy.

Carbon taxes are consumption taxes, and these are very common and workable. For example we have had petrol and diesal taxes to fund roads for as far back as I can remember, and no problem. We have tobacco taxes as an incentive to reduce use, and to subsidise healthcare, and this has worked quite well. A carbon tax used to fund renewable energy is fundamentally no different in principle. Where do you think China gets its subsidies on renewable energy from, if its not some form of tax somewhere?

Of course a tax is politically difficult in some countries, but not everyone is as partisan as America. If a carbon tax is correct, the public as a majority will generally accept it even if somewhat reluctantly, just as we have mostly accepted tobacco taxes and petrol taxes and road user charges. Your problem in America (and plenty of other countries, mine to some extent) is your so called politicians ignore the public, and are basically slaves to narrow business interests. Until the public stands up to this you are going nowehere environmentally. Standing up to lobby groups and corporations is not socialism! Taxation is not socialism. Corporates have a good and bad side like anything.

I agree privatised electricty can be problematic, and freemarket ideologies can become fanatical and irrational if pushed to absurd extremes, but simply having a public utility will obviously not automatically solve the climate issue, or provide cheap power. You would still have to mandate that it build only renewable energy, and/ or have carbon taxes to push people in the right direction.

The only system I can see that would be effective is what James Hansen suggests. A small tax on carbon coming out of the ground or across your boarder increasing by some pre set increment each year. Every cent of the money collected given in equal proportion to each individual tax payer by virtually free electronic transfer. If someone doesn't have a digital bank account, too bad. Sending checks is expensive. Use the IRD data bank and sent the money to the same account that they send refunds to.

Gingerbaker and Richard:

Evidence suggests carbon taxes work in British Columbia, Canada.

Some targeted policies are required (fugitive emissions from wellsites and gas-infrastructure, for example), but there's little that says a carbon tax won't work as a main tool at tackling CO2 emissions.

Sorry! The %GDP numbers in my @5 above are wrong concerning on how much $100/UStonCO2 would be in %GDP. I mistakenly used global 40bn UStonsCO2 (wrong) & divided by $18tr US GDP (right) to calculate the incorrect 22% value. If using the correct 7.4bn UStonsCO2 & dividing by $18tr US GDP, the correct percentage is 4.1% for the 100/USton CO2 RNCFD tax rate.

Presently, energy costs are 8.8% of GDP (LINK). Therefore, the 4.1% is ~50% of current GDP energy costs. If current RE uninstalled technologies are equal to uninstalled carbon technologies (based on recent internet articles I have seen), then this $100 RNCFD tax would therefore make carbon technoloiges 50% more than RE's (12.9% GDP vs 8.8% GDP).

A 50% increase in energy cost is a fairly significant driving force so to economically justify investment infusion for R/D, RE commerical ventures, and justify both transition & conservation projects (both in the private & public sectors). If $100 RNCFD tax rate does not result in fast enough transition & reduction in discretionary consumption, then the $100 RNCFD tax rate could be increased so to accentuate the economic driving force.

Linked below is a very good, indepth podcast on carbon pricing policy & related subjects. It's very much worth the 40mins to listen to it! It is an open interview of two very knowledgeable & articulate people on the economics & global politics concerning climate action policies. Some of this addresses the faults of the past carbon pricing "1.0" attempts, and, looking forward, some of the reasons for a brighter outlook for a carbon tax with today's growing political & commercial voices, what they call carbon pricing "2.0". This podcast was posted on the CCL FB page a few days ago.

www.brookings.edu/podcast-episode/carbon-pricing-harnessing-market-efficiency-in-pursuit-of-clean-energy/

Thanks for the update and good sourcing. I appreciate the frustration with inaction and stubborn political and media resistance to facing facts, which I share. Thanks particularly for the Brookings summary.

In general, as soon as someone starts to say something along the lines of "nofink works, so why do anyfink" I tune out. It's a failure to acknowledge the problem, which is life threatening not just in the lifetimes of younger people, but in my view within the next 20 years give or take a few.

That means, even if its not working - and particularly if the only objective is that it has not been demonstrated to work yet - we need to keep trying.

Life is not something we have a choice to refuse by proxy. Proxy refusals are pretty much evasive bunk.

"failure is an important part of innovation" (from Brookings)

Linked below is a very good, explanatory TED talk (13mins) which was filmed just last month. The speaker is Ted Halstead, leader of the Climate Leadership Council, which is advocating a GOP-based RNCFD (revenue-neutral carbon fee & dividend) solution to hasten the reduction of carbon emissions. The starting point ($40/ton) is higher than CCL's but the ramp-up rate (from year-to-year) is slower after the start. But other than that, the two schemes are nearly identical.

www.ted.com/talks/ted_halstead_a_climate_solution_where_all_sides_can_win#t-775828

The CCL approach at first appear seductive; however, I have concluded that it will result in more or less "business as usual" (and likely more). The tax rebate will result in a rebound effect with the population segment that is of less than average wealth. And, for the those of above average wealth (and particularly for those in, say, the top 20%) a tax will have negligible effect — and these are the people who for example fly the most often and the farthest.

The net effect, I believe, will be on average more of: consumption of stuff, travel, size of dwellings, etc.

So, I think the solution is instead to put a cap (with no trade, and no C tax) on fossil fuel production and imports (on a C-content basis). That gets the matter down to the absolute basics. Anything else is fiddling around so that it looks like we're doing something while actually still doing the same damage or worse. The CCL is a ruse, even if a popular one, in my opinion. Let's get real!

Larry E @15

CCL's FAQ about carbon fee and dividend touch on at least some of your objections:

Q: Why will citizens change to low-emissions technologies if they are given a dividend to pay for the increasing price of fossil fuels?

A: With Carbon Fee and Dividend legislation, it is clear to citizens that prices for fossil fuels will go up every year. Part of their motivation is to save as much of their dividend check as possible rather than spending it on more expensive fossil fuels. They can do this by changing over to energy efficient lighting and appliances, upgrading their insulation or windows, replacing that old oil furnace with a geothermal heat pump, etc. When it comes time to get another vehicle, they would consider one that gets better gas mileage or an all-electric vehicle. They can then buy clean electricity (where available) through their utility to charge their car, getting them off fossil fuels altogether. The motivation is to reduce cost in the years to come. The same is true for investors and for fossil fuel companies: as the fee increases, and the cost of doing business rises with it, the rising dividend will ensure that the true cost of doing business will be paid by those in that business.

Q: Why is Carbon Fee and Dividend better than Cap and Trade?

A: Cap and Trade was used by some early signers of the Kyoto Protocol, the first international treaty to address climate change. Though most early adopters tried hard to make it work, Cap and Trade was not easy to understand, energy prices swung wildly, consumers paid the whole cost of the experiment, and it was not very effective in reducing total CO2 emissions. Much of the reason for this was because of offset credits. Power providers could buy offset credits that allowed them to burn more fossil fuels, but the offset credits did not actually reduce total CO2 emissions. Carbon traders and offset investors made lots of money. Utilities and manufacturers had increased costs that were passed on to the consumer. No real reduction in CO2 was achieved and the consumer was stuck with the bill. Carbon Fee and Dividend, on the other hand, is easy for everyone to understand, it gives the end consumer 100 percent of the proceeds of the carbon fee to help pay for the transition to clean energy, there are no offset credits or carbon credits to manipulate and no one technology is singled out to win or lose. Only with inaction over several years do you become disadvantaged. With action you become more efficient and competitive. The free market picks the winning and losing technologies. Low-emissions energy and efficiency measures become cost competitive as prices rise for fossil fuels. As we transition to green technologies and green energies, CO2 emissions are reduced. Investments in green energy spur the development of innovative technologies that we export to other countries. America regains leadership in the green revolution.

Hope this helps!

Some more information:

1. Increased incomes can lead to increased energy use. Carbon Fee and

Dividend is designed to prevent this.

2. The rapidly rising fee makes increased energy use much less likely, and pushes investment away from artificially cheap FF.

3. Modeling of 160 sectors of the US economy, cross referenced with behaviors observed historically from income and price changes, shows there is no rebound that pushes up emissions.

4. Before significant economy-wide transition sets in, some carbon-fuel companies may earn more while selling less, but they have to diversify to avoid a steep fall-off in their profits.

5. Modeling shows faster rate of emissions reductions than from any other known policy.

For a lot more information, check the REMI-study:

https://citizensclimatelobby.org/remi-report/

So, from what I can tell, the alleged rebound effect is a myth.

BaerbelW, thanks for your replies and the link to the REMI study.

1. The first part of your #16 presumes rational behavior, but it is well established that people don't behave rationally concerning consumption.

2. The second part of #16 and #17.1 regard "cap and trade," but my comment was explicitly that what we need is a "cap WITHOUT trade."

3. Regarding #17.2, a rapidly rising fee also results in rapidly rising dividends. It seems likely that the economy and behaviors will adjust to that, just as they do to other inflation. The dividend facilitates that. It is a huge gamble (at best) that this mechanism will adequately change behavior.

4. Regarding #17.3, the rebound effect should be casually dismissed. Also, I find the REMI report to be non-transparent concerning whatever assumptions (e.g. rational consumer behavior?) are inherent in it, through the three models that were employed. Also, how the economic feedbacks for both the fee and the dividend are handled for the various segments of society is critical, but is not disclosed.

5. Regarding #17.4, will the FF companies end up selling _enough_ less to solve the problem? That is a crux. It could be that they would end up selling about the same or somewhat (but not enough) less, or fall far short. From the REMI report example on gasoline prices, the 90-cent per gallon increase by the end of the first decade is relatively minor, as is the $1.80 increase after two decades. That would still leave US prices far lower than in Europe, for comparison, and the steady $10 per year increase in the CCL plan gets eaten away by inflation to a significant degree.

As a final point, the REMI study shows a 52% CO2 emissions decline (if correct) by 2035. However, the CCL plan and the study date back a few years and BAU year-on-year since then has made the climate change challenge. In looking at the remaining carbon budget for either a 1.5 or 2.0 oC increase, we need to be at essentially zero emission by 2035-2040. (See Kevin Anderson's "Laggards or Leaders" presentation, https://play.kth.se/media/28+mars/0_aej506wl, as one recent example.) Fee & Dividend doesn't get us there for this budget reason, as well as the ones above.

Larry - for me this is a case of "don't let the perfect be the enemy of the good". Which is why I think that CCL's Carbon Fee and Dividend is well worth a try as it beats not having anything (as in the U.S.) or just having something inadequate (as the ETS in the EU). Once implemented it can be improved upon as needed. Not having anything cannot really be the best path forward in my opinion.

As mentioned in the article, I'm active with CCL in Germany and thereby Europe. So, we are having discussions of how something like and as close to Carbon Fee and Dividend could be made to work within or alongside the ETS. Overall, solutions will most likely differ per region and country, but I really hope that we'll get a meaningful price on carbon sooner rather than later. We "simply" have to stop using our shared atmosphere as a free dumping ground for our CO2 emissions.

Just my 2 cents.

I appreciate the dialog. Here are further thoughts.

1. "Don't let the perfect be the enemy of the good ... a meaningful price on carbon sooner rather than later."

I see this a question of workability rather than perfection, and believe Fee & Dividend won't work out as promoted, for reasons already explained.

If a carbon price is the way to go, just put on a price but without the dividend. The Canadian federal government is moving that way with a plan that does not have a dividend: https://www.canada.ca/en/services/environment/weather/climatechange/pan-canadian-framework.html

2. "Once implemented [fee and dividend] can be improved upon as needed."

Obviously back-sliding as well as improvement could occur. The "dividend" part of the arrangement seems to me make backsliding more likely. We need to get to zero fossil fuel carbon emissions, which means zero dividend. Early on, people will become dependent on the dividend, and won't want it cut off. Politically, that can be expected to maintain a continuing carbon "fix," a continuing addiction at some level. Alaska's permanent fund dividend (PFD) (essentially a negative tax) is an example such pressures. The state has been in a severe fiscal crisis for several years and cannot balance its budget, yet cutting back or eliminating the PFD is a political third-rail that has proven untouchable.

3. "Fee and Dividend is well worth a try as it beats not having anything (as in the U.S.) or just having something inadequate (as the ETS in the EU)."

We need a complete solution, even if it is a combination of things. If Fee & Dividend is muscled through by itself it is likely to be perceived as "the" solution and either greatly delay or block more effective measures. (Apart from the fact that I don't think F&D will perform as promoted.)

4. As said in my last comment, the target we need to hit is changing year-by-year as we have continued with high emissions. We need zero FF emissions by 2035-2040 (actually should have been by now, really) as Anderson has well demonstrated (see URL in my last comment). CCL needs to lead the target, not aim at where it appears to be or was.

Larry E: A few more points to consider:

1) %Increase of Power & Nat-Gas will much higher than Petro increase: A $100/ton fee would raise 95%coal/5%gas mix generated power (typical US midwest power) by $0.10/kwh (1.9x above current residental rates $0.112/kwh, and 2.45x above current industrial rates $0.07/kwh). Nat-Gas heat would increase from $9.00/dth to $16.0/dth (1.8x increase). These are not minor increases. I agree that the petroleum increase is not significantly substantial (this lower %increase is because its cost/btu is already much higher than that for power & nat-gas), but even a $1/gal will have a noticeable impact on shipping (& its technologies). This higher cost will trickle-down to impact those markets w/ higher % dependency on shipping, resulting in definite impacts on their future market growth. But, for the power & gas energies, as pointed out above, their significant higher increases in cost (almost double for residential power, 2.45x for industrial power), will have significant impact on the future market share for these FF laden products, services & processes.

2) Summary of Household Costs: Avg US per capita annum CO2 emission is 18tonsCO2/yr; so $100/ton translates to $1800/person, or x 4 = $7200/yr increase for avg household of 4. This injects sizeable incentive to shift market choices to those products & services that will be competitively more attractive (toward lower C footprint choices) while providing the dividend to finance these transitions. As some people start to transition, then the financial incentive on the others, who delay, will increase as their household costs will stay high while their dividend will start to drop as total net FF consumption drops. Investors will definitely shift to RE technologies, R/D will grow because of these new investments, production & installation cost for RE will drop as market share & volume increases & more efficient stds are developed, further reducing transitional costs & giving more incentive to transition to lower C footprint products & services.

3) Impact on the High Footprint Industries: Industries, who do life & breathe on rational financial terms, and would get no dividend, will be forced to make huge changes or else fail.

Let me give a real-life transitional scenario for our plant: The impact to the industrial plant where I work would be significant: A) Product Mix: Those products that have a higher FF energy input would have a higher % of cost impact. Customers for these product would likely shift to alternate/lower cost ingredients (lower in cost due to a lower FF footprint), or else shift to more efficient suppliers. Final result: lower net C footprint. B) Process/Technology Changes: Our purchased power cost is currently $15m/yr. W/ $100/ton, power cost will rise 2.45x or rise to $37m w/tax. To reduce costs, we would immediately install CCGT (combined cycle gas turbines), w/ HRSG for 100% cogeneration, so to transition away from the new very high cost of purchasing power. The cogeneration means that the 2.5x of wasted energy from the power plant rankine cycle would seize. Counting this power wasted energy in our total energy usage (i.e. our primary energy), this CCGT project would cut our total C footprint by 27% (yes, this isn't what is ultimately required, but it is a huge first step). ... Today, we don't do this because the $10m/yr payback (based on $20/mmbtu coal+gas purchased power vs gas at $5/mmbtu and 80% ineff) would take ~8-10 years (DCF) to pay off the $65m investment. Change that power cost to $37m, and now the payback is $32m/yr for a 2-3 year (DCF) payoff. Huge increase in financial incentive! Many other cost reduction measure would then be financially justifiable, reaping further reductions in C emissions. ... To think that a $100/ton tax would yield no net reduction in carbon emission does not hold up to standard engineering & economic incentive principles.

4) Think thru your approach of "Cap w/ No Trade": How exactly would this approach logistically work? Would Duke Energy be given a max quota coal or gas they can burn? One option: they would start using spot brown-outs here & there to curtail consumption to meet these max quotas. Contracts for continuous supply, at a higher cost, would be the immediate business reaction. These increased costs would have to continue to increase until some business could not afford reaching an equilibrium where demand shrank enough to equal the curtailed supply. These higher costs would be passed onto the products. Markets would shift toward lower C footprint products, but the lack of dividend would result in recession. True, such an approach, would cause sharp reductions in FF consumption, but the poor would suffer the most (even though their per capita footprint is the lowest, their energy costs as a percentage of total income is higher than avg). The backlash to the recessionary impact would not be political durable (listen to the @11 Brookings podcast above, which is extremely informative) and thus this approach would not survive into the long-term & thus would not fulfill its ultimate goal of a durable approach to achieve lasting carbon emission reductions.

Expert Endorsements: It is unlikely that my points will change your mind, but consider the list of endorsements from James Hansen, Katharine Hayhoe, Jerry Taylor (Niskanen Center, read its Case for Carbon Tax), George Shultz & James Baker (Climate Leadership Council, see @14 above for informational link), the Carbon Tax Center, read Shi-Ling Hsu book (the Case for a Carbon Tax). I invite other readers to submit their known list of other expert endorsers. ... These experts recognize the efficacy of a carbon tax & especially the non-regressive revenue-neutral variety. These endorsements should carry some weight in your deliberations. ... Lastly, if $100/ton is too slow, and the economy is holding together OK, then there is nothing to say to stop at $100/ton. But, per the Brookings podcast, a well forecasted rise in the tax is vital so that business can prepare so to avoid recessionary collapse. So, any change in the rate-of-rise of the tax needs to be laid out w/ advance notice and not too-quickly tinkered with, o/w business will be caught off-guard and political durability may collapse. The Brookings podcase explains all of this. ... Take care!

Never mind methods of pricing carbon, should a first step not be global agreement to abandon all searches for new sources of fossil fuel?

SauerJ, first I didn't propose a tax, but declining cap (with no trade).

But to address some of what you wrote: The CCL proposal starts out at $10/ton and won't reach the $100/ton in your calculation until a decade out. Due to inflation (e.g. at current rates) and the economy's adjustments to inflation over that period, the situation will be much different then than portrayed in your calculations.

Also, I believe your calculation for cost to an "average" household of your $100/ton tax doesn't mean much. Because the direct and indirect carbon emissions of the wealthy and moderately wealthy are extraordinarily high, using the average for all households is a distortion. You need to look at the tax impact by "bins" that are determined by household income and the typical carbon emissions for each bin. I think that will give a much different result for households in the bins of average income and lower. (And of course the result will vary by region for various reasons, so the analysis gets complicated.)

Concerning industries, the time for a soft landing for many of them is rapidly evaporating because global society has delayed so long in effectively addressing climate changing emissions. We need to ratchet down emissions sharply, year-on-year for a prolonged period — much more so than the CCL proposal could accomplish. For many industries the kind or quantity of production will have to change. Some won't survive (and who makes typewriters anymore). That is the pickle we are in, due to past inaction. Other industries will grow or arise.

You ask how would cap with no trade work. The cap would be on fuel (solid, liquid, gas) production and imports, so indirectly on emissions. The allowed fuel-carbon production/imports would decline year-on-year, moderately for a short period and then sharply. Increases in renewable energy would make up some of the difference, but demand for energy use (for electricity, transport, etc.) will also need to decline (as it must for any real climate solution). The marketplace may play some role in how fuel-carbon is allocated among uses, but regulation will be key in managing that in managing allocation for an orderly ramp-down of FF use. Some taxation on carbon would be used to relieve price impact on low-income households, but the cap would be the instrument for reducing FF use and not particularly the tax. As Digby suggests, ceasing the search for more fossil fuel should be part of this.

It is a bitter pill, but is what the climate emergency demands. Perhaps a decade and a half ago the CCL proposal would have been worth a go, but it is not up to the present task and will distract from a real solution. Despite wishful thinking, including by some experts. Do we have the will to survive?

Larry E: Thanks for your kind reply. You write well & have thought thru your points; and are definitely passionate on reducing carbon emissions (we are on the same side on that front). We just differ on what we think are effective & politically obtainable/durable ways to get there.

CCL & others have worked the numbers on the demographic "bins" (I like your word here). I purposely simplified this so to be brief. Yes, per CCL reported studies, 70% of the population consumes avg FF per capita or less. And, 85% of the poorest bin would come out net positive on div-fee. Yes, my avg cost fee & dividend #'s were simplified, but on purpose so to be brief & only give the ballpark norm, for general talking purposes, on the near-avg (close enough) increase in fees & dividend. Certainly the % increase in power & nat-gas costs, that I gave, are right on (in terms of $/kwh or $/dth, those are easy to calculate, which I have done & verified); and I think these are substantial to the avg pocketbook so to influence market choices (they would be for me, and so, I don't see why not for many others).

Would buying choices & habits change? I strongly think so. Would I put that $7200 to use to reduce the $7200 increase in costs? Yes, and I think that would be the norm. Actually 50-70% of that increase would be in home/car utilities; the other 30-50% would be increases in costs packed into everything else. Would people forego this or that product or service because now its cost was more than other lower cost options (due to lower C footprint); I think so. After all, that is how we make our choices now. But, for industry, I know that the impact will be immense because I am intimately immersed in what drives its inner workings. And, these changes would cause significant C reductions (this would be real), and increased price signals would trickle-down to impact market choices to the public.

I like your choice of words for the 'soft landing'. Yes, the policy does ramp-up the artificial price (to include the external cost of CC) so to give the economy time to adjust (i.e. a 'soft landing'), but too sharp (too fast a ramp-up) or too regressive (little or no dividend) and it won't politically survive (the Brookings podcast says this is partly to blame for the reversal of the recent Australia policy). As I said, there is nothing to stop going higher than $100/ton (don't discount this conceptual strategy simply based on a tactically hard set #), and, as you wisely uncovered, it would be smart if the ramp-up rate also included additional cost to account for inflation. That makes total sense!

Political obtainability: I live in a state (IN) where getting any sort of macro policy (even one that would be amiable to the GOP; i.e. the revenue-neutral variety) enacted has, at most, only about a 5-10% chance of any gaining political support, which only happens by building enough "political will" so to sway government policies (I judge this by how few people actually "walk the talk"; out of the few genuinely concerned "talkers" there are very few policically engaged "walkers"). And, I even live in a progressive town in this state. AGW simply is not toxic enough nor is its 'causal & effect' connection obvious enough on its own (at least, in the next 10-20 years) to cause the required self-regulating forces in society to bring about the large scale changes that are required (unlike other forms of pollution). So, political durability has been and still continues to be real issue to contend with that can not be dismissed if we hope to achieve real carbon reductions. ... If the political support for RNCFD (rev-neu CFD) is already weak, then its going to almost non-existent for a cap-only policy, especially after the follow-up substantial regressive impacts come to bear (I think case histories demonstrate).

Lastly, if I wanted to help support a cap-only policy, where would I go to help build support? Is there any organized groups that are advocating such a policy so to rally behind? Are there any active lobby groups, or grass-root or grass-top groups that are building coalition for this? Are there any studies to describe its follow-up economic & political impact? ... What gives you a personal sense of confidence that a cap-only policy would practically have any political "legs" both in the now & after implementation? ... If the answers to these questions are mostly in the realm of ideals and has little to no developed organized coalition, then I can't get past the lack of its tangible political practicality to commit myself to advocate 24/7 for it. ... For me the logic of RNCFD (rev-neu CFD) is straight foward. It "thinks" & "works" like an engineer; it has a logical power to it. Therefore, I believe it will be effective (if $100/ton isn't enough, then increase it; think of it in terms of its conceptual strategy). And, most importantly, I believe it is politically tangible and durable, which is a point to absolutely contend with in the US.

I know none of this will change your mind. But, I do enjoy the kind dialogue we have had. We both must fight on (there are driven by no other choice), working toward the same goal, but just on two different fronts. Have a good day!

sauerj,

Your faith in how the CCL proposal would work in the marketplace continues to be magical thinking.

Also, you asked: "Lastly, if I wanted to help support a cap-only policy, where would I go to help build support? Is there any organized groups that are advocating such a policy so to rally behind? Are there any active lobby groups, or grass-root or grass-top groups that are building coalition for this? Are there any studies to describe its follow-up economic & political impact? ... What gives you a personal sense of confidence that a cap-only policy would practically have any political "legs" both in the now & after implementation?"

I will answer in reverse order. I suggest you read "Any way you slice it: The past, present and future of rationing," a book by Stan Cox (2013). Rationing was supported during WW-II by the populous in both the US and UK because it was necessary and fair. For some materials it was done to limit consumption, and for others to contain prices. So it was fair both in distributing supply and in maintaining broad access through reasonable prices, and by adaptations to avoid black markets. (In the UK such rationing existed into the mid-1950s, as well as other places in Europe.) As far as having "legs," any scheme is going to require a shock in order to be enacted, and we are getting those not infrequently with climate tragedies (Sandy, Katrina, killer heat waves and floods), so the thing is to have an EFFECTIVE plan ready to push to enactment.

Check out The Climate Mobilization (http://www.theclimatemobilization.org/). They have a well thought out plan that includes rationing. All it needs is to build momentum, with more people behind it, and be ready for triggering events to build yet more momentum until it reaches a tipping point for implementation. I suggest humanity's future it would be best for you and other CCL supports to instead put a shoulder into pushing this effort.

Best regards; as you said we both seek the same outcome.

"Unfortunatley, the number of ways to do something wrong always exceeds the number of ways to do something right."

(Gary Kasparov)